Editor's PiCK

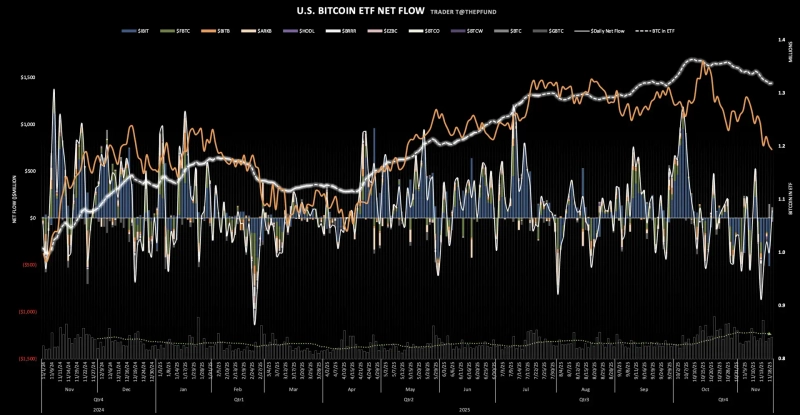

U.S. Bitcoin spot ETFs saw net inflows of about KRW 113.4 billion the previous day…returned to net inflows after 6 days

Summary

- Bitcoin (BTC) spot ETFs turned to net inflows after six days.

- Inflows to BlackRock IBIT and Grayscale Mini (BTC) drove the overall trend.

- Some ETFs, including Fidelity FBTC and VanEck HODL, experienced capital outflows.

Bitcoin (BTC) spot exchange-traded funds (ETFs) recorded net inflows of $77.09 million (about KRW 113.4 billion) the previous day. BlackRock IBIT and Grayscale Mini (BTC) led the inflow trend and determined the overall direction.

On the 20th (local time), according to crypto (cryptocurrency) specialist account TraderT, BlackRock's IBIT had net inflows of $62.23 million the previous day. Grayscale Mini (BTC) also saw inflows of $53.84 million. The bearish trend that had continued until recently thus turned to net inflows in six days.

Meanwhile, Fidelity (FBTC) recorded net outflows of $21.35 million, and major ETFs such as Vanguard, Bitwise, Ark Invest, and Franklin showed no notable changes. VanEck (HODL) saw outflows of $17.63 million.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)