Summary

- "Ethereum (ETH)"'s $2800 range is highly likely to act as an important on-chain support level, a CryptoQuant contributor said.

- It was analyzed that when Ethereum recently broke its price low, the scale of long position liquidations decreased, weakening selling pressure from forced liquidations.

- It said that with short positions currently expanded, conditions have formed where even a small rebound in a low-liquidity zone could trigger cascading liquidations leading to a short squeeze.

Analysis suggests that selling pressure on Ethereum (ETH) has weakened.

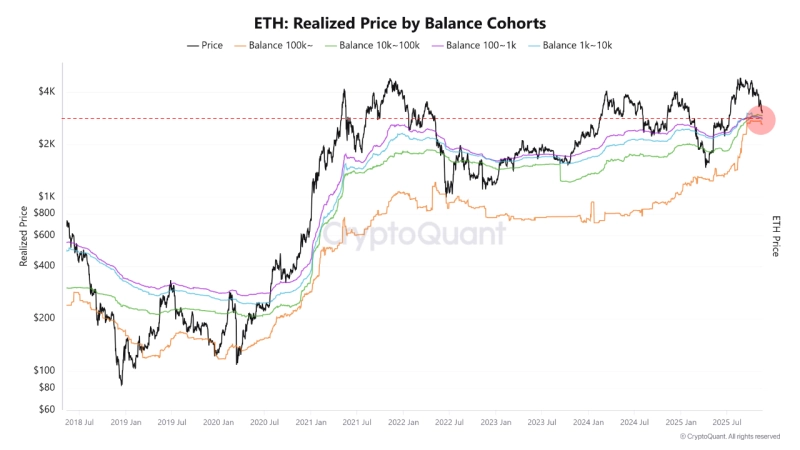

MacD (MAC.D), a contributor to CryptoQuant, said on the 20th (local time) through CryptoQuant, "The $2800 range is highly likely to act as an important on-chain support level for Ethereum" and "because the realized prices of retail investors and whales (large investors) are concentrated in that range." MacD said, "The realized price is an area that has formed cycle lows several times in the past" and "it suggests that that price range could serve as the basis for a short-term rebound."

He also mentioned liquidation indicators. MacD said, "It is also necessary to note that when Ethereum recently broke its price low, the scale of liquidations of long (buy) positions has sharply decreased" and analyzed, "This means that selling pressure from forced liquidations has been steadily weakening." He added, "On the other hand, short (sell) positions are expanded" and "conditions are forming such that even a small rebound in a low-liquidity zone could trigger cascading liquidations and lead to a short squeeze."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)