Editor's PiCK

Mixed rate signals and Wall Street selling... Can Bitcoin hold $80,000? [Kang Min-seung's TradeNow]

Summary

- Recently, Bitcoin has seen increased short-term volatility due to the Fed's mixed rate-cut signals, outflows from spot ETFs, and dollar strength.

- On-chain data and experts say the $80,000 Bitcoin support will be the short-term turning point, and that a break below it could lead to further declines.

- Large investors' position reductions and weakness among digital asset treasury firms are acting as additional downward pressure on the market.

After the release of strong employment data, Bitcoin (BTC), which had been trading weakly, is seeing increased volatility amid mixed policy signals from the U.S. Federal Reserve (Fed). Outflows from spot exchange-traded funds (ETFs) and a stronger dollar are also acting as burdens, expanding the possibility of a short-term correction, analysts say.

As of 8:27 a.m. on the 22nd, on Binance Tether (USDT) markets, Bitcoin was trading down 2.96% from the previous day at $83,906 (approximately KRW 127,760,000 on Upbit). The kimchi premium was 2.51%.

Strong employment, mixed Fed signals... Stocks and crypto show mixed moves

Recently, global stock and crypto markets have failed to find a clear direction as signals around rate cut expectations have diverged. Although there has been some short-term recovery of losses, the prevailing view is that the likelihood of a sustained trend reversal remains unclear.

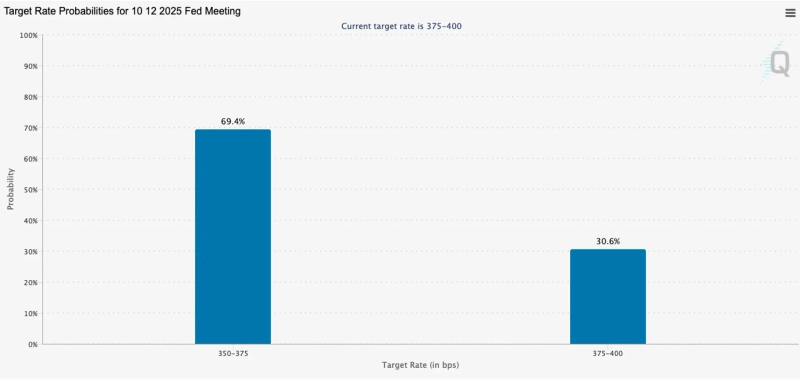

On the 21st (local time), John Williams, president of the Federal Reserve Bank of New York, said at an event hosted by the Central Bank of Chile that "the Fed could have room to cut rates in the short term. Current monetary policy is somewhat restrictive and the labor market is easing," comments that reignited market expectations for a rate cut. Immediately after this remark, the probability of a December rate cut jumped from the 30% range to around 70%.

Conversely, views within the Fed are not fully aligned. Michael Barr, vice chair of the Fed, said, "Inflation remains around 3%, so a more cautious policy approach is needed." Beth Hammack, president of the Cleveland Fed, also emphasized the need to hold rates, saying "an aggressive rate cut increases financial market risks." Governor Lisa Cook warned that "the possibility of a correction in overvalued asset prices has increased."

Earlier, the September employment report released on the 20th also served to constrain rate cut expectations. Nonfarm payrolls increased by 119,000, showing solid momentum, and hourly wage growth exceeded expectations at 3.8%. Given the extended statistical gap due to the federal government shutdown, the market paid particular attention to this report.

As of 8:30 a.m. that day, the Chicago Mercantile Exchange (CME) FedWatch tool reflected a 69.4% chance that the Fed would cut the policy rate in December.

ETF outflows and dollar strength... "Bitcoin selling pressure working all at once"

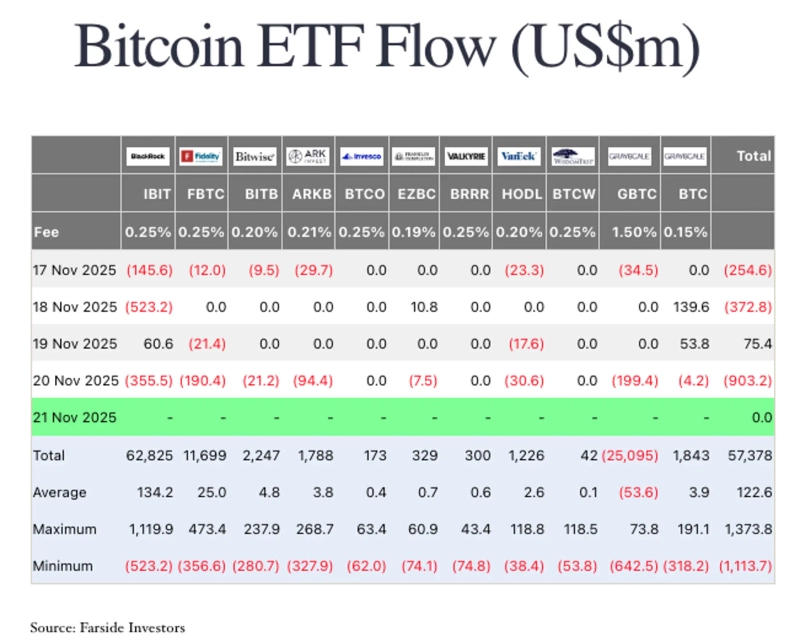

This week (17–20), spot Bitcoin ETFs saw net outflows of about $1,455.2 million. Cumulative net outflows for the month stand at $3,790 million (about KRW 5,593.2 billion), the largest monthly amount.

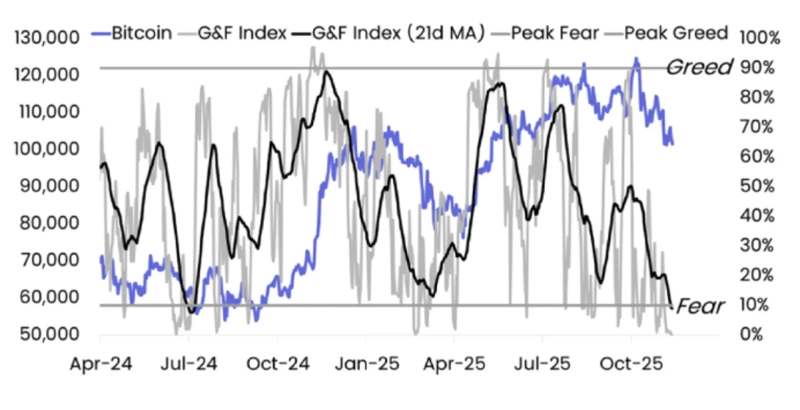

On-chain data also show the market has entered a loss zone. Glassnode said in a report that "a substantial portion of recent buyers are in loss" and "panic selling at the strongest level since the FTX incident has been detected." It added, "The amount in loss exceeds 6.3 million BTC, with a large portion sitting at 10–23% losses," and warned that "a period of range-bound adjustment is more likely than a short-term rebound."

Recent selling in the downturn has been attributed to so-called "Wall Street whales." 10X Research said, "On the back of ETF flows, Wall Street is reducing positions for risk management. There is evidence of selling close to forced liquidations," and predicted, "Their remaining selling capacity will determine near-term volatility."

Typically moving inversely to Bitcoin, the strengthening dollar is adding corrective pressure across risk assets. Jamie Coots, chief crypto analyst at Real Vision, said, "Since Bitcoin typically moves opposite to the dollar, dollar flows as a liquidity indicator will likely determine market direction for the time being." He added, "The market views current rate and liquidity measures as insufficient," and predicted, "An increase in volatility is inevitable in the short term."

Meanwhile, weakness among digital asset treasury (DAT) firms that hold crypto assets is also cited as a risk factor. Crypto-focused media CCN reported on the 15th that "many DAT firms used leverage to purchase crypto assets, so price declines could rapidly amplify losses," noting, "Some firms' stocks have plunged 80–95% during the recent correction, dozens of firms are in loss positions, and some even face delisting risk."

"$80,000 support is shaky... further correction could drop to the $76,000s"

Experts say whether Bitcoin holds the $80,000 support will be the short-term turning point.

Aayushi Jindal, a researcher at NewsBTC, said, "Bitcoin appears to be finding a short-term bottom in the low $80,000s, but there is no clear buying pressure," adding, "Strong resistance is expected near $85,000." She warned, "If $83,200 breaks, the price could fall below $80,000 and extend into the high $79,000s."

Katie Stockton, founder of Fairlead Strategies, said, "Although the recent correction has been significant, no clear bottom signal has been observed," and added, "If global risk-off flows continue, the likelihood of a medium-term correction grows." She described the $78,000–$80,000 range as "the lower boundary of the medium-term trend," warning, "If this level breaks, cyclical upward momentum could weaken." She noted, "It is weak in the medium term but the long-term trend remains intact."

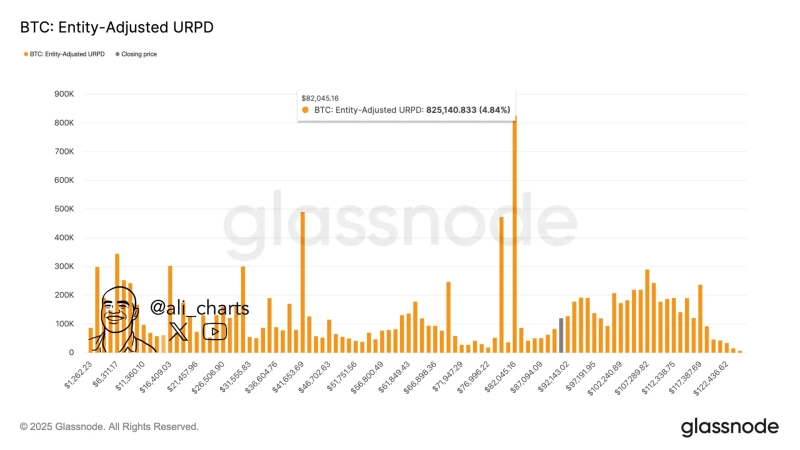

Ali Martinez, a crypto analyst, said, "Bitcoin is forming strong support near $82,045, a major long-term holder band with about 825,000 BTC accumulated." He added, "If that zone fails, the next support is in the $76,000 range, where downside volatility could increase."

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)