Summary

- A Bloomberg strategist stated that Bitcoin (BTC) may face additional corrective pressure in the medium term.

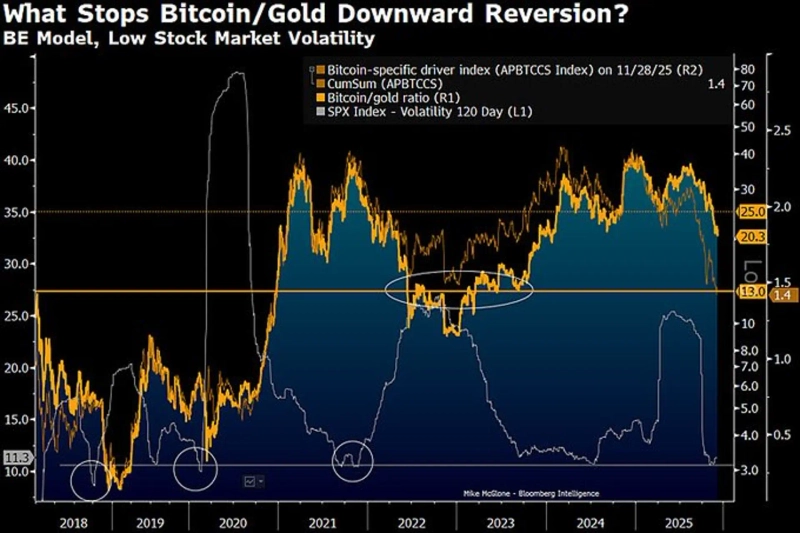

- An analysis raised the possibility of a retest around $50,000 for Bitcoin's price and that the Bitcoin/gold ratio could retreat to about 13x.

- He said that the S&P500's low volatility increases corrective risk for risk assets overall, and that Bitcoin could move as a leading corrective indicator.

An analysis suggests that Bitcoin (BTC) may face additional corrective pressure in the medium term despite recent rebound attempts.

On the 1st (local time), Mike McGlone, a Bloomberg strategist, wrote on X (formerly Twitter), "Bitcoin's price could retest around $50,000," and "the Bitcoin/gold ratio could also face pressure to revert from the current 20x to about 13x."

McGlone pointed out, "The 120-day volatility of the S&P500 is heading toward the lowest year-end phase since 2017," and said, "Such extremely low equity market volatility is a factor that increases corrective risk across risk assets." He explained, "Bitcoin could act as a leading indicator of correction in this environment."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)