Editor's PiCK

FIU "Warning about 'illegal' virtual asset service providers active on Telegram, etc."

Summary

- The Financial Intelligence Unit (FIU) said that illegal virtual asset service providers active on Telegram, etc. are rapidly increasing and urged users to be especially cautious.

- The FIU stated that any virtual asset service provider not reported under the Specific Financial Information Act is illegal, and illegal operators are likely not to have anti-money laundering obligations or user protection systems.

- The Financial Services Commission said that remedies are difficult when damages caused by illegal operators occur, and that it will continue to cooperate with related agencies and respond firmly.

The Financial Intelligence Unit (FIU) under the Financial Services Commission said that illegal virtual asset service providers on Telegram, open chat rooms, SNS, etc. are rapidly increasing and urged users to exercise caution.

On the 2nd, the FIU said, "To respond to illegal activities related to virtual assets and the risks of money laundering, we have been sharing types of illegal activities and detection status through a joint response team with related agencies," and "recently, determining that users need to be especially cautious, we are informing cases of illegal virtual asset service providers confirmed by the joint response team."

The FIU explained that it has identified illegal service providers based on complaints and reports and has taken measures such as notifying investigative agencies and requesting app access blocks. However, it added that even beyond the publicly disclosed list, illegal operations continue to increase, so caution is necessary.

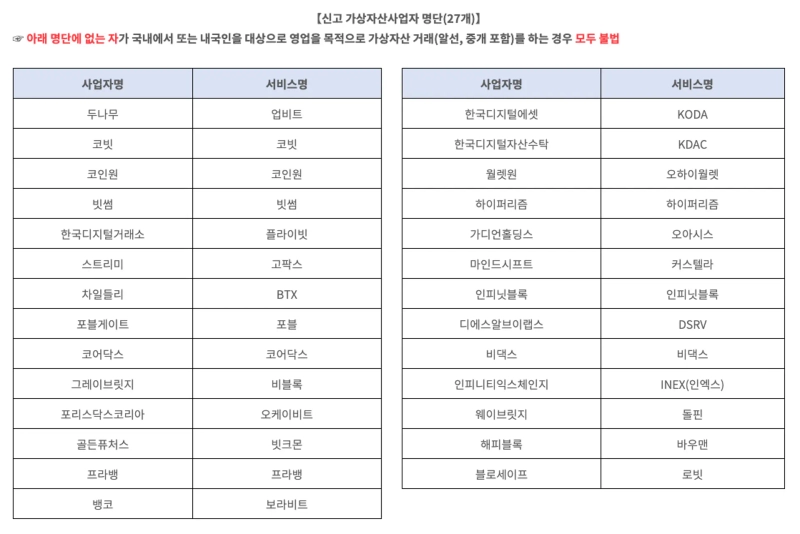

According to the FIU, among virtual asset service providers operating for domestic customers, all providers other than the 27 virtual asset service providers reported under the Specific Financial Information Act are illegal. The FIU advised, "Anyone can report to related agencies or file a complaint with investigative agencies about acts of buying, selling, or exchanging virtual assets such as stablecoins without reporting."

The FIU pointed out that illegal service providers are not subject to the management and supervision of financial authorities, so they are likely not to have anti-money laundering obligations or user protection systems. It also warned that because they are at high risk of being involved in fraud, tax evasion, and violations of the Foreign Exchange Transactions Act, it can be difficult to obtain remedies if damages occur.

In addition, the joint response team, operated together with the Korea Customs Service and the National Police Agency, identified major illegal types as: anonymous stablecoin exchanges via Telegram and open chat rooms; promotion on blogs/SNS and recruitment of referrals by unreported overseas virtual asset service providers; and virtual asset-based illegal currency exchange through exchange shops.

The Financial Services Commission said, "There have been many damages caused by illegal operators, such as selling coins that are practically untradeable by claiming potential value appreciation, or taking the sale proceeds without delivering the coins," and "The FIU will continue to cooperate with related agencies and take firm action against illegal virtual asset handling activities to prevent money laundering and protect users."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)