Editor's PiCK

[Analysis] "Bitcoin was excessively pushed down…Higher chance of rebound in December"

Summary

- K33 Research said Bitcoin has stabilized in the $70,000–$80,000 range despite a recent strong correction, and that the likelihood of a rebound in December is high.

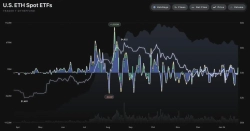

- It said Bitcoin spot ETFs turned to net selling in November and CME futures trading also decreased, but leverage in the perpetual futures market is low and forced liquidations are limited.

- K33 said expanded access to digital assets in 401(k) retirement plans and policy changes by the Fed could strengthen demand in the medium term.

Bitcoin (BTC) has seen investor sentiment weaken after a recent correction, but analysis suggests December could be the turning point for the trend.

On the 8th (local time), according to CoinDesk, K33 Research said, "Bitcoin has experienced the largest correction since the last bull market, but structural selling pressure is weakening and the price is stabilizing around the strong historical support zone near $70,000–$80,000," adding, "the likelihood of a rebound in December is much higher."

K33 also analyzed, "Bitcoin spot ETFs turned to net selling in November and CME futures trading has declined to multi-year lows, but leverage in the perpetual futures market is low and forced liquidations are limited."

Meanwhile, although long-term variables such as quantum computing risks, potential selling from strategies, and concerns over Tether (USDT) are being overly highlighted in the market, K33 pointed out that "these issues are matters that will materialize years from now," making them difficult to view as factors that determine short-term price movements. Rather, K33 expected that policy changes such as expanded access to digital assets (cryptocurrency) in 401(k) retirement plans and the Fed's pro-crypto stance would strengthen the demand base in the mid term.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.