Summary

- The US government allowed exports of Nvidia's high-performance AI accelerator H200 to China, saying this is a strategy to slow China's semiconductor self-reliance and increase its dependence on the United States.

- Chinese semiconductor companies, including CXMT, YMTC, and SMIC, are rapidly growing thanks to attracting overseas talent and support for technology development, leading to criticism that US regulation has instead contributed to China's industrial advancement.

- Industry observers say Nvidia CEO Jensen Huang may be the ultimate winner through H200 inventory clearance and market share expansion, while there are domestic concerns in the US that the decision could be a 'self-inflicted wound.'

Trump allows Nvidia high-performance chip 'H200' exports to China

"Increase China's dependence on the US"

Regulation judged to instead spur Red Tech growth

Purpose is to provide AI chips to delay China's self-reliance

Analysis: "The ultimate winner is Jensen Huang"

"H200 inventory clearance before Rubin launch"

Some call it a "self-inflicted wound by the US government"

Three years ago, a Chinese national A, who majored in memory semiconductors at a top domestic university's semiconductor lab, returned to his home country as soon as he earned his doctorate and joined a Huawei affiliate disguised as an independent semiconductor company. A received an annual salary three times that of Samsung and ten times that of local companies in exchange for seven-day work weeks, standing at the forefront of China's semiconductor drive. Professor B, who taught A, said, "I understand Huawei created dozens of shell affiliates across China to avoid US semiconductor export regulations," explaining, "this is why the development speed of China's semiconductor industry has been faster than expected."

◇A step back from Trump

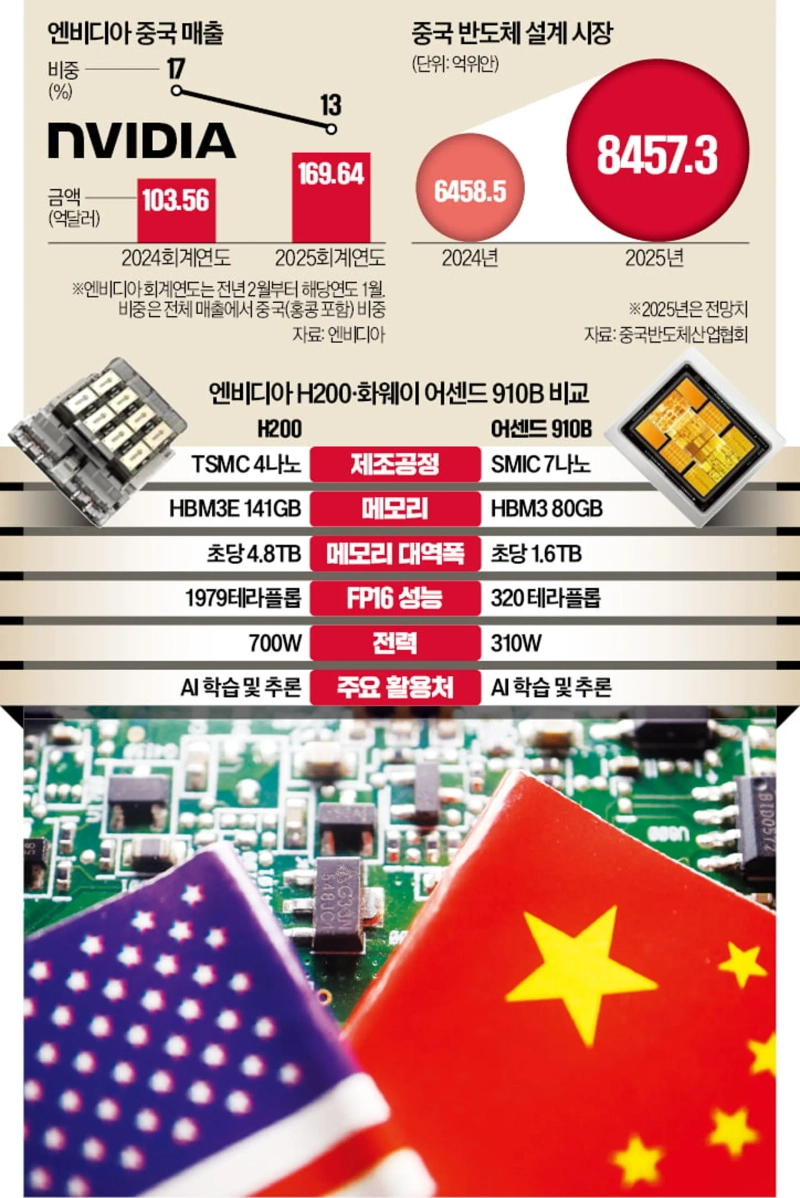

The US government decided on the 8th to allow exports of Nvidia's high-performance artificial intelligence (AI) accelerator H200 to China. The semiconductor industry analyzes that President Donald Trump judged that 'taming' rather than 'strong regulation' would be more effective in checking China's rise in AI and semiconductors. By allowing exports of products inferior to Nvidia's latest high-performance AI accelerator 'Blackwell' series, the aim is to slow China's semiconductor self-reliance and increase its dependence on the United States.

The US government had maintained a hardline stance toward China. The Huawei restrictions that began in May 2020 occurred during Donald Trump's first administration. In July 2022, during the Joe Biden administration, export controls on semiconductor equipment for processes of 14 nanometers (㎚·1㎚=one billionth of a meter) and below to China began, and three months later the supply lines for cutting-edge AI accelerators were blocked. Although some exports of downgraded AI accelerators were later partially allowed, the intensity of US regulations continued to rise into Trump's second term.

US AI accelerator developers such as Nvidia and AMD, and semiconductor equipment companies like Lam Research, which have about 15% of their revenue tied to the China business, protested when that market was cut off. Jensen Huang, Nvidia's chief executive officer (CEO), publicly warned that "export controls will spur China's self-reliance."

◇China, speed of semiconductor self-reliance

CEO Huang's concern became reality. The Chinese government has been bringing semiconductor talent like A back from abroad and supporting technology and equipment development. Changxin Memory Technologies (CXMT), Yangtze Memory Technologies (YMTC) and foundry SMIC have continued to grow even without access to extreme ultraviolet (EUV) lithography equipment. SMIC rose to third place in the global foundry rankings as of this year's third quarter, and CXMT and YMTC have each entered the top-five range in the global DRAM and NAND flash markets, respectively.

Growth in the semiconductor design market has also been steep. According to the China Semiconductor Industry Association, this year China's semiconductor design market is expected to reach 845.73 billion yuan (about 176 trillion won), a 29.4% increase from the previous year.

◇The ultimate winner: Jensen Huang

There are varied assessments of the US strategic pivot. For Chinese big tech companies increasing AI investment such as Baidu and Alibaba, there is no reason not to use the H200, which outperforms domestic products. For this reason, there is significant concern in the US that this will spur "China's AI advancement." Alex Stapp, co-founder of US think tank IFP, analyzed, "This decision will be an enormous self-inflicted wound."

There is also the diagnosis that the ultimate winner is Jensen Huang. It is said that Nvidia, preparing next year's 'Rubin' AI accelerator following the current flagship Blackwell, will succeed in clearing H200 inventory. A Chinese semiconductor expert evaluated it as "Jensen Huang's victory, as he can clear H200 inventory ahead of the Rubin launch."

Because the US and China know each other's intentions well, there is also a forecast that the H200 export approval may fizzle out.

Hwang Jeong-su / Kang Hae-ryeong, reporters hjs@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)