Why Long-Term Rates Rise Even When the Fed Cuts... The Market Is Betting 'Here' [Binnan-sae's Flawless Wall Street]

Summary

- Wall Street said that despite Fed rate cuts, inflation concerns and rising long-term yields could expand market volatility.

- It noted that the Trump administration's combination of accommodative monetary policy and fiscal stimulus raises reflation expectations, benefiting U.S. large caps and the commodities sector.

- However, if inflation becomes entrenched, plans for more and faster rate cuts could be disrupted, so investors should watch inflation risks closely.

With the Fed's final rate decision of 2025 looming, market caution is high. On the day before, the 9th (local time), financial markets were broadly mixed. Wall Street's baseline scenario anticipates that the Fed will cut rates again this time following October, while signaling a cautious (hawkish) stance on further cuts.

This kind of 'hawkish cut' can, in the short term, increase volatility in risk-asset markets that want faster, larger rate cuts. The S&P 500, which had opened higher that day, ultimately closed slightly down, and yields on the U.S. 2-year and 10-year Treasuries both rose.

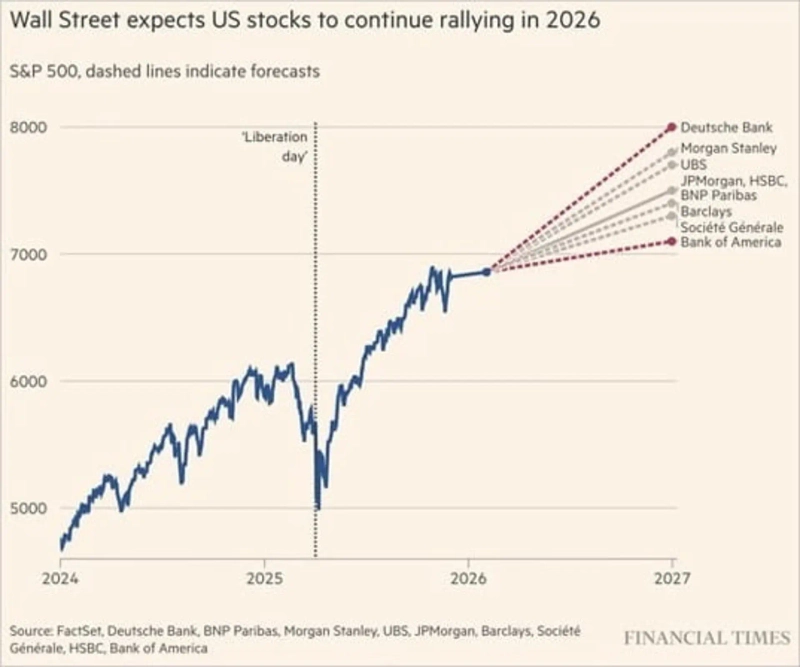

Of course, if the Fed turns out to be less hawkish than the market fears in advance, equities could react positively. Also, unless the Fed ends the rate-cutting cycle outright, Wall Street's consensus is that cuts will continue next year — it's just a matter of pace — and that the environment will remain supportive for stocks. According to a CNBC survey, Wall Street strategists' average year-end 2026 S&P 500 target is 7618. That implies they expect the U.S. stock market to rise more than 10% next year.

Oppenheimer, which has the highest target of 8100, cites accommodative monetary policy, fiscal stimulus, technological innovation, and sustained corporate earnings growth as key reasons. The lowest target, 7100, comes from Bank of America (BoA). BoA warns that AI and efficiency gains could slow the labor market and that inflation-driven purchasing-power erosion could weaken consumption. Still, it expects corporate capital expenditures, tax cuts and fiscal stimulus under the Trump administration, and Fed rate cuts to spur growth.

In short, although to varying degrees, the underpinning of optimism is the Fed's rate cuts and growth acceleration from the Trump government's fiscal stimulus. In an interview published that day with Politico, President Trump called the current U.S. economy "A++++."

If it's A++++, why cut rates?

The central driver of the bullish outlook remains Fed rate cuts. Oppenheimer said a key bullish argument is that "if inflation remains contained, the Fed will cut the policy rate at least once or twice next year." The crucial caveat is "if inflation remains contained."

Recently, doubts have resurfaced in the bond market about whether that premise can hold. If the economy is so strong, why cut rates now — is this the right time? A Bloomberg survey of 39 investment banks and asset managers across the U.S., Asia, and Europe found that the biggest worry for next year was a reacceleration of U.S. inflation.

If inflation picks up again and the Fed suddenly halts cuts or even raises rates, market volatility could spike. Amundi Asset Management said, "While that is not our baseline scenario, if U.S. inflation reaccelerates in 2026, stocks and bonds would be hit simultaneously, making it a much worse scenario than a simple slowdown."

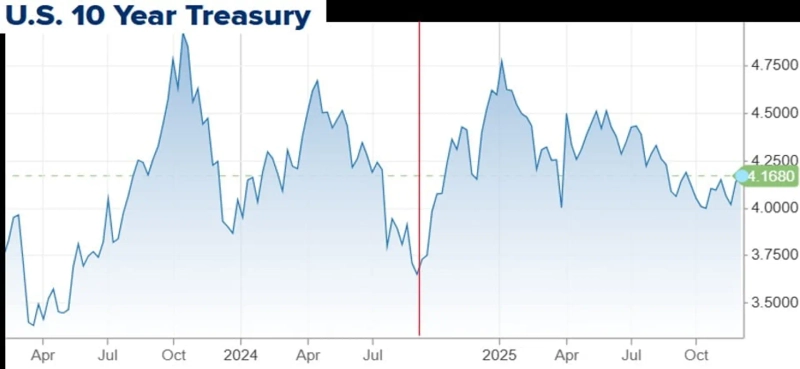

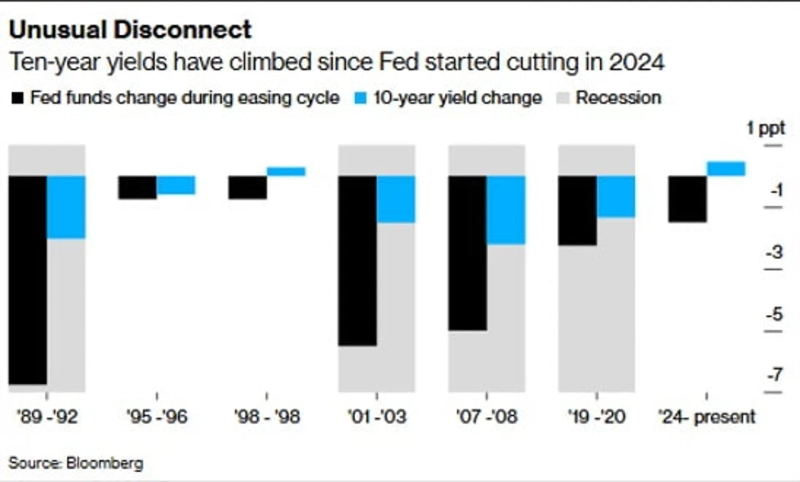

The bond market is already partially pricing in these concerns. The clearest evidence is rising long-term yields. As of 6 p.m. that day, the U.S. 10-year Treasury yield was up 0.02% points from the previous day, nearing 4.19% — a three-month high since early September. Since the Fed resumed cuts in September last year, the policy rate is down 1.5% points while the 10-year yield is up 0.5% points. Bloomberg noted this is a "rare phenomenon not seen except in 1998."

For reference, 1998 was when Alan Greenspan led the Fed. At that time the U.S. economy was in the early stages of the IT bubble boom, but many non-U.S. countries were struggling due to the Asian financial crisis and the Russian default; additionally, the collapse of U.S. hedge fund Long-Term Capital Management (LTCM) drove flows into safe assets like Treasuries, pushing yields very low (and bond prices high).

The New York Fed stepped in to mediate the LTCM rescue, and the Fed subsequently implemented insurance-like rate cuts. That restored confidence and reignited expectations of an economic rebound, and despite Fed cuts, market rates rose. Markets expected high growth, low policy rates, and some inflation. In many ways, there are similarities to the current situation.

Why long-term yields rise even though the Fed is cutting

Considering these circumstances, we can outline reasons why long-term yields are rising now. Some on Wall Street — including Oppenheimer, PGIM, and WisdomTree — argue "the bond market is merely returning to pre-2008 normal rate levels." They say the ultra-low 0–2% era from 2008 to 2021 was historically exceptional and that normalization is simply occurring. If so, recent long-term yield increases are natural and not overly concerning.

However, a louder countervoice argues that cutting rates further amid astronomical debt burdens and inflation concerns is inappropriate — the so-called 'bond vigilantes.'

Ed Yardeni, founder of Yardeni Research and the originator of this term, said, "Bond investors are not following the Fed's easing scenario or the Trump administration's easier policy scenario aimed at lowering policy rates and long-term rates. They remain worried about massive federal deficits and rising U.S. debt, and everyone can see that inflation is staying above the Fed's 2% target."

Jim Bianco of Bianco Research also argued, "Cutting rates while inflation is above the Fed's target looks like 'too much easing' to the market." In this camp, there are views that under the next Fed chair — carrying President Trump's mandate for 'faster rate cuts' — more aggressive cuts could exacerbate side effects.

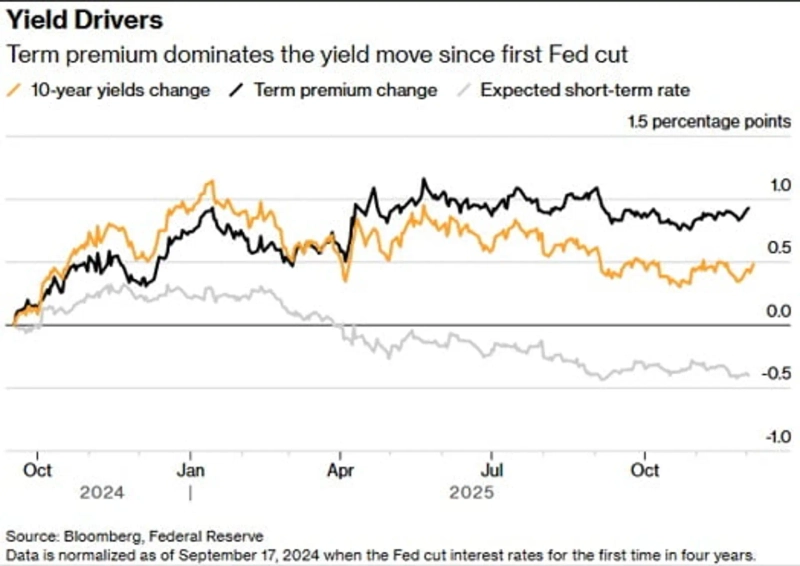

One such side effect is that the term premium demanded by bond investors could rise further. The term premium is additional compensation for risks associated with holding long-term bonds, such as inflation and fiscal uncertainty. If the central bank cuts rates more than the market deems appropriate, increasing inflation and debt risks, bond investors will demand higher compensation (yields) for long-term bonds. That means long-term yields rise. In fact, since the Fed began cutting rates last September, the entire rise in the 10-year yield has been driven by an increase in the term premium.

Renewed inflation burden

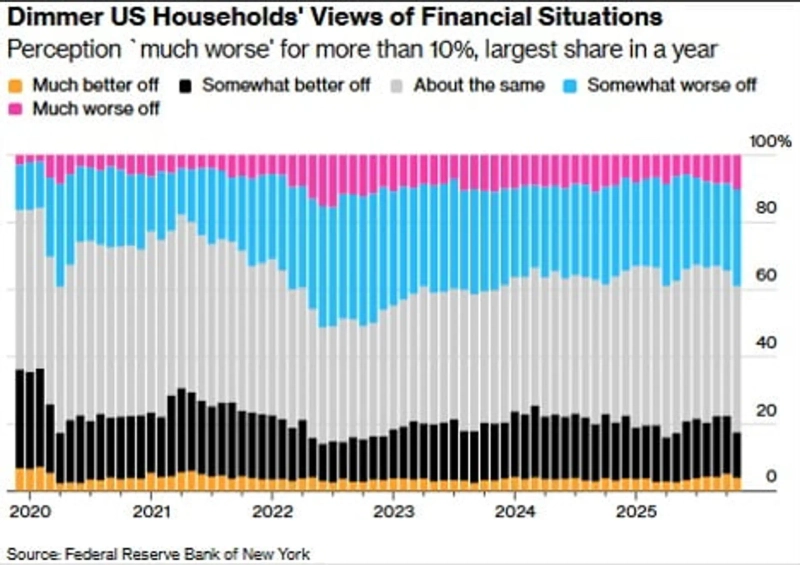

Inflation risk has flared again for two main reasons: first, firms that have been absorbing tariff costs may start passing some of them on to consumers. Second, rising complaints about high domestic prices are starting to negatively affect support for the Trump administration.

Soaring grocery prices for items like coffee, bananas, and beef have made affordability a top priority for the Trump administration ahead of the midterms. It appears President Trump, who had focused on immigration and tariff policies, is shifting his policy emphasis. He recently removed tariffs on some food items and launched a task force to curb record-high beef prices, along with antitrust probes into food companies. He has also left open the possibility of further tariff reductions on certain items.

In addition to a $12 billion support package for farmers hit by reduced soybean imports from China, the administration is pursuing measures like health-care subsidies. The problem is these measures could paradoxically pump more money into the economy, stoke inflation, and reduce tariff revenues, widening the fiscal deficit.

The Trump administration's (original) plan

Of course, the Trump administration and its supporters reject the market's worries that inflation will rise. The Trump economic team's vision resembles the late 1990s growth model: low rates and AI-driven productivity gains → positive supply shock → strong growth without price rises → real wages can increase.

To kickstart corporate investment and production, they argue rates must remain low. If that happens, even if inflation rises somewhat, growth and real-wage gains will be stronger, which Scott Bessent, Treasury Secretary, and Kevin Hassett, Chair of the White House National Economic Council, say is acceptable. Hassett, a leading candidate for the next Fed chair, told CNBC on the 8th, "Like Alan Greenspan's Fed in the 1990s, which tolerated a somewhat hot economy, we now have AI-driven productivity improvement opportunities to seize."

Hassett did add, however, "We need to pay very close attention to inflation figures." The late 1990s had inflation below 2%; today it's closer to 3%, which makes investors more sensitive to inflation risks than they were then.

Rise of the 'reflation trade'

When accommodative monetary policy and fiscal expansion combine to lift both growth and inflation, it's called 'reflation.' The market has begun to price this 'reflation trade' in. Tony Pasquariello, head of hedge funds at Goldman Sachs, noted last week clear signs of reflation: rising yields (bond weakness), curve steepening, broad commodity price gains, and strength in cyclical sectors like banks, industrials, materials, and energy. That indicates the market is betting on a scenario where both growth and inflation rise.

He advised that "while the FOMC could cause short-term volatility, maintaining core positions in U.S. large caps and reflation beneficiaries such as energy, materials, and industrials is reasonable."

Many expect a strong commodities market. Goldman Sachs sees commodities rising through 2035 (excluding oil), led by gold and copper, and Michael Hartnett, Bank of America's chief strategist, said "next year every commodity chart will look like gold," arguing commodity long positions will be hottest. Under fiscal expansion, populism, inflation, and deglobalization, real assets and commodities could outperform bonds. Gold and copper are expected to see double-digit returns next year.

In the end, according to Wall Street consensus, the U.S. economy may achieve stronger-than-expected growth next year under this reflation flow, creating a favorable environment for equities. But investors should also be mindful that inflation concerns could disrupt the market's hoped-for path of "more and faster" rate cuts.

New York = Bin Nansae, correspondent binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)