'Hundreds of billions flew away over '10 won'... Korean companies 'cry out' [Global Money X-file]

Summary

- Korean companies report that net profits are decreasing due to rising foreign exchange hedge costs, called the 'volatility tax'.

- By contrast, U.S. Wall Street investment banks recorded record derivatives profits thanks to exchange-rate volatility.

- Recent rises in the exchange rate have been outweighed by hedge costs and raw material import costs, increasing burdens especially on SMEs and financial institutions.

Exchange-rate 'fear' hits companies… Wall Street sits on a pile of cash

Recently, the cost that companies must pay to avoid exchange-rate fluctuation risk—currency hedge costs—has been rising. This invisible cost, called the 'volatility tax', is analyzed as eating into the net profits of Korean companies and pushing up consumer prices. On the other hand, some argue that the volatility tax is delivering record profits to large U.S. Wall Street banks.

Surging demand for hedging products

On the 12th, according to the Bank for International Settlements (BIS) and the financial investment industry, as of April the global foreign exchange market's average daily turnover was $9.5 trillion, a 27% increase from 2022. This is not because real trade has increased. Analysts say it is because worried market participants rushed to buy hedging (insurance) products.

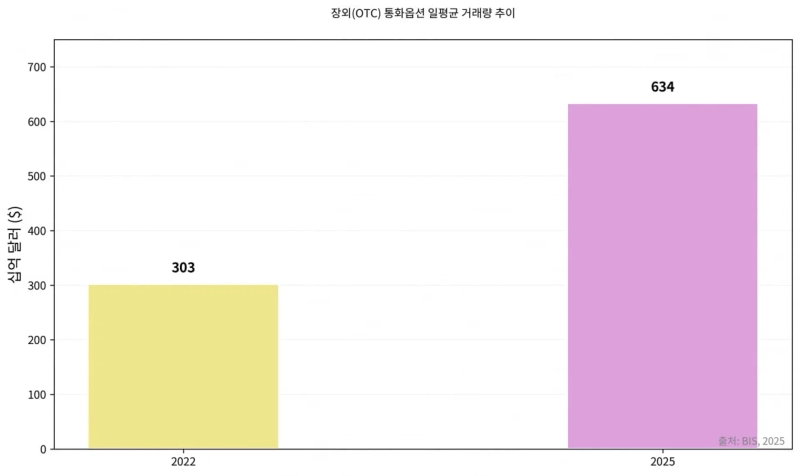

A notable point is the surge in FX options trading. According to the BIS, average daily over-the-counter (OTC) currency option trading rose from about $303 billion in 2022 to $634 billion in 2025—more than doubling. This means companies are paying higher premiums and turning to the options market to defend risks that simple forward contracts cannot handle.

This increase in such hedging costs (the volatility tax) begins with structural imbalances in global financial markets. The era when central banks around the world moved in one direction after the pandemic has ended. Each country is now taking its own path to balance the conflicting goals of defending against domestic inflation and economic recession.

The U.S. Federal Reserve (Fed) is lowering rates gradually. However, it is maintaining high rates in the upper 3% range. By contrast, the European Central Bank (ECB), citing recession concerns, is emphasizing stability with rates in the 2% range. The Bank of Japan (BOJ) has effectively exited negative rates and raised rates to 0.5%, pursuing its own path to normalization.

The Bank of Korea is caught between a rock and a hard place. With rising household debt, instability in the Seoul metropolitan real estate market, and an unruly exchange rate, the Monetary Policy Committee in November kept the policy rate unchanged at 2.50% for the fourth consecutive time. The policy rate gap between Korea and the U.S. has remained above about 1 percentage point at the upper end. In the past the gap widened to 2.0 percentage points. Although that gap has narrowed, the market has begun to accept that the gap is a 'structural constant' that will be difficult to eliminate.

Analysts say this interest-rate gap has changed the basic grammar of the foreign exchange market. Theoretically, the forward rate is determined by reflecting interest-rate differentials between countries. If demand to sell low-interest-rate Korean won and buy high-interest-rate dollars surges, the won should trade much cheaper in the forward market than in the spot market. This is called 'negative swap points.'

In the past, when Korean rates were higher than U.S. rates, exporters received a 'premium' equal to the interest-rate difference when they sold the dollars they would receive in the future in advance (selling forward). Hedging was profit. Now the situation is reversed. Because U.S. rates are high, exporters reportedly have to sell dollars usually at 20–30 won cheaper per dollar than the spot rate to sell dollars in advance.

The prospectability of the foreign exchange market has sharply declined as a second Trump administration has shaken the global trade order. Such uncertainty acts like a kind of premium, forcing market participants to pay more than before to secure dollars.

As a result, the cross-currency basis has widened (Cross-Currency Basis — the spread reflected in currency swap rates due to imbalances in funding costs between different currencies). Companies effectively bear an additional 'volatility tax' in the form of higher currency hedging costs.

Wall Street smiles at volatility

On the other hand, analyses show U.S. Wall Street investment banks have benefited. In financial markets, volatility is both a product and a source of profit. The more fearful companies are of exchange-rate swings, the greater the demand for derivatives provided by banks. Banks widen bid-ask spreads to maximize margins.

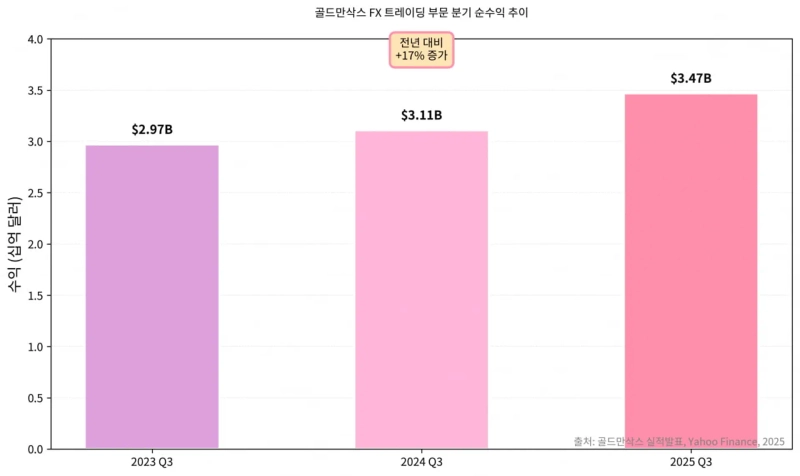

Combining Yahoo Finance and industry analyses, Goldman Sachs' fixed income, currencies and commodities (FICC) net revenues in the third quarter this year were $3.47 billion, a 17% increase year-on-year. According to analyses by risk.net and FX Markets, Goldman Sachs' annual FX trading revenue last year rose 125% year-on-year to $6.3 billion, the highest among U.S. banks.

Goldman Sachs CEO David Solomon said on the third-quarter earnings conference call, "This quarter's results show that our strategic priorities hit the mark in an improved market environment," and "we generated revenue by intermediating risk while helping clients manage volatility." This means hedge costs paid by companies in non-reserve-currency countries, including Korea, increased.

The vanished exchange-rate effect

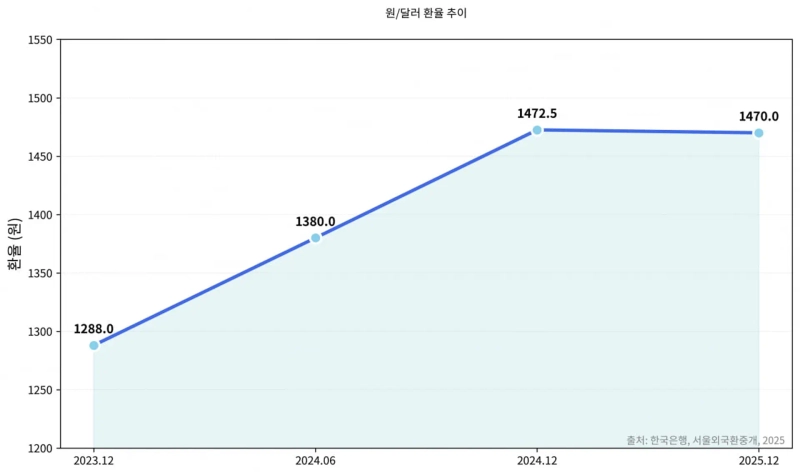

Normally, a weaker home currency (a higher exchange rate) is good news for exporters. When earnings in dollars are converted into won, profits rise and exporters gain price competitiveness. But recent Korean economic data suggest this formula has broken down. The volatility tax and higher costs of raw material imports needed to defend that exchange rate have outweighed the benefits of a rate in the 1,400-won range.

In the airline industry, aircraft lease payments are made in dollars and jet fuel is also paid in dollars. Every 10-won rise in the exchange rate causes hundreds of billions of won in foreign exchange losses. The energy industry is also on alert. Industry sources estimate that Korean refiners incur an additional $5–10 million in crude oil payment costs for every 10-won rise in the exchange rate. The most vulnerable link is small and medium-sized enterprises. Unlike large companies, SMEs often lack sophisticated finance teams and face exchange-rate volatility with little protection.

Korean financial institutions are also affected. Domestic life insurers invest a significant portion of their assets in overseas bonds because domestic bonds alone are insufficient to meet the promised returns to customers. However, these overseas investments have become a liability this year.

Under the new capital adequacy regime (K-ICS), required capital increases if foreign exchange risk is not 100% diversified. To meet prudential ratios, insurers are forced to hedge. Reportedly, recent hedging costs have surged to around 2% per year. Even if they earn 4% from U.S. Treasuries, after deducting 2% hedging costs, little remains.

The 'big player' National Pension Service has also been at the center of related controversy. Critics have argued that the NPS's process of converting won into dollars to buy overseas stocks fuels exchange-rate rises. The government decided to extend the foreign-exchange swap with the National Pension Service (limit $65 billion). This is intended to reduce upward pressure on the exchange rate by having the NPS borrow the Bank of Korea's dollars instead of buying dollars in the market.

Reporter Kim Joo-wan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)