Korea-U.S. interest rate gap narrowed... won-dollar exchange rate rose instead

Summary

- Despite the U.S. policy rate cut narrowing the Korea-U.S. interest rate gap, the won-dollar exchange rate was reported to have risen.

- The market said that dollar-buying momentum limited downward pressure on the exchange rate.

- It was reported that the Bank of Korea's rate-hold stance could continue until at least the first half of next year.

Bank of Korea likely to prolong rate freeze

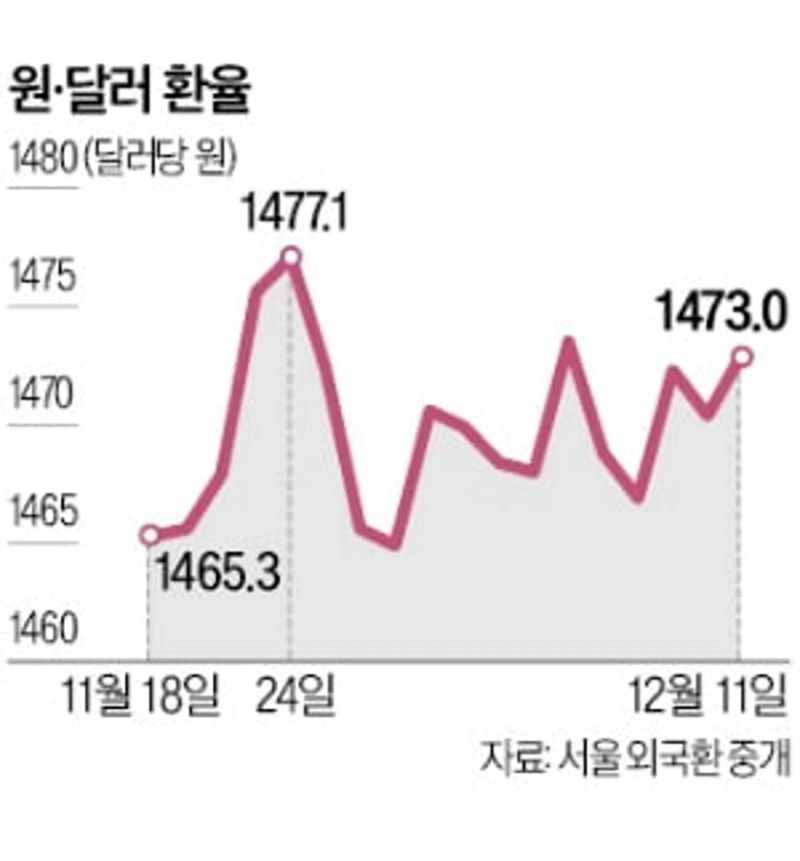

On the 11th, when the Korea-U.S. interest rate gap narrowed due to the U.S. central bank (Fed)'s policy rate cut, the won-dollar exchange rate actually rose. Although the upward pressure on the exchange rate from the interest rate gap eased, it was analyzed that dollar-buying demand remained large.

On the 11th, according to the Bank of Korea, the Fed on the 10th (local time) lowered its policy rate by 0.25% point to 3.50~3.75%, narrowing the rate gap with Korea (annual 2.50%) to 1.25% points (based on the upper end of U.S. rates). As the gap and inversion in policy rates with the United States, which had widened to a record high of 2.00% points since last May, was reduced, the pressure for capital outflows decreased. This is because the returns available in the U.S. market relatively decreased.

That day in the Seoul foreign exchange market, the won-dollar exchange rate actually rose (the won depreciated). It finished weekly trading at 1473 won, up 2 won 60 jeon from the previous day. In the morning it started at 1464 won 50 jeon, down 5 won 90 jeon due to the narrowed rate gap and other factors, but around 10 a.m. as the Asian session opened it turned into an upswing. The market analyzed that this was due to dollar buying that perceived the recent exchange rate as a bottom.

Lee Chang-yong, governor of the Bank of Korea, said at a meeting with reporters that afternoon, "The Fed's decision and Fed Chair Jerome Powell's press conference were all as expected." On why the exchange rate did not fall despite the U.S. rate cut, he said, "It seems the outlook for (policy rates) next year is being reflected," adding, "Who will be the Fed Chair is important." Deputy Governor Park Jong-woo held a morning meeting to review market conditions related to the FOMC that day and predicted, "The Fed's monetary policy stance will become more cautious."

The Bank of Korea's monetary policy is also expected to remain on hold, which has continued since May, for the time being. This is because high exchange rates and a continuing rise in real estate prices make it difficult to lower rates. Market participants expect the rate freeze to be prolonged at least until the first half of next year.

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)