Summary

- The U.S. central bank (Fed) cut the policy rate by 0.25%% percentage point and indicated it will hold rates for the time being and that there may be only one rate cut next year.

- Within the Fed there is division over the need for rate cuts, with 7 of 19 members saying cuts are not necessary, indicating a split in monetary policy decision-making.

- Chair Jerome Powell raised the growth outlook but said inflation remains elevated and the Fed is being cautious about the timing and magnitude of further cuts.

Fed 'hawkish rate cut'…signals it will hold rates for the time being

Down 0.25% percentage point…rules out further cuts

Some say "less hawkish than the market expected"

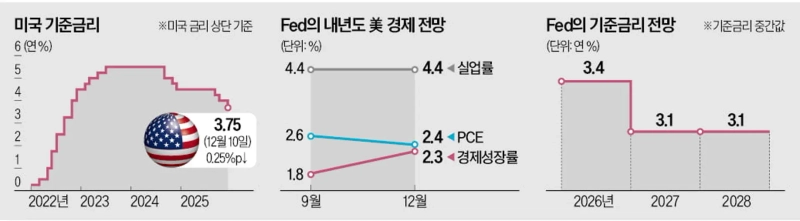

The U.S. central bank (Fed) lowered its policy rate by 0.25% percentage point on the 10th (local time) as expected, bringing it down to 3.5~3.75%. However, it signaled it will hold rates for the time being and indicated that the number of rate cuts next year may be limited to one, leading many to describe the move as a "hawkish cut."

The Fed cited an "increased downside risk in the labor market" as the reason for the rate cut. At the same time, it warned that "inflation is still at a somewhat elevated level," indicating continued caution. Fed Chair Jerome Powell said that "(with this cut) we are in a good position to wait and see how the economic situation evolves," hinting that rates will be held for the time being. The dot plot showing Fed members' rate projections presented a median policy rate of 3.4% for next year.

Powell also said that "there are almost no people who think the next move will be a rate hike," drawing a line under rate increases. While saying it is not quantitative easing (QE), the Fed announced plans to purchase short-term Treasury bills, which has money-injection effects in the market. Some market participants evaluated Powell as "less hawkish than expected."

Of 19 Fed officials, 7 say "no cut is needed next year"

Powell: "Monetary policy is not unanimous"…inflation still somewhat elevated

"I acknowledge that this is not the usual situation where everyone fully agrees on the direction and actions of policy."

This was Jerome Powell's response on the 10th (local time) at a press conference held immediately after the Federal Open Market Committee (FOMC) when asked whether there were internal disagreements. Although the Fed has cut rates three times since September, Fed members' views on rate decisions were sharply divided.

Seven say "no cut needed"

In the Summary of Economic Projections (SEP), the Fed presented a median policy rate of 3.4% for the end of next year, unchanged from the September projection. This suggested one rate cut next year.

The FOMC statement issued immediately after the meeting used the phrase "considering the magnitude and timing of any further adjustments" regarding future rate decisions. Compared with the previous phrase "considering any further adjustments," the addition of 'magnitude and timing' is seen by the market as a sign that the Fed may delay or even stop future cuts. The phrase 'magnitude and timing' was also used around this time last year, when the Fed held rates for a while before starting cuts in September this year.

Looking at the anonymous dot plot that records members' views, monetary policy decisions do not appear easy. Of the 19 whose views are reflected in the dot plot, 7 said cuts are not necessary next year. Four said one cut is needed, and eight said at least two cuts are needed. It is not easy to find a single direction for policy. In particular, in the rate cut vote that day, Steven Myron, described as a close ally of U.S. President Donald Trump, argued for a big cut (a 0.5% percentage point reduction in the policy rate). In contrast, Jeff Schmid, president of the Federal Reserve Bank of Kansas City, and Austan Goolsbee, president of the Federal Reserve Bank of Chicago, maintained positions to keep rates unchanged. It was the first time in six years that three members dissented in the FOMC.

Raise growth, lower inflation

The Fed assessed inflation as "still at a somewhat elevated level." It also said "uncertainty about the economic outlook remains high." However, it expects growth to rise and inflation to fall next year.

First, economic growth is projected at 2.3%. This is higher than the 1.8% projected in September and also higher than this year's expected 1.7%. Powell said the upward revision to the growth forecast is due to improved productivity, and some of it may be attributable to artificial intelligence (AI). Powell said, "Part of it is that consumption has remained resilient, and another part is that spending on data centers and AI-related investment—i.e., investment related to AI—is supporting business fixed investment," adding that "the baseline view is 'solid growth next year' ."

The unemployment rate for next year was forecast unchanged from September at 4.4%. The personal consumption expenditure (PCE) inflation rate, an inflation gauge, is expected to fall from 2.9% this year to 2.4% next year. If growth rises and inflation falls, pressure for rate cuts could also be reduced.

After the FOMC's rate cut announcement that day, President Trump criticized Powell at a White House event, calling the Fed "stubborn" and saying "Chair Powell is a stiff person." He also said "(the Fed should have cut rates) at least twice as much today," arguing for a 0.5% percentage point cut.

Investors are watching whom President Trump will name to succeed Powell, whose term ends in May next year. Kevin Hassett, chairman of the White House National Economic Council (NEC), has been cited as a leading candidate, and a final nominee could be announced as early as this month. Hassett told Fox News before the FOMC decision that "we could certainly cut by 0.5% or more."

New York = Park Shin-young, correspondent nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)