Summary

- Global fintech firm PayPal announced it is pursuing establishment of a bank in the United States, aided by U.S. financial regulatory easing.

- Cryptocurrency firms such as Circle and Ripple received preliminary approvals to establish banks, signaling active market entry.

- JPMorgan applied blockchain technology to money market funds (MMFs), enabling real-time trading and potential use as collateral assets.

U.S. regulatory easing leads to bank entry

Circle, Ripple among those receiving preliminary approval

JPMorgan applies blockchain to MMFs

Global fintech and payments firm PayPal is seeking to establish a bank in the United States. After the inauguration of the second Trump administration eased financial regulations, the company plans to shift from being a 'loan intermediary' to a 'lender' that directly provides funds. The U.S. financial industry is rapidly evolving as it lowers entry barriers and integrates technology, such as JPMorgan deciding to apply blockchain technology to the traditional financial product money market funds (MMFs).

On the 15th (local time), PayPal said it had submitted an application to the Federal Deposit Insurance Corporation (FDIC) and Utah financial regulators to establish a bank. The application is for a Utah-chartered industrial bank (ILC) and, if approved, 'PayPal Bank' would be launched. PayPal expects to strengthen its small business lending capabilities by establishing a bank. If the bank formation is approved, it would create a structure that allows PayPal to fund loans to small businesses directly without partnering with other banks.

Since 2013, PayPal has provided more than $30 billion in loans and capital to small businesses. Alex Chriss, PayPal CEO, said, "Establishing PayPal Bank will improve business efficiency and provide an opportunity to more effectively support small business growth and economic opportunities across the United States."

Since the start of the second Trump administration, not only fintech firms but also cryptocurrency companies have been actively pursuing bank entry in the U.S. This month, Circle, Ripple, Paxos and others received preliminary approvals related to bank formation. Nissan Motor's financial subsidiary and Japan's Sony Group have also applied for similar types of bank charters.

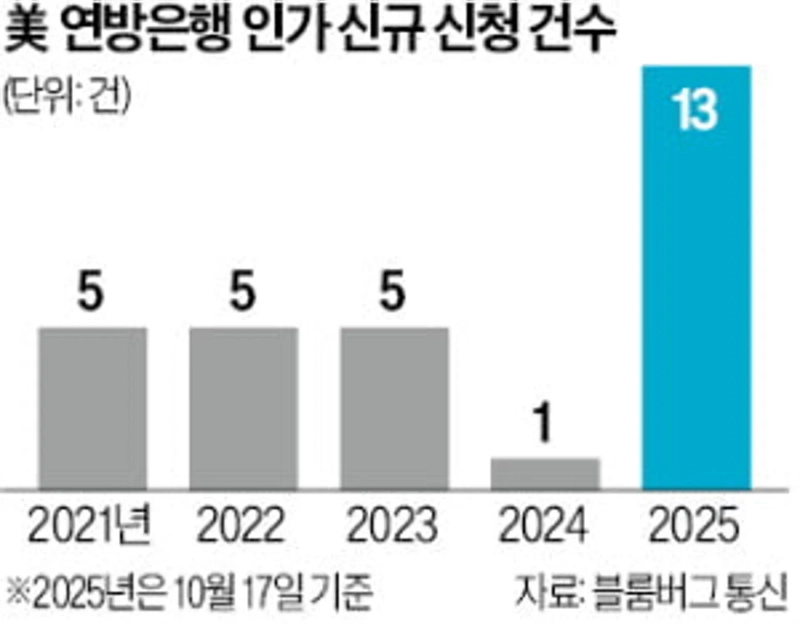

Foreign media have assessed that the Trump administration's more flexible stance toward fintech and virtual asset firms' entry into banking has led to a surge in related applications. According to consulting firm Claros Group's tally, as of October 17, the number of new federal bank applications this year reached 13, the highest since 2020. Last year there was only one. During the previous Joe Biden administration, applications themselves were rare due to the perception that bank formation approval was difficult. Bloomberg News explained, "Owning a banking arm greatly increases capital access needed for business expansion," adding, "Consumers also gain expanded access to loans, lower fees, and more choices in competition between new and existing banks."

On the same day, JPMorgan Chase Asset Management announced the launch of its first tokenized MMF product, 'My Onchain Net Yield Fund' (MONY), on the Ethereum blockchain. An MMF that invests in traditional assets such as government bonds has entered the blockchain ecosystem. MONY can be subscribed to and redeemed in cash or the stablecoin USDC, and investors receive digital tokens corresponding to the fund shares (units) upon subscription. Tokenized MMFs can be traded in real time and can be transferred directly between financial firms without needing to redeem into cash, making them usable as collateral assets.

Han Kyung-jae Reporter/New York = Park Shin-young Correspondent hankyung@hankyung.com

Han Kyung-jae Reporter hankyung@hankyung.com New York = Park Shin-young Correspondent nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)