Import prices driven by the exchange rate…Dollar prices fell but won prices rose [Price&]

Summary

- Recently the won-dollar exchange rate has approached 1,500 won, widening the gap between 'dollar prices' and 'won prices'.

- The dollar-denominated import unit prices of major imported grains and livestock products fell, but won-denominated import prices rose or rose by a larger margin.

- Analysts say this phenomenon is mainly caused by the recent high exchange rate.

Grains and livestock products: dollar-denominated import prices fell

Won prices converted according to the exchange rate are rising across the board

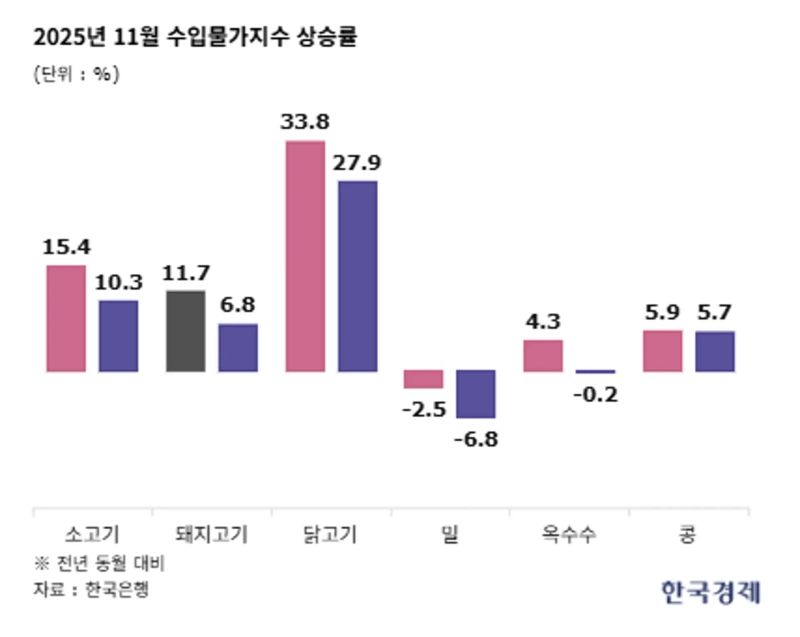

The gap between 'dollar prices' and 'won prices' is growing. This is the effect of the won-dollar exchange rate soaring to nearly 1,500 won. Although dollar-denominated import unit prices for major imported grains fell, import prices converted into won actually rose. Imported livestock products saw larger increases in won-denominated import prices than in dollar-denominated import prices.

On the 17th, according to the Agricultural Outlook Center of the Korea Rural Economic Institute (KREI), import unit prices for major edible grains last month all fell compared with a year earlier. Milling wheat was 295 dollars per t, down 12.5% from 337 dollars per t in the same month last year. Food corn fell 2.4% from 261 dollars per t in November last year to 255 dollars per t this November, and food soybeans fell 7% from 846 dollars per t to 787 dollars per t. Oilseed soybeans used for pressing oil also fell by more than 9% from 527 dollars per t to 479 dollars per t.

Meanwhile, won-denominated import prices continue to rise year on year. According to the Bank of Korea import price index, the won-denominated corn import price index last month was 135.27, up 4.4% from 129.6 in the same month last year. Soybeans rose 10.6% from 124.04 to 137.18. The wheat import price index was 122.11, only slightly down compared with 125.19 in the same month a year earlier.

For livestock products, there are many items whose won-denominated import price index rose far more than the dollar-denominated one. The beef import price index (2020=100) rose by about 10% in dollar terms from 117.82 in last November to 129.99 last month, but in won terms it jumped about 15% from 139.1 to 160.75. Pork rose 6.8% in dollar terms but 11.7% in won terms, and chicken rose 28% in dollar terms but surged 33% in won terms. In particular, the chicken won-denominated import price index was 192.79 in November this year, nearly double the 2020 level.

The price trends of imported items are affected by factors such as growing conditions in partner countries and domestic demand, but analysts say the main cause of the recent divergence between dollar- and won-denominated prices is the high exchange rate. The monthly average won-dollar exchange rate last month (based on weekly closing prices) was 1,460 won 44 jeon, up 4.7% from 1,394 won 32 jeon in the same month last year. On the previous day in the Seoul foreign exchange market, the won-dollar exchange rate closed at 1,477 won, the third highest so far this year.

Lee Gwang-sik reporter bumeran@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)