[Analysis] "Bitcoin on-chain capital inflows slow… investor sentiment recovery will take several months"

Summary

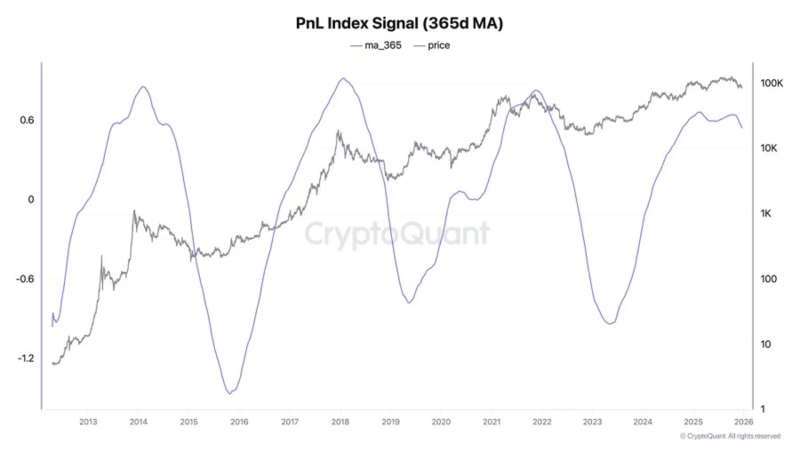

- Signals of slowing capital inflows were detected in Bitcoin on-chain indicators.

- The realized market capitalization has stagnated, weakening new buying momentum.

- They analyzed that investor sentiment will likely require several months rather than recover immediately.

Signals of slowing capital inflows were detected in Bitcoin (BTC) on-chain indicators, leading to analysis that short-term market recovery may be limited.

On the 22nd (local time), Ki Young Ju, CEO of CryptoQuant, said on X, "Bitcoin on-chain capital inflows are weakening," and "the realized market capitalization, which had been rising for about two and a half years, has remained stagnant over the past month."

Realized market capitalization is an indicator calculated based on the price when each Bitcoin last moved, and is a key on-chain indicator that reflects the amount of capital actually flowing into the market. An increase in this figure indicates new funds are flowing in, whereas stagnation or decline suggests that buying momentum is weakening.

Ki Young Ju analyzed, "Looking at the current flow, it is likely that investor sentiment will require several months to recover rather than recover immediately." This can be interpreted as indicating that, rather than a short-term rebound, an adjustment or sideways phase may continue.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Iran war stokes stagflation fears [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/2921d103-2e89-41c7-b9ac-1551400bdd6b.webp?w=250)