[Analysis] "Bitcoin shows network cooling signals... confirmation of entry into a low-activity phase"

Summary

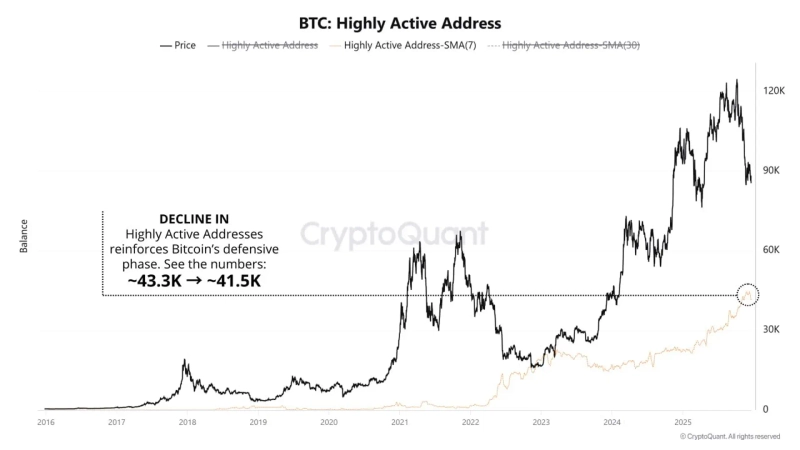

- It analyzed that the Bitcoin network's activity slowdown is continuing and the market has entered a defensive phase.

- It stated that the decrease in high-activity addresses and transaction counts suggests weakening activity by large participants and speculative demand.

- It warned that, as in past cases, there is a possibility of increased volatility after a low-activity period, so caution is necessary.

Activity across the Bitcoin (BTC) network has continued to slow, leading to analysis that the market has entered a defensive phase.

On the 22nd (local time), CryptoQuant contributor GugaOnChain said, "Bitcoin's bull-bear cycle indicator and the 30-day moving average are below the 365-day moving average, and the current gap is around -0.52%," adding, "This is a signal that the market remains in a bearish trend."

According to the contributor, the number of high-activity addresses fell from 43,300 to 41,500. This suggests that activity among large participants and professional traders has decreased. Historically, periods of declining high-activity addresses have seen institutions and whales adopt a more watchful stance, and often transitioned into quiet accumulation phases ahead of increased volatility.

At the same time, key indicators that make up network activity have all slowed. Transaction counts decreased from about 460,000 to 438,000, indicating reduced trading frequency and speculative use. In past down cycles, transaction declines clearly indicated weakening speculative demand, and low activity levels tended to persist until a new catalyst emerged.

The fee environment is showing a similar trend. Dollar-denominated network fees fell slightly from about $233,000 to $230,000. This indicates eased competition for block space and is consistent with the low-demand environment repeatedly observed in past bear market phases.

The contributor said, "Some indicators also show similarities to the 2018 bear market. At that time, decreases in active addresses, reduced transactions, falling fees, and the retreat of major participants occurred simultaneously," adding, "However, the Bitcoin network's user base is currently around 800,000, significantly expanded from about 600,000 in 2018. This means the ecosystem's structural resilience has strengthened compared to the past, but caution is still needed because the low-activity period could later lead to increased volatility," he analyzed.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Iran war stokes stagflation fears [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/2921d103-2e89-41c7-b9ac-1551400bdd6b.webp?w=250)

![Stocks Whipsawed by Iran Crisis… “Money Moves Will Continue” [Weekly Outlook]](https://media.bloomingbit.io/PROD/news/dc1511ef-f8da-4fba-95dc-908afdb380f1.webp?w=250)