Editor's PiCK

Tom Lee "Ethereum could rise as high as $9,000 next year… Tokenization market is key"

공유하기

- Tom Lee, chairman of Bitmain, said Ethereum could reach an all-time high next year.

- He predicted that if institutions' on-chain finance experiments accelerate, Ethereum's price could rise to as much as $9,000 by early 2026.

- It noted that the Ethereum network accounts for the largest share of the real-world asset (RWA) market.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Altcoin leader Ethereum (ETH) could reach a record high next year, according to forecasts.

On the 27th (Korean time), crypto-focused media Cointelegraph reported that Tom Lee, chairman of Bitmain, said, "Wall Street is trying to tokenize every asset," adding that "Ethereum is the blockchain asset at the center of this change." He went on to predict, "If institutional on-chain finance experiments accelerate, Ethereum's price could rise to $7,000–$9,000 by early 2026."

Lee said Ethereum could emerge as "financial infrastructure" starting next year. He stated, "It will bring efficiencies to traditional finance while enabling the development of practical use cases built on Ethereum," and emphasized, "Long term, $20,000 is also possible."

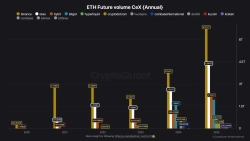

In fact, the Ethereum network holds the largest share in the tokenized real-world asset (RWA) market. According to RWA.xyz, a website providing RWA market data, a significant portion of tokenized assets are issued and circulated on the Ethereum blockchain, with tokenized U.S. Treasuries and commodities in particular growing rapidly.