Editor's PiCK

Coin investors left out as the Kospi breaks above '5,000'… “All we can do is sigh in envy”

공유하기

Summary

- The Kospi index crossed the 5,000 level for the first time, surging 97% in a year, reflecting the impact of AI, the semiconductor supercycle and the government’s push to support stock prices.

- Over the same period, total crypto market capitalization fell about 15%, and Bitcoin, Ethereum and XRP all declined, widening the performance gap versus the Kospi.

- Industry officials and experts said the divergence in fundamentals and weaker risk appetite suggest crypto funds are moving into the domestic stock market.

Kospi up 97% in a year

Crypto market cap down 15%

“Performance diverged due to differences in fundamentals”

The Kospi broke above the 5,000 mark for the first time ever, turning the “dream index” into reality. By contrast, the virtual asset (cryptocurrency) market has yet to shake off its slump, further dampening investor sentiment toward digital assets.

On the 22nd, the Kospi briefly topped 5,019 intraday, scaling the 5,000 milestone for the first time in its 46-year history. The index has climbed about 97% over the past year. The rally is seen as being driven by a surge of buying amid a semiconductor supercycle fueled by expanded artificial intelligence (AI) investment, expectations for the robotics industry, and the government’s push to support stock prices.

Over the same period, the virtual asset market remained weak. Total crypto market capitalization fell about 15%, from $3.58 trillion (about 5,260 trillion won) a year ago to $3.04 trillion (about 4,470 trillion won) now. While there have recently been signs of a rebound after a sharp correction late last year, prices still sit roughly 30–40% below their all-time highs.

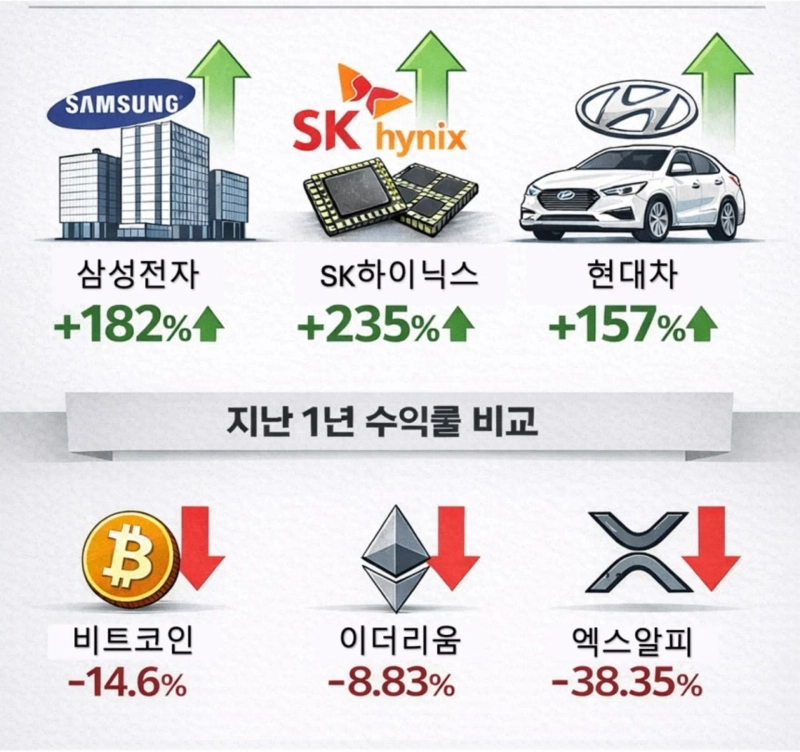

Kospi vs. virtual assets: sharply different one-year report cards

Comparing performance among bellwether assets in each market makes the gap even clearer.

Samsung Electronics, SK hynix and Hyundai Motor—ranked No. 1 to No. 3 by market capitalization on the Kospi—have been setting fresh record highs day after day since the start of the year.

As of 3:30 p.m. that day, Samsung Electronics closed on the Korea Exchange up 1.87% from the previous session at 152,300 won, marking a 182% surge from a year earlier. Over the same period, SK hynix and Hyundai Motor also jumped 235% and 157%, respectively.

By contrast, leading names in the crypto market struggled. Bitcoin (BTC), the bellwether crypto, was down 14.60% from a year earlier. Ethereum (ETH) fell 8.83% over the same period, while XRP plunged 38.35%.

Trading turnover also showed a stark contrast. As of that day, Upbit’s 24-hour trading volume fell 10.9% from the previous day to $1.67378 billion (about 2.4694 trillion won). Kospi trading value, meanwhile, rose 8.1% from the previous day to 32.5264 trillion won.

Upbit’s daily trading volume had at times approached $8.854 billion (about 13.074 trillion won) last year, even surpassing the Kospi’s total trading value, but more recently the Kospi has been outpacing it in turnover day after day.

Industry officials say the trend reflects differences in fundamentals between the two markets.

Hong Sung-wook, an analyst at NH Investment & Securities, said, “With a policy-driven push and clearer earnings visibility in growth industries, the Kospi had distinct upside momentum,” adding, “In the case of the virtual asset market, while it shares the macro environment with other markets, internal factors—such as heightened volatility in the futures market and deteriorating investor sentiment—overlapped, resulting in relatively sluggish performance.”

As the two capital markets move in opposite directions, some also argue that domestic investors’ money has been flowing out of crypto and into the local stock market.

Kim Jin-il, a professor of economics at Korea University, said, “There had been aspects of low trust in the Kospi, but the situation has changed recently,” adding, “When returns diverge, investors have no choice but to move funds.”

“Should I ditch coins and buy stocks?”

As performance has diverged sharply between equities and virtual assets, investor sentiment is also splitting. While stock investors enjoy a daily record-high rally, crypto investors are voicing a sense of relative deprivation.

Crypto investor A said, “I kept holding because I strongly believed in virtual assets, but I’m envious of friends who invested in the Kospi,” adding, “I’m wondering if I should start investing in stocks even now.” Another retail investor, B, said, “I invest in both stocks and virtual assets, but the situation is completely different,” adding, “I’m considering increasing my Kospi allocation.”

Still, some retain a positive view on virtual assets. Retail investor C said, “Virtual assets are more sensitive to the global macro environment and regulatory changes than the domestic market,” adding, “If catalysts emerge—such as the U.S. putting crypto laws and regulations in place or global uncertainty easing—there is also a possibility that funds taking profits in the stock market could flow back into the coin market.”