Editor's PiCK

"Invest on Your Own"... 'AI Agent' Emerges as a Hot Topic in the Crypto Market [Hwang Doo-hyun's Web3+]

Summary

- The 'AI Agent' is rapidly emerging as a new narrative in the crypto market, with its market cap surpassing $16 billion in just three months.

- Bitwise analyzed that AI agents will innovate DeFi and blockchain by automating complex trading strategies.

- ai16z and Virtuals Protocol are representative AI agent projects, recording high yields and market cap increases.

'AI Agent' Rapidly Rises in the Crypto Market Narrative

'AI Agent' Sector Market Cap Reaches $16 Billion in 3 Months

Crypto Industry Says "AI Agents Should Be Watched This Year"

ai16z·Virtuals Protocol Among Key Projects

The 'Artificial Intelligence (AI) Agent' is emerging as a new narrative in the cryptocurrency market. There is anticipation that AI agents can solve the entry barriers of the crypto market caused by complex trading structures.

The market capitalization of the AI agent-related crypto sector surpassed $16 billion (approximately 23 trillion won) just three months after AI agents began to gain prominence last October. Global asset management firm VanEck and Web3 venture capital (VC) Hash have also highlighted AI agents as a field to watch in the crypto market this year.

So what exactly is an AI agent, and what role can it play in the crypto market that it is receiving such attention?

"Complex Coin Investments, We'll Handle It for You"... Will AI Agents Revolutionize the Crypto Market?

AI agents are autonomous software that learns and plans on its own to achieve specific goals. Unlike traditional AI bots that operate based on pre-set codes and rules, AI agents have the ability to analyze data and make final decisions independently.

In crypto investments, an AI bot can be set to execute a purchase when the price falls below a certain range. However, it cannot evaluate whether that decision is the best choice. In contrast, AI agents analyze market fluctuation patterns and trends to determine the optimal buying time and execute trades.

The crypto industry believes that the capabilities of AI agents can lower the high entry barriers of the crypto market, characterized by ▲24-hour trading without opening and closing times and complex investment procedures ▲complex concepts like decentralized finance (DeFi) and bridges ▲information asymmetry among investors. AI agents can collect vast amounts of data on behalf of humans, understand complex concepts, and respond to the continuously operating crypto investment environment.

Bitcoin spot ETF issuer Bitwise analyzed that "AI agents will innovate DeFi and blockchain by automating complex trading strategies and optimizing asset management for investors." Global VC Dragonfly also evaluated that "AI agents are ready to revolutionize cryptocurrencies."

Kim Byung-jun, a researcher at Dispread, stated in a report, "AI will enable efficient asset management in various aspects such as on-chain basket-type token fund management, DeFi yield farming optimization, risk analysis, and management," and "based on this, a new economic ecosystem based on agents will be formed on-chain in the future."

Annual Yield 80%·Token Surges 9000%... Increasing AI Agent Projects

According to VanEck's data, the number of AI agents used in crypto investments exceeded 10,000 in the fourth quarter of last year. The profits they generated amounted to $8.7 million (approximately 12.8 billion won). VanEck predicted that "the number of AI agents aiming for profit generation this year will increase tremendously, surpassing 1 million."

Amidst the already active combination of AI agents and cryptocurrencies, 'ai16z' is cited as the most representative success case.

ai16z is a project born through the Solana (SOL)-based decentralized autonomous organization (DAO) platform 'Daos Fun', which allows the creation of hedge funds led by AI agents. ai16z invests across various fields, including meme coins, AI agent-related coins, non-fungible tokens (NFTs), and DeFi. Participants can also present their investment opinions, but the final decision is made by the AI agent.

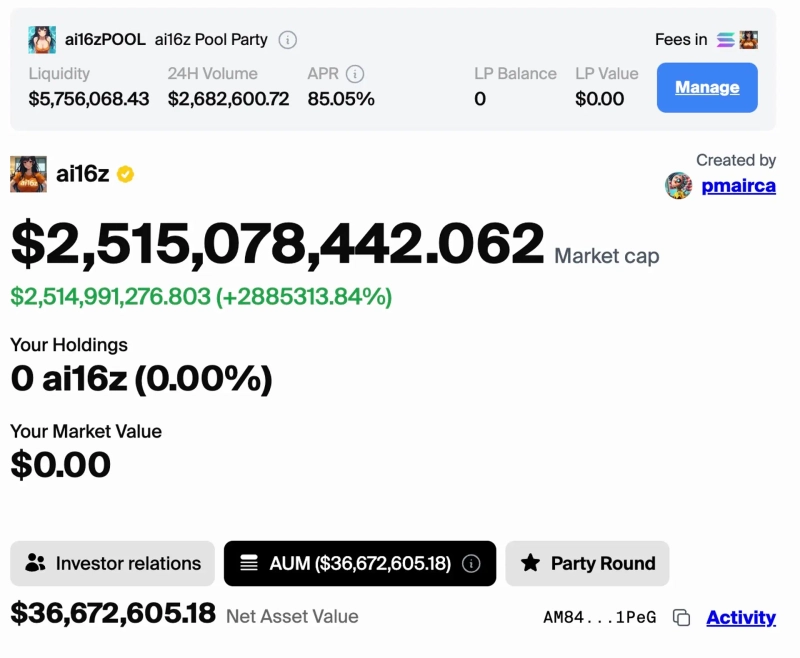

As of the 2nd, ai16z's assets under management (AUM) amount to approximately $36.6 million (55.8 billion won), with an annual percentage rate (APR) of 85%. Riding on such performance, the market capitalization of the token 'AI16Z' issued by ai16z soared to $2.5 billion (approximately 3.8 trillion won). On the 30th, they announced a roadmap including the launch of their own Layer 1 blockchain, staking mechanism overhaul, and token launchpad platform launch, actively developing infrastructure for AI agents.

Virtuals Protocol (VIRTUAL) is also evaluated as a representative AI agent project. Virtuals Protocol was listed on the most noteworthy crypto list of the year selected by global crypto asset management firm Grayscale.

AI agents created through Virtuals Protocol hold about 1 billion unique agent tokens. AI agents generate revenue through activities such as broadcasting, managing crypto wallets, posting X posts, and opening Telegram chat rooms, which are distributed to investors.

Through this, Virtuals Protocol achieved $60 million in revenue and surpassed 200,000 agent token holders since its official launch last October. The token VIRTUAL, which was only $0.05 at the time of the token generation event (TGE), is currently recording a 9700% surge, reaching $4.9 as of the 2nd.

Crypto analysis firm Four Pillars stated, "ai16z and Virtuals Protocol have grown into projects representing the AI agent sector," adding, "They are already being defined as 'Layer 1 of AI agents.' They will continue to function as the most fundamental infrastructure of the AI agent industry."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀