Editor's PiCK

"Animoca Brands Also Hit"...AI Agents Take Direct Hit from 'Trump Storm'

Summary

- AI agent-related digital assets have been showing a sharp decline in market capitalization this month, with Trump's tariff policies being cited as a major cause.

- Investors, including Animoca Brands, have focused their investments on the AI agent sector, but are now experiencing significant losses due to increased volatility.

- Market opinion suggests this is merely a short-term adjustment, and the medium to long-term outlook for the AI agent sector is still viewed positively.

'AI Agents' Rapidly Emerged Last Year

Animoca Brands Also Heavily Invested

Market Cap Continues to Decline This Month

Impact of Trump's 'Tariff Bomb' and Other Factors

Analysis Suggests "Entering Chasm Phase"

Artificial Intelligence (AI) agent-related digital assets have been experiencing a sharp decline across the board this month. This is due to the combined effects of China's AI rise and the 'Trump Storm.' However, the prevailing market analysis suggests this is merely a short-term adjustment.

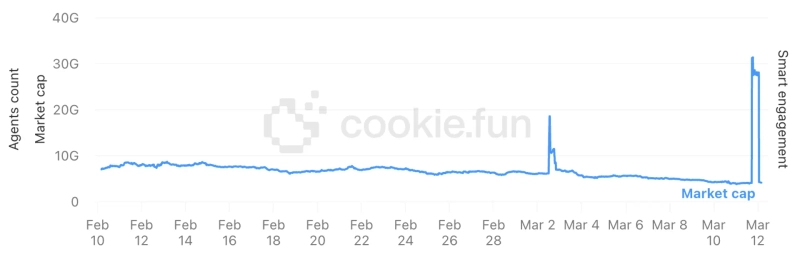

According to virtual asset analysis platform CookieFun, the total market capitalization of AI agent sector digital assets stood at $4.02 billion as of the 12th. This represents a 3.78% increase compared to the previous day. The market cap of AI agent sector assets had fallen to the $3 billion range on the 10th before recovering to the $4 billion level today. This recovery was aided by the overall upward trend in the digital asset market, thanks in part to the easing of trade tensions between the US and Canada.

AI agents are software that, unlike traditional AI bots, can learn, plan, and make decisions on their own without direct human intervention. Global CRM company Salesforce has compared AI bots to 'vending machines' and AI agents to 'personal chefs.' Until early this year, AI agents were considered a 'mega trend' in the digital asset industry. This is why global asset management firm VanEck identified AI agents as the technology to watch this year.

This context explains why global blockchain company Animoca Brands focused its investments on the AI agent sector last year. According to Animoca Brands' recently released earnings report, the company concentrated its investments in AI agent projects such as ai16z, VIRTUAL, and GRIFFAIN last year.

70% Market Cap Decline in One Month

However, AI agent-based digital assets have been struggling recently. Their market capitalization has fallen by nearly 70% from its recent high just this month. Previously, the total market cap of AI agent sector digital assets exceeded $6-7 billion last month. In early November, when Donald Trump first mentioned federal government strategic reserves of digital assets after taking office, the market cap soared to $15.3 billion.

This trend is also evident in the Upbit Digital Asset Index (UBCI) calculated by the domestic digital asset exchange Upbit. Last week (3rd-9th), the AI sector index fell 36.7% compared to the previous week, showing the largest drop among all sectors. This decline is twice the rate of the Upbit Market Index (UBMI), which reflects the entire digital asset market and fell by 16.61%. Just in the last week of the previous month, the AI sector index had risen by 8.93% compared to the week before.

While the causes of the decline are complex, market analysts point to Trump's 'tariff bomb' as the key factor. Donald Trump's aggressive and sudden tariff policies have increased risk aversion, and the resulting maximized volatility in the digital asset market has also affected the AI agent sector. Christopher Larkin, Trading Director at E-Trade under Morgan Stanley, said, "Multiple factors always affect the market," adding, "(But) right now, almost all factors have been overshadowed by the tariff issue."

Some analysts suggest that recent speculative demand in the AI agent sector has amplified the decline. An industry insider explained, "Since the second half of last year, expectations for AI agent projects have grown, leading to an influx of speculative capital," adding, "Emerging sectors like AI agents are vulnerable to volatility and are inevitably more affected by external factors than major digital assets like Bitcoin (BTC) and Ethereum (ETH)."

"Not a Short-term Narrative"

Chinese 'AI shocks' such as DeepSeek and Manus are also believed to have influenced the recent downward trend. Whenever China introduces 'low-cost, high-efficiency' AI models, questions arise in the market about US leadership in the AI industry. This explains why the AI agent sector, including ai16z and VIRTUAL, experienced sharp declines when DeepSeek, which signaled China's AI rise, was first unveiled.

However, the medium to long-term outlook remains positive. Teng Yan, founder of AI and cryptocurrency research firm 'Chain Of Thought,' analyzed that "(AI agent-based digital assets) are not a short-term narrative that will end in days or weeks," adding, "Because of the scale of potential, (the narrative) will unfold over several years at most." He added, "The 'mini cycle' of AI agents we've seen over the past few months is just a preview of what will happen over the next few years."

Some analysts suggest that AI agents have entered the Chasm phase (temporary demand stagnation). DeFi Warhol, a digital asset developer, explained, "AI agents are simply following the same process that all past technological innovations have gone through," adding, "Expectations peaked at the end of last year, and they entered the 'Trough of Disillusionment' in the first quarter of this year."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul