Summary

- Ethereum has attracted investor attention with the announcement of a change in its foundation structure.

- Monero's sharp rise during the day has raised interest along with the possibility of market manipulation.

- The demand for stablecoins USDC and Tether has surged due to market volatility.

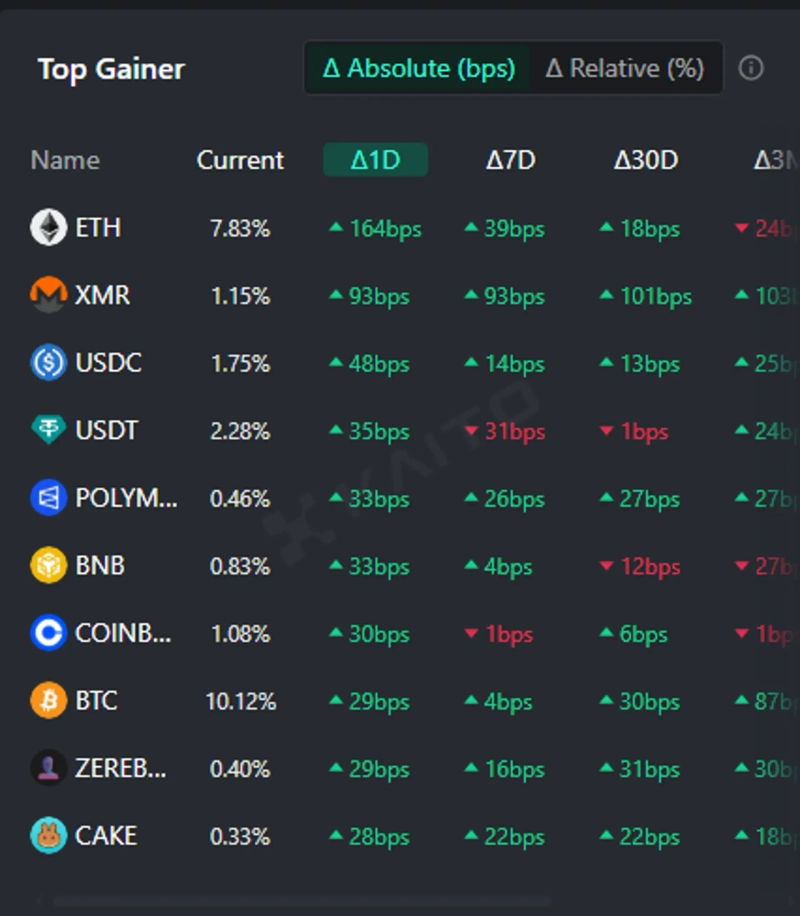

According to the Token Mindshare (a metric quantifying the influence of specific tokens in the virtual asset market) top gainer by the AI-based Web3 search platform Kaito, the top 5 virtual asset keywords currently attracting the most interest are Ethereum (ETH), Monero (XMR), USDC, Tether (USDT), and Polymarket.

Ethereum, ranked first, has garnered investor attention by announcing a change in its foundation structure. The Ethereum Foundation announced on its official blog that "responsibilities between the management and the board have been separated," stating that "the board will be responsible for setting Ethereum's vision, while the management will handle the strategic execution of the vision."

Monero followed, attracting attention with a sharp rise overnight. As of 1:13 PM today, Monero is trading at $269.76, up 2.45% from the previous day. Although the upward trend has paused, Monero hit an intraday high of $338.05 overnight. However, today's rise is suspected to be due to market manipulation. Blockchain analyst ZachXBT stated, "We have identified a suspicious transfer of 3,520 Bitcoins ($330.7 million), which was subsequently swapped to Monero."

The third and fourth places are occupied by stablecoins (virtual assets pegged to fiat currency) USDC and Tether. The demand for stablecoins is analyzed to have surged due to increased market volatility.

The fifth place is taken by the decentralized prediction platform Polymarket. Interest was drawn to related betting as an early general election was held to decide Canada's next prime minister. According to the election results released so far, the ruling Liberal Party's victory seems likely. On Polymarket, the probability of Liberal Party leader Mark Carney's victory is as high as 97%.

Additionally, investors are also showing interest in Binance Coin (BNB), Coinbase, Bitcoin (BTC), Zerebro, and PancakeSwap (CAKE).

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)