Summary

- It was reported that Chinese investors sold gold on a large scale ahead of Labor Day, causing gold prices to drop significantly.

- There is an opinion that Bitcoin could emerge as a preferred asset as a reflection of this gold sell-off.

- At the same time, it was stated that the price of Bitcoin rose by 2.46% from the previous day.

Ahead of one of China's biggest holidays, Labor Day, gold prices are on a downward trend. Some suggest that Bitcoin (BTC) could benefit from this decline as a reflection.

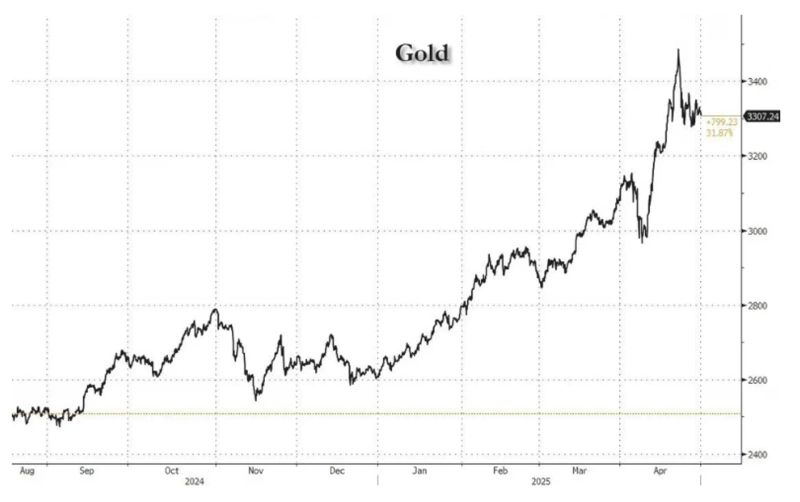

On the 2nd (Korean time), The Defiant reported that Chinese investors sold off gold amounting to one million ounces ahead of Labor Day. As a result, the gold futures price, which hit an all-time high of $3,500 in mid-April, is currently at $3,245.56, down 2.49% from the previous day as of 7:51 AM, according to Investing.com.

The Defiant stated, "This gold sell-off is one of the largest ever," and added, "There is an opinion that Bitcoin could establish itself as a preferred asset due to this sell-off."

Meanwhile, at the same time, Bitcoin is trading at $96,429, up 2.46% from the previous day, according to CoinMarketCap.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)