Summary

- A Crazzyblock contributor reported that the stablecoin trading volume on the Binance exchange has increased.

- According to the report, trading through Tether accounts for 57% of the total Bitcoin trading volume.

- The contributor emphasized that the increase in stablecoin trading strengthens market liquidity and contributes to the popularization of virtual assets.

It has been observed that the trading volume of stablecoins on Binance, the world's largest exchange, has significantly increased.

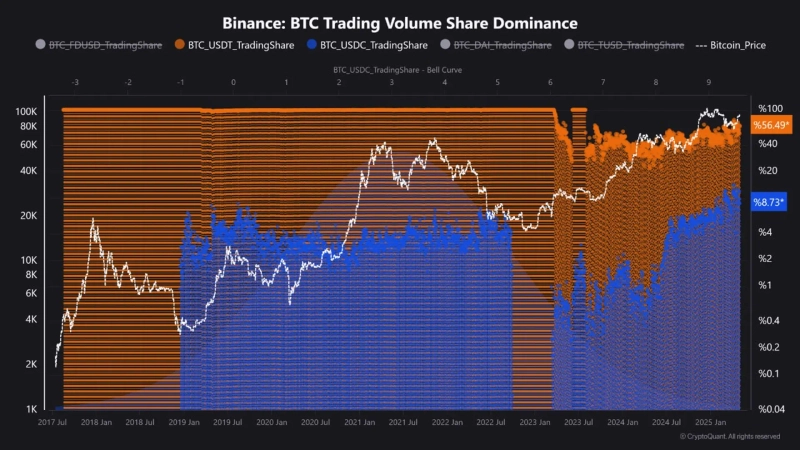

On the 5th, a Crazzyblockk CryptoQuant contributor analyzed in a report that "recent data shows a significant increase in the share of stablecoin pairs in Binance's Bitcoin (BTC) spot trading."

According to the report, trading through Tether (USDT) currently accounts for 57% of the total Bitcoin spot trading volume. Trading through USDC recorded 9%.

The Crazzyblock contributor explained, "The liquidity centered around stablecoins shows that users are participating more actively and prefer stablecoin-based trading on centralized exchanges."

He added, "As the trading share of Tether and USDC increases, trading within the exchange becomes more active, and the liquidity pool deepens, indicating that stablecoins play a key role in Bitcoin price formation."

The Crazzyblock contributor viewed the current situation positively. He emphasized, "As stablecoin and user activity increase, liquidity grows, and the market becomes more robust, ultimately accelerating the popularization of virtual assets through an easier trading environment."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)