Summary

- It was reported that an analysis suggested cryptocurrency volatility could increase due to Binance's spot trading volume decrease.

- Darkpost CryptoQuant stated that as Binance's futures trading volume increases and spot trading volume decreases, high price volatility could occur.

- Martun CryptoQuant analyst emphasized that futures trading volume is 4.9 times that of spot trading volume.

An analysis has emerged suggesting that the decrease in Binance's spot trading volume could increase cryptocurrency volatility.

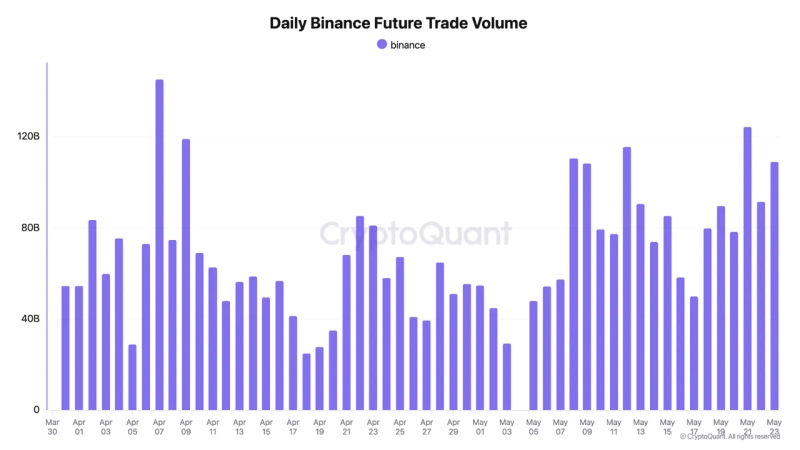

On the 25th (local time), a Darkpost CryptoQuant contributor stated in a report, "Since May 5th, Binance's futures trading volume has increased. Meanwhile, the spot market trading volume is clearly on a declining trend," adding, "Futures trading is mostly short-term leverage betting, and without strong spot demand, high price volatility can occur." He further noted, "More cautious investment is required."

Previously, on the 23rd (local time), Martun CryptoQuant analyst also mentioned, "The ratio of Binance's spot to futures trading volume has reached a 1.5-year high of 4.9," indicating "this means the futures trading volume is 4.9 times that of the spot trading volume."

As of 1:52 PM, Bitcoin is trading at $108,192, down 0.35% from 24 hours ago, according to Binance USDT market.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)