Editor's PiCK

INIT, SOPH, and Beyond Leading the Korean Narrative: Korean Crypto Weekly [INFCL Research]

Summary

- Last week in the domestic crypto market, the narrative and listing strategies of new projects like INIT and SOPH drew significant attention from investors.

- Distinct differences between Upbit and Bithumb's listing approaches and trading volumes resulted in intersecting opportunities and market impacts for early investors.

- Policy and governance issues such as the Korean presidential election and exchange leadership changes are expected to influence investor sentiment through institutional support and shifts in the market environment.

1. Market Overview

Last week in the domestic virtual asset (cryptocurrency) market, Upbit and Bithumb’s contrasting growth strategies once again attracted attention.

Sophon (SOPH) held its Token Generation Event (TGE) after drawing expectations with its Upbit listing and a $60 million node sale. Despite initial delays, consistent KOL (Key Opinion Leader) communications encouraged retail participation and helped the project successfully establish itself in the market. Initia (INIT) also demonstrated the impact of a ‘participatory narrative’ through its gamified testnet and community-driven branding.

On the listing strategies side, Upbit continued its selective approach with listings such as Livepeer (LPT) and POKT Network (POKT), while Bithumb pursued higher turnover rates by listing mid-cap tokens like B3 (B3) and Xterio (XTER). Although Bithumb showed heavy trading volume, the overall market sentiment there remained relatively subdued.

In trading dynamics, WCT’s volatility after surging and crashing on Upbit drew interest. Some speculated that a particular group’s intervention may have played a role, though no clear evidence was found. In contrast, large IP-based projects such as MapleStory Universe produced underwhelming results due to gameplay and security controversies.

This week clearly highlighted the unique characteristics of the Korean market. Narrative timing, KOL trust, and UX design were reconfirmed as the core elements dividing success and failure. Subtle differences in listing policies and project response strategies at each exchange are expected to continue influencing market trends.

2. Exchanges

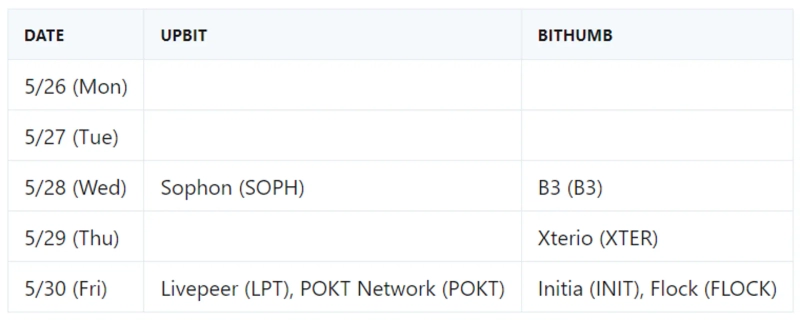

2-1. Newly Listed Tokens

Last week, leading Korean crypto exchanges listed several new tokens:

Upbit listed Sophon (SOPH), Livepeer (LPT), and POKT Network (POKT).

Bithumb listed B3 (B3), Xterio (XTER), and Flock (FLOCK).

2-2. Key Marketing Strategies and Insights

SOPH

SOPH started drawing attention in the Korean market in early 2024, launching its own node sale following Aethir, which had previously conducted a successful node sale.

Node sales generally involve a long wait for token distribution and returns, so Korean investors react more sensitively to VC involvement and the project’s narrative.

SOPH secured $10 million in investments from firms like OKX Ventures and Spartan Group, and drew attention through a partnership with Aethir and an official mention from zkSync.

Though SOPH’s node sale did not sell out, it raised about $60 million, and its early conclusion benefited initial participants with greater rewards. The launch of the mainnet is scheduled for over seven months after the node sale, prompting some complaints in the community. However, the SOPH team continued to communicate regularly with the community, mainly via key influencers (KOLs).

At the time of the TGE (Token Generation Event), SOPH was listed on both Binance’s spot market and Upbit’s KRW market. Promotional campaigns such as quizzes and airdrops captured retail investors’ attention. Even after launch, the team has actively communicated about the technical foundations and vision for the project.

SOPH’s successful debut highlights the importance of ‘narrative timing’ in Korea. When message delivery, market sentiment, and community participation align precisely, a project’s chance of success increases dramatically. This serves as a valuable lesson for future projects.

INIT

In April 2024, Initia ran a closed chatroom open only to a select group of users, with invite-only events linked to KOLs (influencers). This strategy, emphasizing exclusivity and scarcity, proved effective for brand impression, and similar exclusive initiatives by Monad and Elixir sparked a “fear of missing out” among users.

At the height of interest, Initia opened its public testnet. The strong interest from Korean users, joined by investments from YZi Labs, led to broad participation. The testnet was designed not as a simple check-in but as a game where users periodically fed a mascot dog named “Jenny.” The gamified element made it easy for KOLs to create content and helped sustain lasting interest in the testnet.

Initia subsequently held regular AMAs, ecosystem updates, and communication with testnet participants, leading up to the TGE without major setbacks—a contrast to other projects that fade after initial hype due to lack of communication.

Initia also built a “trendy project” image through Twitter content, offline events, and merchandise. Such branding strategy was key not just for tech development but also for shaping project identity and user perception.

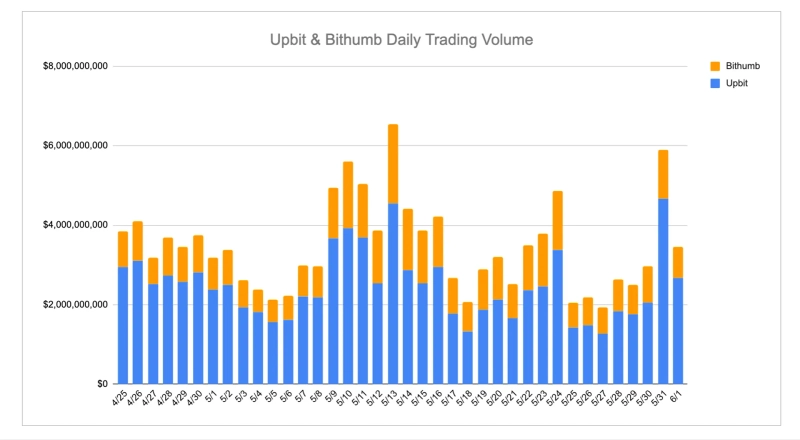

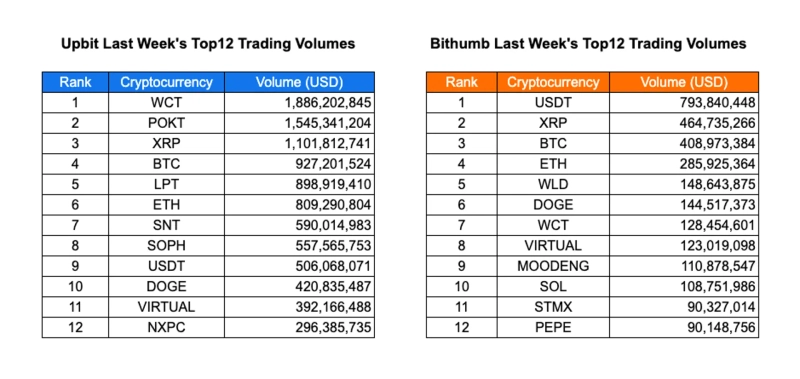

2-2. Trading Volume

Last week, Upbit’s trading volume surged again, attracting investor attention. The sharp rise and fall of the WCT token was the main driver. Some in the community questioned if a certain entity was artificially controlling liquidity; however, there was no solid evidence.

In contrast, Bithumb showed a more stable flow. Major assets such as USDT, BTC, and XRP consistently held high trading volume rankings.

An interesting point is that even with tokens listed on both Upbit and Bithumb’s KRW markets, trading patterns differed. This suggests Upbit’s more active user base and liquidity make it a preferred platform for projects and market makers looking to lock in initial volume. In fact, newly listed LPT and POKT saw high trading activity on Upbit immediately after listing, and NXPC entered the weekly top 10 by trading volume.

Still, a core project of the NXPC ecosystem, ‘MapleStory N,’ has recently drawn criticism from Korean users for lack of gameplay, diminishing reward structures, and suspected bot activity from Southeast Asia and China accounts. With no clear response or communication from the project, early hype is quickly fading.

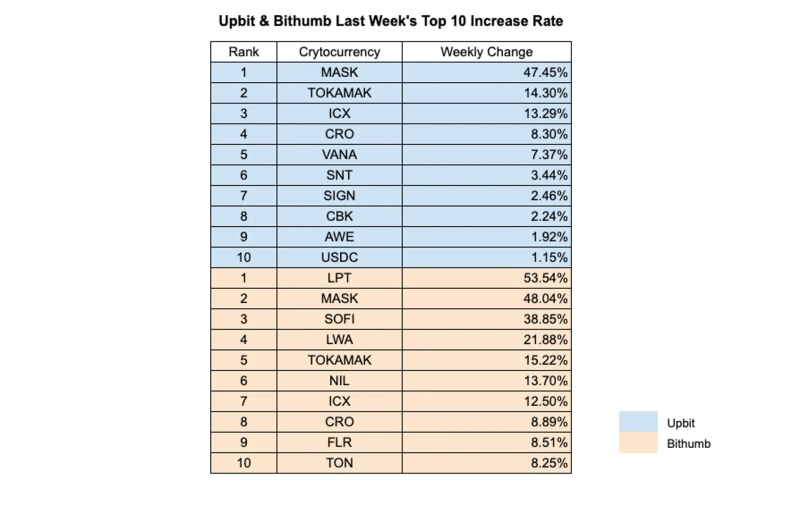

2-3. Top Weekly Gainers

While Bithumb continued its aggressive listing of new tokens, Upbit maintained a more conservative and selective policy. Notably, just after Upbit listed LPT, its trading volume and price spiked on Bithumb as well, making it a weekly top performer.

A similar pattern was seen with LWA. After Bithumb temporarily suspended deposits and withdrawals of Sui (SUI) Network in response to the recent Cetus protocol hack, interest shifted to LWA, pushing it to fourth place in weekly gains.

Among tokens listed on both exchanges, MASK showed the strongest upward trend, while TOKAMAK posted relatively stable returns. This week’s overall price movement, however, aligned more with general market trends than with issues at specific exchanges.

3. Korean Community Buzz

3-1. Upbit CEO Resignation, and the Community’s Hidden Readings

Big news broke in Korea’s virtual asset industry: Lee Seok-woo, CEO of Dunamu (operator of Upbit), announced he would step down in July. The official reason was “health and personal matters,” but the timing has sparked many interpretations.

The successor is Oh Kyung-seok, formerly a judge, with no prior background in Web3 but a wealth of experience in legal, tax, and compliance areas.

Within the community, most view this personnel change as Dunamu entering a new phase of regulatory response. Some expect this shift to bring greater stability, while others worry that Upbit may lose its innovative drive.

3-2. Korean Presidential Election

The South Korean presidential election concluded with Lee Jae-myung’s victory. As he had campaigned on various promises, including a KRW stablecoin, crypto ETF, and improved investment access through lower trading fees, institutional support is anticipated.

A KOL joked, “Isn’t this basically a Korean mainnet AMA?” and Crypto Twitter was flooded with hopeful memes and satires. There is consensus that the new government will strongly impact local Web3—from tax policies to mainstream adoption.

3-3. Kaito’s LOUD Campaign Dominates Korean Crypto Twitter

Last Friday, Kaito’s LOUD leaderboard campaign caught the Korean crypto community’s attention. KOLs, degen traders, and regular users alike filled Twitter with @stayloudio and $LOUD tags, fiercely competing for top airdrop spots.

A well-known KOL publicly pledged to share half of their airdrop with followers, and with this strategy, successfully landed in the top 1,000.

Not everything was smooth, though. Delays in the token sale frustrated participants waiting overnight, leading to mixed reactions. Some called it a “fun and profitable event,” while others had a more cynical take, saying it was “just a short-term show benefiting only snipers.”

Ultimately, the event sparked lively debate about the attention economy, community loyalty, and the efficacy of viral airdrops.

*All information is provided for informational purposes only and is not intended as a basis for investment decisions or as a recommendation or advice. The author is not responsible for any investment, legal, or tax consequences arising from the use of this material.

INF Crypto Lab (INFCL) is a consulting firm specializing in blockchain and Web3, providing one-stop services for Web3 expansion strategy, tokenomics design, global market entry, and more. With an extensive track record and references, INFCL supports sustainable growth in the digital asset ecosystem through strategic services for domestic and global brokerages, game companies, platforms, and leading global Web3 firms.

This report is independent of any editorial direction by media outlets, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)