[Analysis] “Ethereum Options Market Shows Clear Lean Toward Call Options... Stronger Bets on Price Rise”

Suehyeon Lee

Summary

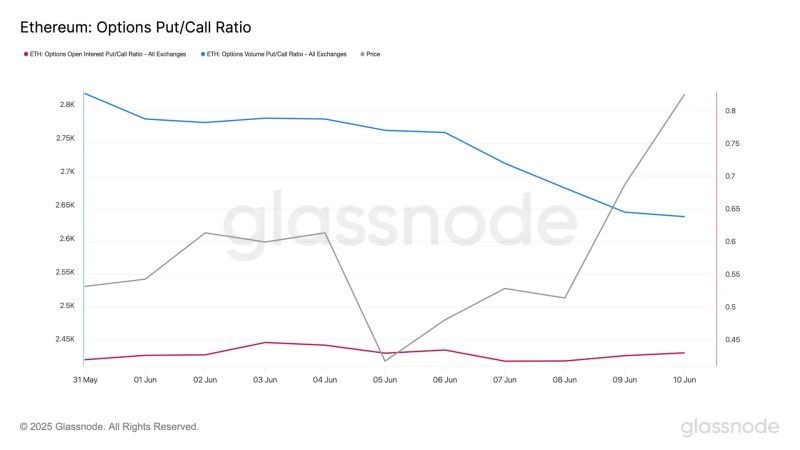

- It is reported that demand for call options is increasing in the Ethereum (ETH) options market, strengthening bullish bets.

- Glassnode stated that the current put/call open interest ratio is 0.43 and the put/call volume ratio is 0.63.

- Glassnode pointed out that the increased demand for call options compared to put options backs up speculative interest in Ethereum’s price rise and a bullish sentiment.

In the Ethereum (ETH) options market, demand for call options is increasing, reinforcing bullish bets.

According to Glassnode on the 12th (local time), the current put/call open interest ratio is 0.43, and the put/call volume ratio stands at 0.63. This suggests relatively higher demand for call options in the Ethereum options market.

Regarding this, Glassnode analyzed, “The heightened demand for call options compared to put options indicates growing speculative interest in Ethereum’s price increase, supporting a strong bullish sentiment across various volatility indicators.”

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.