Editor's PiCK

Six Solana Spot ETF Issuers Complete Submission of Amended S-1 Filings to the U.S. SEC

Summary

- The U.S. SEC has requested Solana (SOL) spot ETF issuers to submit amended S-1 filings.

- It has been revealed that six issuers, including Fidelity, 21Shares, and Franklin Templeton, have submitted the revised S-1 filings.

- The SEC has reportedly requested clarifications in the S-1 regarding the 'redemption mechanism for digital assets' and the 'Solana staking reward structure'.

It has been reported that most issuers preparing to launch the Solana (SOL) spot ETF have completed submitting amended S-1 registration statements at the request of the U.S. Securities and Exchange Commission (SEC).

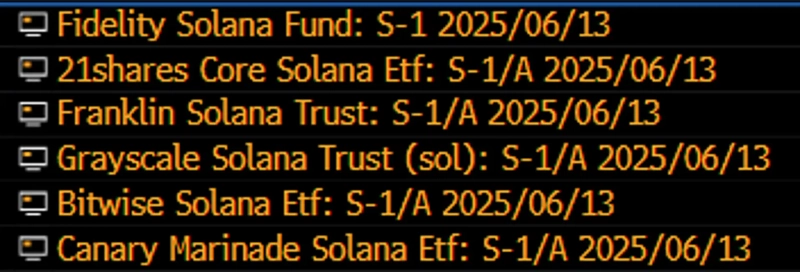

On the 14th (local time), Bloomberg analyst James Seyffart shared on X, "Earlier this week, various media outlets reported that the SEC had requested Solana spot ETF issuers to amend their S-1 filings. Currently, 6 out of the 7 Solana ETF issuers have submitted the revised S-1."

Fidelity, 21Shares, Franklin Templeton, Grayscale, Bitwise, and Canary Capital are reportedly among those that have completed the amended S-1 submissions for the Solana ETF.

Previously, on the 12th, Bloomberg had reported that the SEC requested amendments to the S-1 filings from Solana spot ETF issuers. The SEC is said to have requested amendments and clarifications for two main points in the S-1: the 'redemption mechanism for digital assets (cryptocurrency)' and the 'Solana staking reward structure'.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.