Editor's PiCK

US Bitcoin Spot ETF Sees Net Inflow of $302.77 Million the Previous Day…Fifth Consecutive Session

Summary

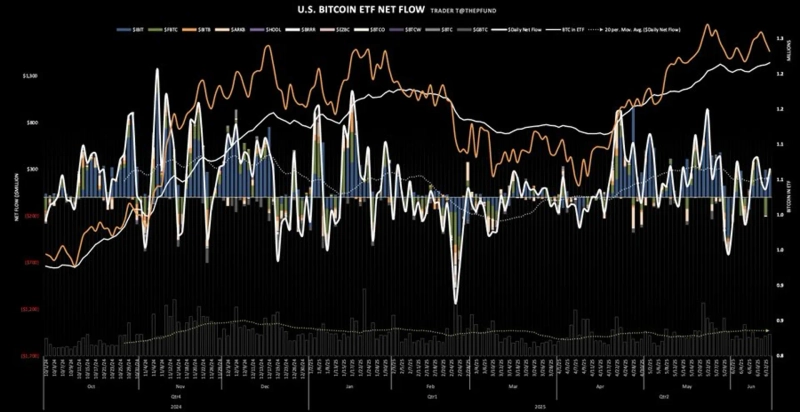

- A net inflow of $302.77 million into the US Bitcoin spot ETFs was recorded, reaffirming strong buying momentum for five consecutive sessions.

- The BlackRock IBIT product saw the largest capital inflow among individual products at $240.14 million.

- In addition, continued net inflows were observed for major ETFs such as Fidelity FBTC, Bitwise BITB, and Grayscale GBTC.

The US Bitcoin (BTC) spot ETFs recorded a net inflow of over $300 million the previous day, reaffirming strong buying momentum.

According to Trader T on the 14th (local time), the US Bitcoin spot ETFs saw a net inflow of $302.77 million (about ₩414.1 billion) the previous day. This marks five consecutive trading sessions of net inflows.

The capital inflow on this day was mainly concentrated in BlackRock's IBIT. BlackRock IBIT recorded an inflow of $240.14 million, marking the largest single-product capital movement. This was followed by Fidelity's FBTC with a net inflow of $25.24 million, and Bitwise's BITB with $14.88 million each.

Additionally, Grayscale's GBTC recorded a net inflow of $9.11 million, Grayscale Mini BTC had $7.45 million, and VanEck HODL saw a net inflow of $5.95 million. The remaining products had no net inflow or outflow.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.