Summary

- The shopping economy based on AI agents and stablecoins is said to overcome the limitations of traditional financial infrastructure, enabling reduced payment fees and the transfer of data ownership.

- It was reported that users can participate in various investment-type income models such as point accumulation, personalized recommendations, and profit sharing from growth through agent token staking.

- All transactions and recommendation data are transparently recorded on the blockchain, enhancing market trust and transparency, while AI agent data trading and value distribution systems are attracting attention as new investment opportunities.

Kim Seo-joon, CEO of Hashed

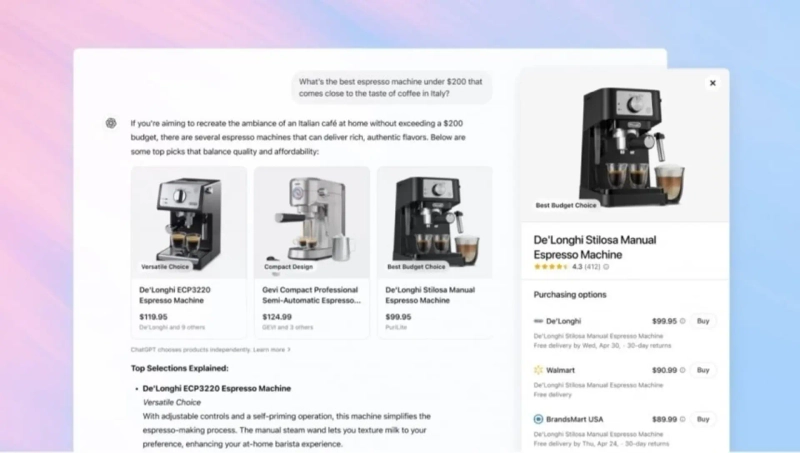

The fundamental way of shopping is undergoing a major transformation. In the past, we had to search “sneakers” on Google and sift through hundreds of results ourselves, or browse categories on Amazon to find products. However, with the introduction of shopping features by ChatGPT and other LLMs, the landscape is rapidly changing toward personalized suggestions, much like having a personal shopper who has known you for a decade, saying: “Given your body type, style, and budget, this brand and this model are 30% off now, so it’s best to buy today.”

This change goes beyond mere UI/UX improvements; it demonstrates the potential for a new shopping economy based on blockchain networks and stablecoins to replace traditional financial infrastructure. It marks a fundamental shift in payment methods, data ownership, and value distribution structures in the shopping economy.

Limits of Traditional Financial Infrastructure and New Alternatives

Currently, e-commerce relies on centralized financial intermediaries such as credit card companies, banks, and payment processors. When making a purchase on Amazon, our payment data goes through Visa or Mastercard, incurring a 1.5–2.5% fee in the process. More importantly, these transaction data belong to the platforms and financial companies, causing users to lose control over their own purchase histories.

On the other hand, in a shopping economy based on stablecoins, direct payments using USDC, USDT, and others become possible. Middleman fees are slashed, and all transactions are transparently recorded on the blockchain, allowing users to truly own their data. In particular, cross-border transactions become instantly global shopping experiences, without exchange fees or payment delays.

AI Agent Ecosystem: Journey to Finding Your Personal Shopper

In the traditional shopping economy, user data is monopolized by a handful of big tech companies such as Amazon, Google, and Meta. They analyze user behavior to generate ad revenue, yet the rightful data owner—the user—receives no compensation. Also, true personalized services are limited by data silos.

In a blockchain-based shopping economy, on-chain payment data is stored publicly verifiable and controllable by users. On top of this transparent data, competing AI agents can offer recommendation services.

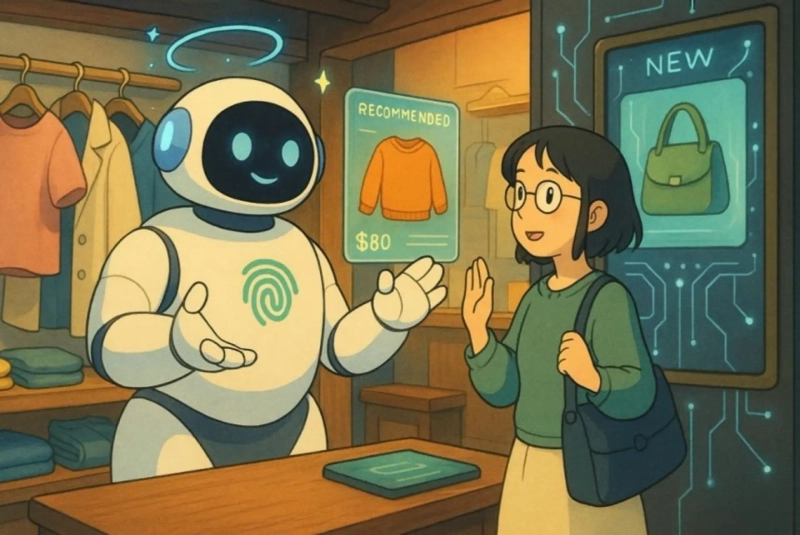

This process is much like VIP department store clients selecting a personal shopper that suits them. ‘StyleAgent’ specializes in fashion for trend-sensitive users in their 20s and 30s, ‘TechGuru’ leverages deep knowledge to recommend the latest gadgets and electronics, and ‘FamilyBot’ comprehensively addresses practical needs from childcare products to family travel for households with kids.

Rise of the Agent Matching Market

Finding the optimal personal shopper among the various AI agents becomes a new service itself. Meta-services like ‘AgentMatcher’ analyze user lifestyle, shopping history, budget, and interests to recommend the ideal combination of agents.

For example, when a woman in her 30s logs into AgentMatcher, she receives questions such as: “What is your average monthly shopping budget? Are you more interested in fashion or beauty? Do you prioritize value over brands? Do you prefer eco-friendly products?” Based on these, AgentMatcher proposes a tailored portfolio: “We recommend a mix of StyleAgent 60%, BeautyBot 30%, and EcoAgent 10% for you.”

Interestingly, the matching service itself may operate with a token economy. AgentMatcher is rewarded in tokens for accurate matches, and users who make satisfactory purchases via recommended agents may receive a portion of the matching fee as a rebate, turning this into a meta-service that enhances the efficiency of the whole ecosystem.

We may even see review and rating platforms like “Which is the best agent for 2030 fashion trendsetters?” and “Top 5 lifestyle agents loved by moms,” similar to how Michelin Guide rates restaurants. Independent bodies could emerge to assess the expertise and trustworthiness of agents.

Stablecoins Power the Data Economy Among AI Agents

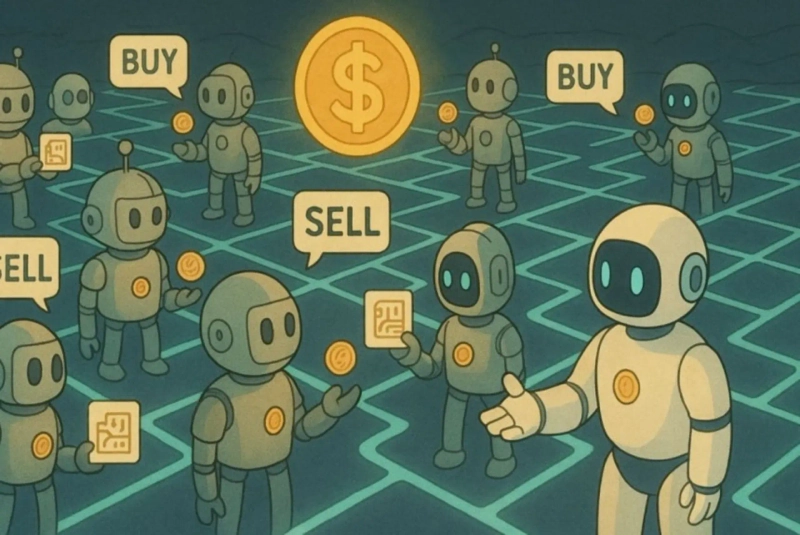

In this ecosystem, stablecoins serve as core infrastructure for data trading and value exchange among AI agents. For example, when ‘FashionBot’ sells a user’s fashion preference data to ‘TravelBot’, instant settlement is made via USDC. Using the acquired data, TravelBot may recommend “tours of popular local fashion brand stores during a trip to Paris.”

AI agents conduct various transactions in real time via stablecoins:

Data Purchase: Buy user preference or market trend data from other agents with USDC

API Service Fees: Pay immediately with stablecoins for external services or advanced AI model use

Collaboration Fees: Automatically distribute proceeds in stablecoins when making joint recommendations with other agents

Quality Reward: Other agents pay incentives in stablecoins for high-satisfaction recommendations

These microtransactions can be automated 24/7, enabling highly efficient operation of the AI agent ecosystem. Small, instant transactions unfeasible with the traditional financial system become economically viable due to the low fees and high speed of stablecoins.

This shifts the monopoly platform structure of the traditional economy to a diversified, competitive ecosystem. Users are no longer beholden solely to Amazon’s algorithms; instead, they can select specialized AI agents tailored to their preferences and needs.

Diverse Ways to Use Tokens and Building Loyalty

There are three primary ways for users to utilize the tokens acquired from AI agents. First is immediate liquidation: users can sell the tokens on exchanges for stablecoins or fiat currency for short-term gain. Second is using tokens as a payment method, directly buying items during their next shopping experience or paying for premium services on the platform.

But the most interesting choice is the third: agent staking. By staking tokens with a specific agent, users forge a deeper loyalty relationship, evolving beyond a simple user-service connection and becoming more like investor-business partners.

For instance, if a user has made several satisfactory purchases via ‘FashionBot’ recommendations and stakes their earned tokens back to FashionBot, this demonstrates strong trust and a long-term commitment, much like signing an exclusive contract with a favored stylist. Such loyalty directly helps increase the agent’s market share. The more tokens staked, the greater the agent’s credibility and stability, increasing the likelihood of attracting new users.

Staking users become direct beneficiaries of agent growth. As agents secure higher market share and intermediary fee revenue rises, a proportion of that revenue is distributed to the staking pool. This parallels traditional share dividends, but—thanks to blockchain transparency and an automated distribution system—the process is more fair and efficient.

Innovative Changes in Value Distribution

Traditionally, user-written reviews, ratings, and recommendations within the shopping economy have been uncompensated labor benefiting only the platform’s shareholders, though they strongly influence the purchasing decisions of other consumers.

A blockchain-based shopping economy fundamentally shifts this structure. Users are instantly rewarded with AI agent tokens for writing reviews or providing useful recommendations, and by staking these tokens with agents, they benefit if token values rise. Users transform from mere consumers into co-investors in the agent ecosystem.

Additionally, whenever AI agents trade data using stablecoins, a portion of the revenue is automatically distributed to users who originally provided the source data. This is transparently managed by smart contracts, ensuring users are fairly compensated for the value generated by their data in real time.

Concrete Benefits of AI Agent Staking

Let’s look at the specific benefits of staking tokens with AI agents.

A key benefit is tiered points accrual. AI agents earn fees from sellers for product mediation, and some of these are distributed to users as points. For example, a user staking tokens with ‘FashionBot’ will receive:

Regular user: 1% of purchase amount as points

500 staked: 2% of purchase amount as points

1000 staked: 3% of purchase amount as points

5000 staked: 5% of purchase amount as points

*If you buy ₩500,000 worth of fashion items monthly, 5,000 staked tokens would earn you ₩300,000 in annual points (₩60,000 for regular users vs. ₩300,000 for staking users).

Personalization and accuracy of the agent’s recommendations also increase greatly. A user who stakes 500 tokens with ‘FashionBot’ will receive tailored suggestions—not just “jackets for women in their 20s for autumn,” but recommendations based on their purchase history, body type, preferred brands, budget, and intended use, such as: “5 office jackets that match the black pants you bought last month, fit for someone 163cm tall, within the ₩100,000–150,000 budget.”

Staking users directly benefit from agent’s growth, including increased token value and rewards, plus extra revenue distributed as agents trade data with others using stablecoins. Additional tokens may also be airdropped during new partnerships or feature updates.

Staking is also an indicator of reliability and influence within an agent. Reviews or feedback from a user with 5,000 staked tokens carry extra weight for the agent’s improvement, and grant early access to beta features.

Varied Staking Strategies and Automation Options

Users may directly stake with individual agents or opt for convenient auto-allocation strategies:

1. Lifestyle-based auto distribution

"Young Professional" option: FashionBot 40%, TechAgent 30%, FoodieBot 20%, FitnessAgent 10%

"Mom" option: KidsAgent 50%, FoodieBot 25%, HomeBot 20%, BeautyAgent 5%

"Senior" option: HealthAgent 40%, TravelBot 25%, BookAgent 20%, GardenBot 15%

2. Risk-based auto distribution

"Conservative": Evenly divided among top 5 verified agents

"Growth-oriented": 50% to new, promising agents; 50% to established agents

"Aggressive": 70% to new agents, 30% to existing agents

3. Interest-based auto distribution

Auto-stake in agents relevant to user-selected interests. For example, if "Fashion, Travel, Food" are selected, tokens are automatically distributed to the top agents in those categories.

For instance, a user distributing 10,000 tokens among various agents can earn: ₩150,000 per month in points, ₩80,000 in staking rewards, ₩20,000 in review rewards, ₩30,000 in agent profit share, and ₩50,000 in data trading profit, for a total monthly return of ₩330,000. Even mere token holding brings considerable returns along with a customized shopping experience.

New Standards of Trust and Transparency

In the traditional financial system, banks or card companies guarantee the reliability of transactions, but this is based on centralized authority, making it vulnerable to system failures or hacks. Also, only financial companies can view transaction details, limiting transparency.

On blockchain networks, trust is established through cryptographic proof and distributed consensus. All transactions are immutably recorded on the blockchain for public verification, and the absence of a single point of failure enhances overall stability. Smart contracts automatically execute transaction conditions, reducing risks of fraud or dispute.

The performance of AI agents’ recommendations and their data transaction records are also traceable on-chain. It is possible to verify which agent made a recommendation that led to an actual purchase, what data was traded for what value, and users’ satisfaction levels—all as verifiable data, forming a market where only truly valuable services survive.

Challenges and Opportunities of the New Shopping Economy

Of course, this shift comes with hurdles. Blockchain network scalability and transaction speed, technical onboarding for general users, and economic instability from token price volatility are important issues. It’s also crucial to balance on-chain data transparency and personal privacy.

Still, as diverse DeFi payment solutions and Web3-based reward systems emerge, this transition is materializing. The adoption of stablecoins is growing and blockchain infrastructure is maturing, which will let the value previously provided by traditional financial intermediaries be replaced in a more efficient and fair manner.

Ultimately, a blockchain and stablecoin-based shopping economy redefines data ownership, value distribution, and trust-building—not just introducing another payment method. In this new paradigm combining AI agents, users become true economic actors, and the potential for building a fairer, more transparent, and profitable shopping ecosystem is emerging. Especially, as real-time data trading and value exchange among agents flows seamlessly over stablecoin networks, their role as core infrastructure will only grow.

■Brief Bio: Kim Seo-joon, CEO of Hashed

△Early graduation from Seoul Science High School

△Graduated from Pohang University of Science and Technology, Department of Computer Science

△Chief Product Officer (CPO) and co-founder at KnowRe

△CEO of Hashed

△Venture Partner at SoftBank Ventures

△Advisor for the National Assembly's 4th Industrial Revolution Special Committee

△Member of the Ministry of Education's Future Education Committee

The views expressed by outside contributors do not necessarily reflect the editorial direction of this publication.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)