Editor's PiCK

Vibrant Korean Community… Risk Appetite Remains Steady: Korean Crypto Weekly [INFCL Research]

Summary

- Last week, new listings on major Korean exchanges—including POKT, AXL, and WIF—drew investor attention, with POKT rising 42.6% for the week.

- ETH, XRP, and BTC maintained top trading volumes, while the increase in USDT suggested that funds were flowing into safe assets ahead of key events.

- Following the presidential election, domestic tokens like Paycoin(PCI) and KLAY surged, signaling that political and policy factors positively influenced the overall asset market.

1. Market Overview

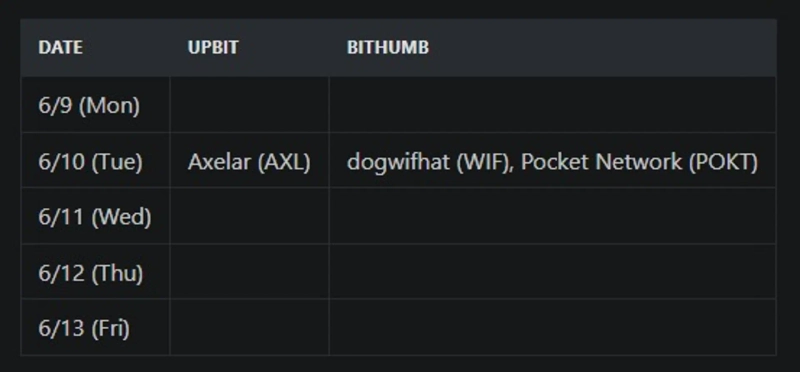

Korean cryptocurrency exchanges continued actively listing new assets last week. Upbit listed Axelar(AXL), while Bithumb listed dogwifhat(WIF) and Pocket Network(POKT). Notably, POKT stood out as the top gainer on Upbit, surging 42.6% for the week.

In terms of trading volume, ETH, XRP, and BTC maintained their strength on Upbit, while mid-cap assets like POKT, RVN, and ANIME also performed notably. On Bithumb, USDT, KAIA, and PCI saw high volumes, indicating a clearer speculative trend.

On social media, optimism surrounding Korea's pro-crypto policy spread positively, and a viral moment involving a prominent influencer (KOL) donating HYPE tokens worth ₩100,000,000 drew attention to the intersection of institutions and community narratives.

2. Exchange Trends

2-1. New Listings

Major exchanges conducted new coin listings last week as follows:

Upbit listed Axelar(AXL).

Bithumb listed dogwifhat(WIF) and Pocket Network(POKT).

2-2. Key Marketing Strategies & Insights

Axelar(AXL)'s Marketing Strategy & Main Points

Unlike projects that made a rapid, short-term appearance on Korean exchanges, Axelar has built a sustained presence in the Korean market.

Axelar has been recognized in Korea for over three years. In particular, in early 2022, during the trend of multi-chain bridge-based airdrop farming, it drew attention with backing from major VCs such as Dragonfly Capital and Polychain Capital.

While a large number of users participated in its airdrop and token sale, there was little significant market impact at the time of token generation. Later, it was listed on Upbit's BTC market in December 2023 and on Bithumb in January 2024, but did not manage entry into the highly-desired 'Upbit KRW market' at that time.

Nonetheless, Axelar has continued to operate local community channels and share key updates with Korean KOLs. Security in bridging, feasibility of institutional adoption, and the RWA (real-world asset) trend have been repeatedly highlighted.

In addition, both online and offline events were held regularly to encourage user participation and maintain community engagement. Axelar’s bridge has operated thus far without a single hacking incident, further enhancing trust in its stability.

Through these consistent efforts and proven track record, AXL has finally succeeded in securing a listing on Upbit’s KRW market.

Trading Volume Analysis

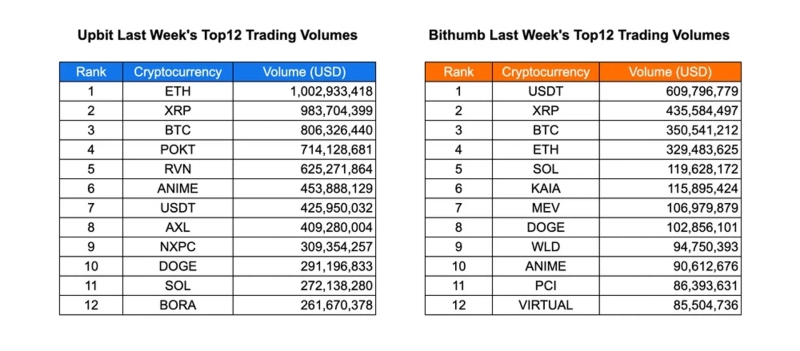

This week, the most traded coins on Upbit were ETH (approx. $1 billion), XRP ($983 million), and BTC ($806 million), demonstrating strong liquidity even during a consolidating market. POKT ($714 million), RVN ($625 million), and ANIME ($453 million) also ranked highly by trading volume.

On Bithumb, USDT ($609 million) took the top spot, possibly indicating a move to safe assets ahead of scheduled events. XRP and BTC followed, and KAIA, MEV, and VIRTUAL became top-volume tokens unique to Bithumb, reflecting effects from community activity or specific promotions. ANIME and PCI ranked on both exchanges, indicating simultaneous thematic interest.

Meanwhile, Upbit’s monthly trading volume—based on CoinGecko data—declined, suggesting temporarily subdued retail sentiment. However, coins like RVN, ANIME, and PCI continued to show notable gains in both returns and volume, signifying ongoing rotation trades.

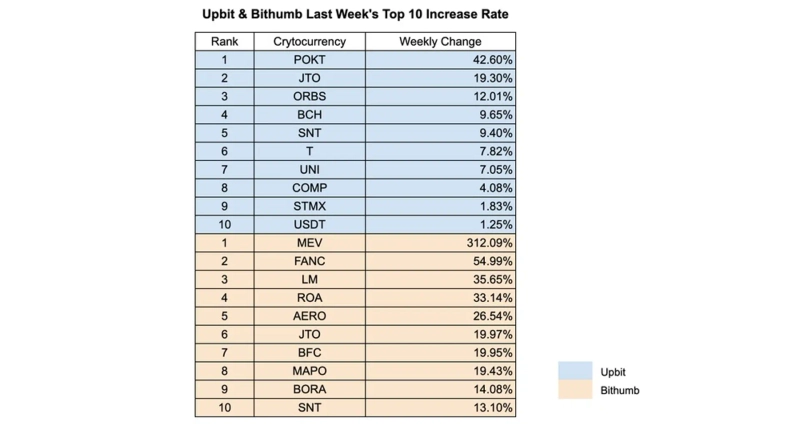

2-3. Weekly Top 10 Gainers

On Upbit, POKT soared by 42.6% for the week, ranking first—driven by consistent high trading volumes and robust community interest. JTO (+19.3%), ORBS (+12.01%) reflected mid-cap centric rotation buying. BCH (+9.65%), SNT (+9.4%) likely experienced speculative demand related to Bitcoin forks and legacy tokens. UNI (+7.05%), COMP (+4.08%) continued to gain, reflecting steady demand in the DeFi sector. USDT also inched up and made the list, possibly due to arbitrage demand between KRW and USDT.

On Bithumb, RVN, PCI, and VIRTUAL—mainly small and mid-cap altcoins—outperformed, though precise figures were not disclosed. These coins garnered community attention, with some gaining ongoing interest through various narratives. Differences in weekly gainers across the two exchanges show diversified retail sentiment.

This indicates that projects must analyze liquidity and responses on each exchange individually. However, POKT stands out as an exceptional case, topping both platforms by key metrics.

3. Korean Community News

1. Surge in Domestic Stocks and Tokens After Presidential Election

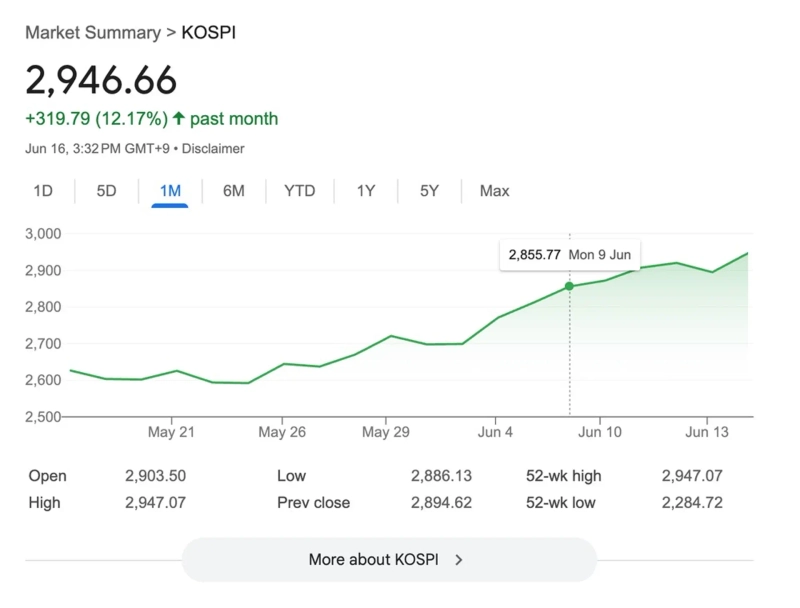

Following the South Korean presidential election, investor sentiment turned positive. Not only traditional equities, but Korea-connected tokens like Paycoin(PCI), KLAY, and BORA also rallied. Community comments included, 'Is the KOSPI finally pumping? Time to open a brokerage account.' Despite lingering caution, political change injected energy into asset markets.

2. KBW 2024 First Lineup Revealed: Sui, 0G, and More

Main conference partners confirmed for KBW 2024—scheduled for September 23–24 at the Walkerhill Hotel, Seoul—are Sui, Stable, and 0G.

The first announced speakers include:

Bo Hines: Former Trump administration cryptocurrency policy lead; current White House Digital Assets Committee member

Arthur Hayes: BitMEX co-founder; a frequently featured and popular KBW speaker

Caroline Pham: Acting Chair of the U.S. Commodity Futures Trading Commission (CFTC)

The community welcomed the mix of regulators and original DeFi figures. There is a local sentiment that KBW is evolving from a typical Web3 event into a 'global policy forum.'

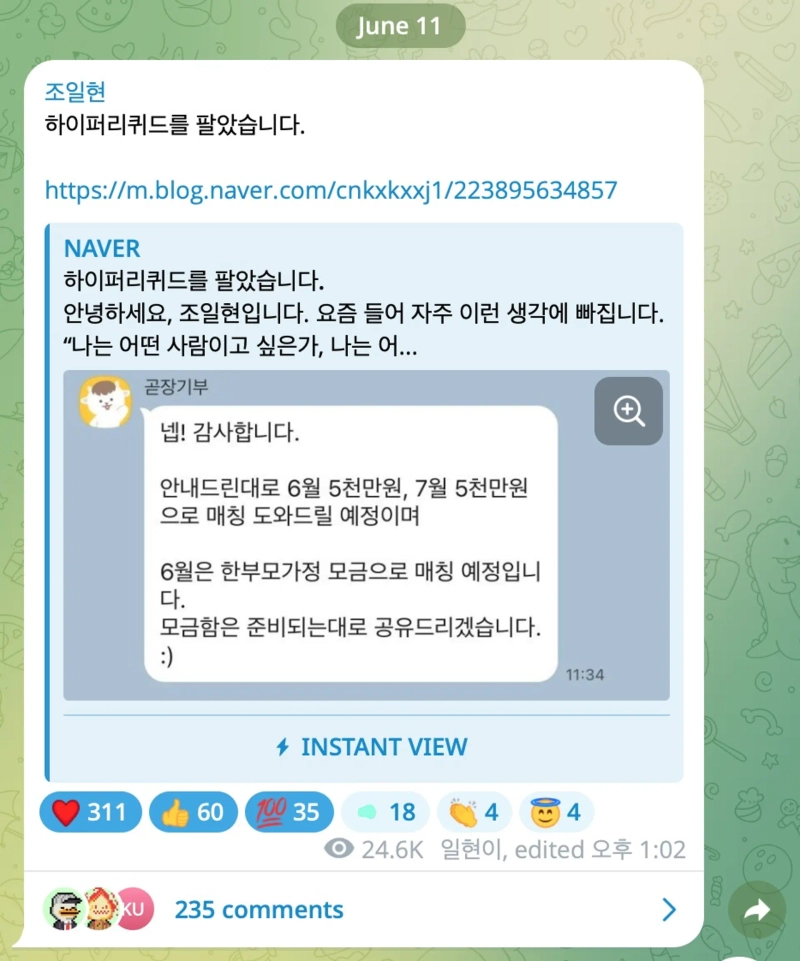

3. Influential KOL Donates ₩100,000,000 HYPE

Ilhyun Jo, a prominent influencer known for actively promoting Hyperliquid, attracted attention by donating a portion of HYPE he sold—worth approximately ₩100,000,000 (about $74,000).

His post recorded over 25,000 views on his Telegram channel, with hundreds of reactions and reposts from KOLs. The 'degen with a heart' meme spread, warming community sentiment.

*All content is provided for informational purposes and does not constitute investment advice or recommendations of any kind. This material does not provide any warranty for investment, legal, tax, or other matters.

INF Crypto Lab (INFCL) is a consulting firm specialized in the blockchain and Web3 sectors, providing one-stop services for corporate Web3 entry strategies, tokenomics design, global market entry, and more. It offers strategy development and execution services for leading domestic and international securities firms, game companies, platforms, and global Web3 companies, leveraging its accumulated expertise and references to drive sustainable growth of the digital asset ecosystem.

This report is independent of any editorial direction and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)