Editor's PiCK

[Column] DEX trading share approaches 25%... When could it surpass CEX?

Summary

- The market share of decentralized exchanges (DEXs) has surpassed 25%, positioning them as core infrastructure within the blockchain ecosystem.

- Future DEX growth drivers include institutional investor inflows, spread of in-app DEX adoption, autonomous AI-powered trading, expansion of derivatives DEXs, and maturity of cross-chain infrastructure.

- By 2030, DEXs are projected to lead mainstream crypto trading with a 65% share, though CEX will remain important for fiat connectivity and user protection.

Seojoon Kim, CEO of Hashed

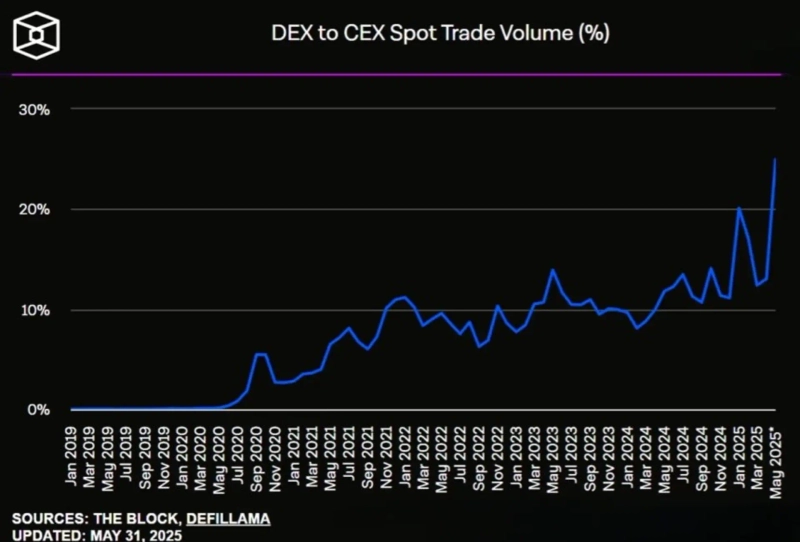

On June 1, 2025, seismic changes in the cryptocurrency trading market became evident in the numbers. According to The Block data, decentralized exchanges (DEXs) captured a 25% market share. Accelerating from just 9.3% eighteen months prior, DEXs now account for a quarter of all crypto trades.

This is more than a simple market share shift. It’s clear proof that the paradigm of financial transactions is shifting from centralization to decentralization, from trust-based to code-based.

The Essence of DEX: The Beating Heart of Blockchain Beyond Exchanges

DEXs are not just 'decentralized exchanges' anymore—they have become essential financial infrastructure for the blockchain ecosystem. If CEXs are isolated fortresses, DEXs are vast interconnected financial cities.

Composability is DEX's most powerful weapon. Trading on Uniswap, depositing in Aave, and providing liquidity in Curve—all can be processed in a single transaction. In 2024, flash loans surpassed $5 billion, making “financial transactions against time” a reality.

Permissionless innovation is also core. Listing on a CEX may require millions of dollars, but on a DEX, anyone can create a token and start trading in just 2 minutes. Hooks in Uniswap V4 have made the protocol programmable.

With cross-chain interoperability, DEXs are becoming a global liquidity network bridging all blockchains. THORChain processed $5 billion in cross-chain trades in 2024, while LayerZero and Axelar are breaking down chain boundaries.

Let’s dive deeper into how these unique characteristics of DEXs led to a 25% market share—and what drivers will power even greater growth.

Past Drivers: How Did We Reach 25%?

1) Solana Meme Coin Craze and DEX-First Listings ★★★★★

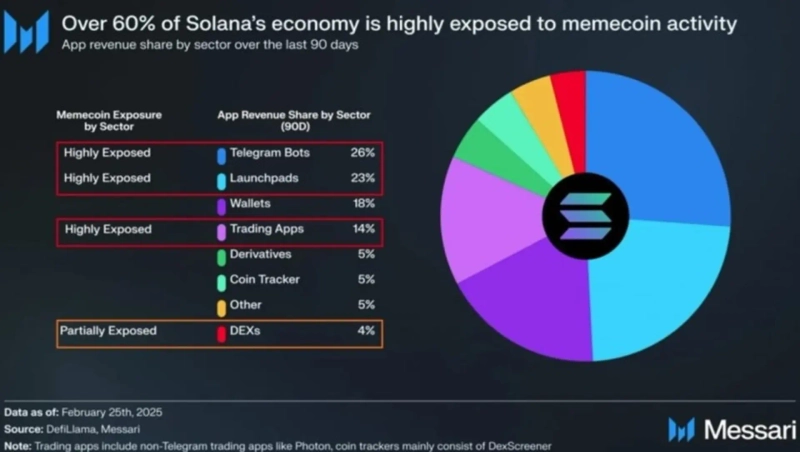

The explosive expansion of the Solana ecosystem was the biggest growth driver for DEXs in 2024. Pump.fun alone generated $106 million in profit just in November, while the total annual profit of all Solana meme coin DApps reached $509 million.

Major meme coins like Donald Trump's $TRUMP, BONK, WIF, and BOME all launched first on DEXs. CEXs only listed them later after they had already reached multi-billion dollar market caps. Now, for innovative tokens, listing on a CEX is simply ‘optional’.

This demonstrates DEX’s fundamental superiority—the power of permissionless innovation, as trading can begin immediately without review, negotiation, or paperwork. While CEXs went through 4–6 month listing processes, DEXs had already processed billions in trading volume.

2) Regulatory Pressure and CEX Credibility Fallout ★★★★☆

In 2024, SEC crackdowns shook the CEX landscape. Simultaneous lawsuits against Binance and Coinbase, Kraken's $30 million fine, and Binance’s exit from the US all exposed the vulnerabilities of centralized exchanges.

The trauma of the FTX collapse lingers. “Not Your Keys, Not Your Coins” is no longer a mantra but a survival strategy. Coinbase's stock plunged 12.1% right after the SEC lawsuit announcement, with $780 million withdrawn from Binance in 24 hours.

Tornado Cash developer arrests were dramatic—but the protocol kept running, demonstrating DEX’s core value: censorship resistance. Without centralized operators, governments find it much harder to intervene.

3) The User Experience Revolution in Personal Wallets ★★★★☆

The main issue with classic non-custodial wallets was managing seed phrases. New generations of wallets are solving this.

Explosive Growth of MPC-based Wallets

By 2024, ZenGo had 700,000 users, growing 250% from the previous year. With Multi-Party Computation (MPC), assets are secured without seed phrases. Users can access wallets with just email and biometrics. Fireblocks focuses MPC wallet services on institutions, managing over $100 billion in assets. Financial giants like Goldman Sachs and Credit Suisse are using this to enter DEX markets.

Spread of Social Recovery Wallets

Argent surpassed 1.5 million downloads and 350,000 monthly active users. The guardian system allows friends or family to help recover wallets, making asset management more accessible for non-technical users.

The Reality of Account Abstraction

As of late 2024, Safe (formerly Gnosis Safe) exceeded $100 billion in managed assets. The smart contract wallet offers multi-signature, spending limits, and automation—similar to bank accounts. Enterprises and DAOs are key users, with 15% of all Ethereum TVL managed via Safe.

Popularization of Embedded Wallets

Privy generated 5 million embedded wallets in 2024 alone. With social login (Google, Apple, Twitter), users create wallets—sometimes without realizing they’re using crypto. Friend.tech reached 100,000 daily active users with this tech.

4) Infrastructure Advances ★★★☆☆

Solana’s 65,000 TPS, 0.0001 SOL ($0.02) fees, and sub-400ms finality equaled CEX-level user experiences.

Ethereum L2s also leaped forward: Arbitrum One’s daily volumes exceeded $500 million, often outpacing mainnet. Backed by Coinbase, Base hit $2 billion TVL six months post-launch. Major L2s like Polygon zkEVM and Optimism dropped average fees below $0.10.

5) Maturation of the DeFi Ecosystem ★★★☆☆

Aggregators like Jupiter, 1inch, and 0x consolidated liquidity across dozens of DEXs. Jupiter alone processed $40 billion in monthly trading volume on Solana, routing users to optimal trades.

Innovations like Curve’s ve-tokenomics and Uniswap V3’s concentrated liquidity minimized slippage on large trades. Curve now boasts $4 billion TVL and dominates stablecoin swaps. Balancer evolved into a portfolio management tool with multi-token pools and weight adjustments.

These factors together drove DEX’s meteoric rise to 25% market share. Meme coin frenzy, regulatory action, UX innovation, and infrastructure and DeFi advances all combined for this rapid expansion.

But the real question now is:

"Can DEXs really surpass CEXs?"

25% is just the beginning. For DEXs to become the dominant force in crypto trading, fundamentally different growth drivers must emerge. Let’s analyze five megatrends set to revolutionize the DEX ecosystem over the next six years.

Future Drivers: Roadmap to Overtake CEX

1) Institutional Entry and DEX Bifurcation: Regulatory Inclusion and Freedom Coexist ★★★★★

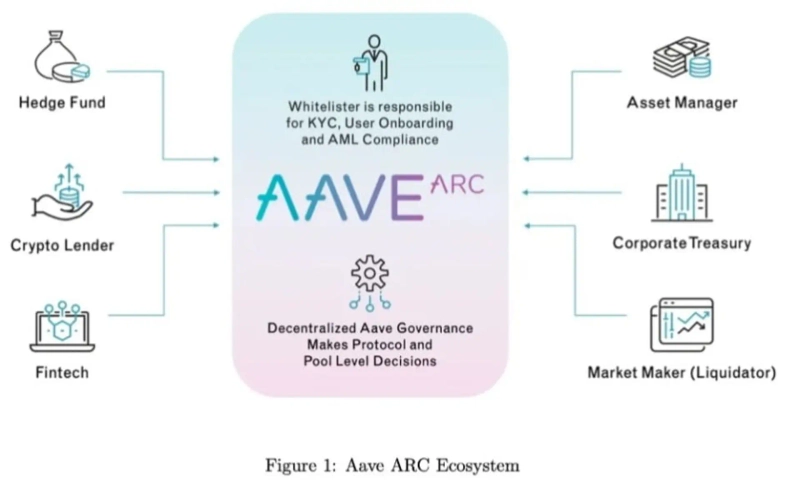

The DEX landscape is fundamentally reshaping as institutions enter, splitting into two distinct paths.

Regulatory-compliant DEXs and RWA Tokenization

With BlackRock’s $1.7 billion BUIDL fund entering DEXs, traditional finance is coming onboard. But they don’t use just any DEX; transactions go through whitelist DEXs integrated with KYC/KYB. Aave Arc has already launched pools for KYC-approved institutions, achieving $500 million TVL.

Maple Finance and TrueFi executed $2 billion and $1.5 billion, respectively, in institutional loans, all KYC-based. Uniswap is set to introduce optional KYC for institutional markets. Boston Consulting Group predicts tokenized assets will reach $16 trillion by 2030. JPMorgan’s JPM Coin, Singapore MAS’s Project Guardian, and experiments with the digital euro by the European Central Bank are all planning to leverage DEX infrastructure. Most of this large capital will flow into compliant DEXs.

Persistence and Evolution of Permissionless DEXs

Meanwhile, the original DEX ethos persists. Even with the Tornado Cash developer arrested, the protocol kept running. New DEXs operate without frontends or use IPFS for censorship resistance. Protocols like CoW Swap and 1inch Pro offer MEV protection and full privacy. Railgun uses zero-knowledge proofs for fully anonymous transactions, exceeding $1 billion in monthly volume. Innovation continues out of reach of regulators.

Future Equilibrium

By 2030, the DEX market is expected to split into 60–70% compliant DEXs and 30–40% permissionless DEXs. Like corporate intranets and the open web, the two systems will evolve with separate goals and users, sometimes bridged but fundamentally different.

2) Invisible Infrastructure: DEX Embedded in Applications ★★★★★

True DEX adoption comes when users don’t even realize they’re using a DEX. As blockchain apps proliferate, DEXs become invisible infrastructure.

DEX in Games

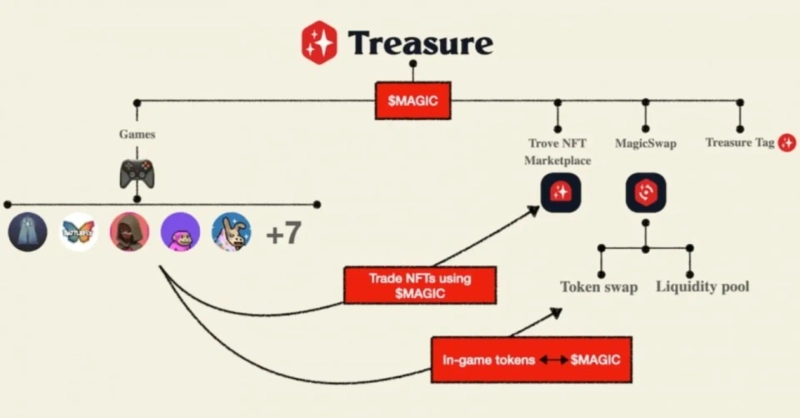

Players on Axie Infinity swap SLP to AXS with Katana DEX, but are unaware of the backend. They just press the swap button in-game. Gods Unchained uses Immutable X’s order book for card trades; in 2024, over a million transactions per day occurred via DEX within games. Treasure DAO established a shared economic system for metaverse games: when players move assets between games, DEX swaps occur automatically—using The Beacon items in Realm, for instance, triggers a swap with a click of the transfer button.

Automated Trading in Social Apps

Lens Protocol-based social apps use DEX in the background for tipping, subscriptions, NFTs, etc., so users just click “Send $5 tip”—MATIC is swapped to USDC under the hood. Farcaster’s Frames feature enables direct token swaps in-feed, supporting 2 million monthly trades.

Payment System DEX Integrations

Protocols like Request Network and Sablier allow payments in any token. Merchants want USDC settlement, but buyers can pay in ETH, MATIC, or even meme coins—the DEX auto-converts in the background. By 2025, such “invisible swaps” are expected to make up 30% of all DEX volume.

DAO and Payroll Systems

Superfluid enables real-time streaming payments, with the backend swapping freely between tokens. DAO reward systems like Coordinape distribute tokens per contribution, converting to recipients’ tokens of choice automatically. More than 500 DAOs were using such systems in 2024.

3) AI-Powered Autonomous Trading Systems ★★★★☆

We’re truly entering the age of AI and automated trading, beyond mere bots—new financial ecosystems are emerging.

The Vast Economy of MEV Bots

In 2024, MEV (Maximum Extractable Value) bots generated over $2 billion in revenue. Flashbots reports that $5 million in MEV is extracted daily on Ethereum alone; the top 10 bots capture 65% of all profits, monitoring thousands of DEXs in milliseconds. Jito Labs’ Solana MEV infrastructure distributed $400 million in MEV profits to validators, enhancing network security and trading efficiency.

Autonomous AI Agent Economies

Truth Terminal autonomously tweets, promotes meme coins, and reinvests donated funds, managing over $1.5 million in assets by late 2024. ai16z is a DAO investing in AI agents, funding $4 million across 16 projects. Each AI develops and executes strategies on its own. Numerai enables 20,000 data scientists to submit AI models and earn NMR tokens based on predictions—its automated trading system executes over $1 billion in trades monthly based on these forecasts.

Rise of Intent-Based Trading

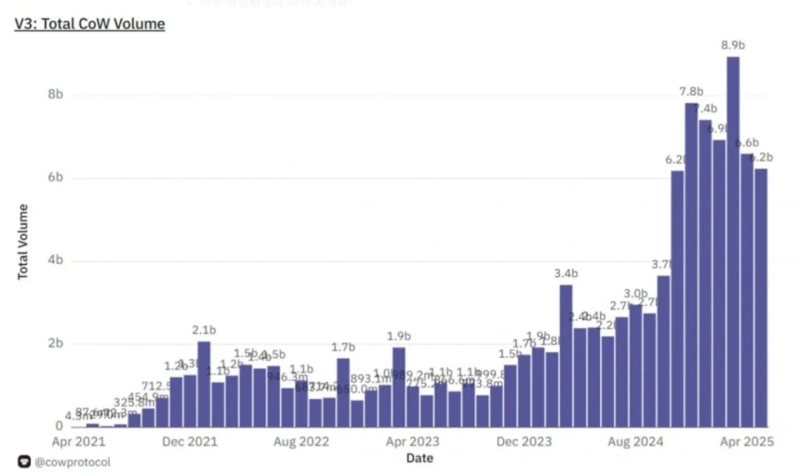

CoW Protocol processed $15 billion in trading volume in 2024. Users submit their intention—“sell ETH at the best price”—and competing Solver bots execute the optimal trade. On average, users get 3–5% better prices versus traditional DEXs. UniswapX, with a similar intent-based approach, achieved $5 billion in trading within 3 months of beta launch in late 2024. Gasless trades, MEV protection, and optimal pricing offer users near-expert trading experiences.

Auto-Rebalancing and Yield Optimization

Yearn Finance V3 has implemented AI-driven strategy optimization, managing $3 billion TVL in 2024 and reallocating across dozens of strategies in real time. On average, APY is 15–20% higher than human-managed portfolios. Sommelier Protocol uses machine learning to fine-tune liquidity provision positions, giving LPs 35% higher returns. Uniswap V3’s complex price ranges can now be managed automatically, allowing non-experts to earn expert-level returns.

Copy Trading and Social Trading Bots

dHEDGE surpassed $1 billion AUM in 2024. Bots automatically replicate top traders’ strategies 24/7—each strategy links 500–1,000 bots, with over 50,000 bots active overall.

4) Perpetuals and Derivatives DEXs ★★★★☆

In 2024, decentralized perpetuals volume hit $1.5 trillion, growing 138% year-over-year—a key growth driver for DEX overall.

Hyperliquid’s Explosive Growth

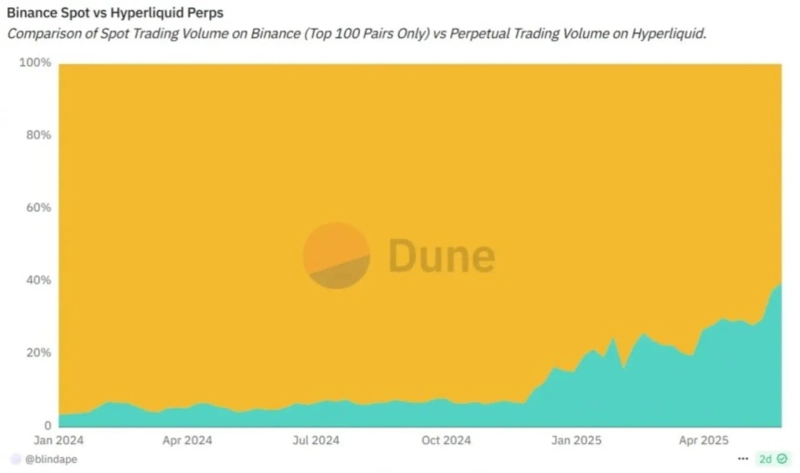

Hyperliquid narrowed the gap with Binance, posting $6 billion in daily volume. Its fully on-chain order book on a proprietary L1 delivers CEX-level speed and experience. With 10ms average latency and 100,000 orders/second, it overcame DEX limitations. Notably, users retain custody while enjoying an institutional-grade experience—no need to worry about losing keys.

GMX and Gains Network Innovations

GMX V2, running on Arbitrum and Avalanche, reached $1 billion in TVL. Oracle-based pricing and multi-asset pools enabled large, slippage-free trades. LPs profit from traders’ losses, earning stable 15–25% annual yields. Gains Network’s gTrade, integrating AI price prediction, processes $20 billion/month and supports up to 1000x leverage, enabling synthetic trading of stocks, commodities, and FX.

Vertex Protocol and dYdX Institutionalization

Vertex Protocol has launched prime brokerage for institutions, offering everything from multi-exchange access to portfolio margin and algorithmic trading. dYdX v4 completed full decentralization, moving to a Cosmos-based appchain, with validators operating the matching engine—becoming a truly decentralized exchange with no single point of failure, and still leading derivatives DEX with $3 billion daily trading volume.

5) Maturation of Cross-Chain Infrastructure ★★★☆☆

Finally, cross-chain infrastructure is reaching practical utility, enabling users to trade across chains seamlessly.

Full Rollout of LayerZero and Stargate

LayerZero V2 links over 30 main chains, processing $500 million in daily cross-chain volume. Stargate integrates stablecoin liquidity across Ethereum, BNB Chain, Polygon, Avalanche, and Arbitrum for instant, cross-chain transfers. Send USDC from Ethereum and instantly get USDC on Solana—no extra bridging step. Average cross-chain transfer time fell below 2 minutes.

Axelar and Wormhole Strengthen Security

Axelar uses a Cosmos validator network with proof-of-stake security, safeguarding over $5 billion in assets and supporting 60+ chains, including cross-chain contract calls. Wormhole’s Guardian network upgrade massively improved security—operated by 19 validators like Jump Crypto, P2P, and Staked, it’s processed over $30 billion in cross-chain trades with no major incident since the 2022 hack.

THORChain Enables Native Asset Swaps

THORChain is the only protocol allowing direct swaps of native assets (e.g., Bitcoin, Ethereum, Binance Coin) without wrapping. Its total 2024 volume topped $8 billion, with average slippage under 0.5%. Daily Bitcoin-Ethereum swaps exceed $100 million, setting a new standard for major asset movement without CEX reliance. Lightning Network integration greatly improved micro-transaction speeds.

The Reality of Chain Abstraction

Solutions like Particle Network and XION deliver ‘chain abstraction’ wallets where users don’t even know—or care—which chain they’re using. One address manages assets across all chains and executes trades on the optimal chain automatically. As this tech proliferates, “Ethereum DEX” and “Solana DEX” distinctions will vanish—users will simply express “swap Token A for Token B” and the system finds the best route.

DEX Market Share Forecast: Approaching the Tipping Point

Timeline Scenarios and Key Turning Points

End of 2025: 28% — Early RWA Tokenization Trials

BlackRock’s BUIDL expands across chains, achieving pilot success. Most institutional investors still remain on the sidelines, however, as regulatory frameworks mature.

End of 2026: 35% — Gradual Institutional Entry

Leading hedge funds and family offices begin using DEX, while major banks and pension funds still await full regulatory clarity. AI trading bots reach 10–15% of DEX volume.

End of 2027: 45% — Approaching the Threshold

Top financial institutions move from pilots to actual DEX adoption, and the first G20 nation experiments with DEX-integrated CBDC. Competition between CEX and DEX reaches a peak.

End of 2028: Over 50% — The Reversal Begins

DEXs surpass CEXs for the first time, albeit only by a slim margin. Both retain separate strengths, and cross-chain technology enables free movement among platforms.

2030: 65% — The New Equilibrium

DEXs dominate crypto trading but CEXs still hold a solid 35% share—retaining importance for fiat connectivity, onboarding, and meeting regulatory requirements. The ecosystem matures, with CEX and DEX playing complementary roles.

Sustainable Role of CEX

CEXs will continue to play essential roles:

Regulatory compliance gateway: Institutional investors and listed companies need audit trails and regulatory reporting—CEXs provide this.

Fiat infrastructure: Connecting to the traditional banking system remains a CEX monopoly, and even with CBDCs, transitional roles will persist.

User protection services: Only CEXs can offer recovery for asset loss, customer support, and insurance against hacks or mistakes.

Region-specific specialization: Local services addressing complex tax and regulatory environments will remain the purview of CEXs.

Conclusion: Ushering in a New Financial Era

25% share for DEX isn’t just a number. It signals a paradigm shift: from trust-based to verification-based, from intermediaries to protocols, from national systems to global networks. Like every great technological revolution, DEX began as 'just a better exchange.' Now we realize it’s the foundation of a whole new financial system.

DEXs exceeding 45% by end-2027 and overtaking CEXs at 52% by the end of 2028 is more than a statistical inflection point—it marks the end of centuries-old centralized finance and the dawn of the decentralized era. We are living through history’s most profound financial experiment. Trust without central authority, finance beyond borders, systems open to all—DEX is making it real.

The growth and evolution of DEX is living proof that blockchain has become the basis of 'open finance'—not just a technical experiment. The peer-to-peer electronic cash vision dreamed by Satoshi Nakamoto has blossomed into a full-fledged financial ecosystem via DEX. Blockchain’s promises—censorship resistance, permissionless access, transparency, self-sovereignty—all are manifest in the DEX world. While CEXs still cast the shadow of traditional finance, DEXs are the true expression of blockchain’s spirit.

■About Seojoon Kim, CEO of Hashed

△Early graduation, Seoul Science High School

△B.S. in Computer Science, Pohang University of Science and Technology

△CPO and Co-founder, NORI

△CEO, Hashed

△Venture Partner, SoftBank Ventures Asia

△Advisory Board, 4th Industrial Revolution Special Committee, Korea National Assembly

△Member, Future Education Committee, Korean Ministry of Education

Contributors' opinions may differ from the editorial direction of this publication.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)