Editor's PiCK

Medium/Legacy Token Frenzy Heats Up... Korean Market Remains Stable: Korean Crypto Weekly [INFCL Research]

Summary

- Korea's major exchanges, including Upbit and Bithumb, reported active trading and listings, particularly centered around midcap tokens and legacy tokens.

- New listings such as ALT, RAY, HUMA and price gains in T, SEI, AERGO highlighted expanding retail interest from major coins to niche tokens.

- Themes such as KRW pair premiums, the spread of NFTs and DeFi, and other diverse investment topics emerged, but overall market sentiment remained cautiously optimistic.

1. Market Overview

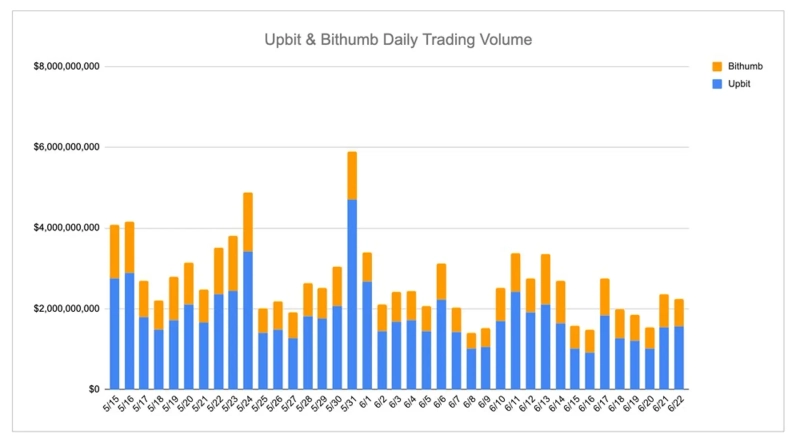

Last week, Korea's major crypto exchanges maintained an active trading environment. Upbit demonstrated its leadership in altcoin liquidity, while Bithumb kept a steady flow centered on stablecoins. XRP consistently held the top spot for trading volume on both exchanges. Meanwhile, midcap tokens like SNT, AERGO, ALT, and LAYER experienced a surge in trading volume, indicating that retail investors are shifting their attention toward legacy narratives and modular infrastructure themes.

Upbit introduced legacy tokens AltLayer and Raydium in new listings. While the market viewed this as catching up on "backlogged homework," the domestic marketing outcome was notably successful. Bithumb continued focusing on niche markets and high-turnover tokens, adding Spark, Huma Finance, and Forta to its listings.

This trend was reflected in the week's top gainers. On Upbit, infrastructure tokens and legacy projects enjoyed steady growth; Bithumb, meanwhile, saw a more speculative pattern with ELX soaring over 60%. KAIA and SEI also recorded double-digit gains. The simultaneous presence of coins like T, AERGO, and SEI on both exchanges is also notable. Meanwhile, an unusual slight premium appeared in the KRW stablecoin pair. Overall, market sentiment remains cautiously optimistic, with a growing emphasis on midcap and community-driven narratives.

2. Exchange Trends

2-1. Newly Listed Coins

Last week, major exchanges listed the following new coins:

Upbit: AltLayer (ALT), Raydium (RAY)

Bithumb: Spark (SPK), Huma Finance (HUMA), Forta (FORT)

Key Marketing Strategies & Insights

AltLayer and Raydium were projects listed on Upbit after a long interval. In the domestic community, such "late listings" are likened to doing overdue assignments. However, AltLayer achieved remarkable success on the marketing front in Korea.

AltLayer (ALT)

AltLayer is a project introducing the concept of "Restaked Rollup." While the technology is complex and not easily explained, it attracted attention through adept marketing.

The first major strategy was an event using the NFT collection "Oh Ottie!" based on its cute otter character. Unlike standard whitelists, these NFTs offered real token allocations as prizes—quickly boosting community interest and making the "AltLayer" name widely known.

In addition to the NFT campaign, participation from prominent VCs such as Polychain Capital and Jump, along with angel investors, boosted project credibility. The NFTs maintained above-mint valuations in secondary trading after mint. The project engaged users consistently through Galxe campaigns and OAT (On-chain Achievement Tokens), and held a TGE (Token Generation Event) after about two years.

AltLayer is a strong example of a technically challenging project successfully driving user engagement through familiar methods like NFTs and Galxe.

Huma Finance (HUMA)

Huma Finance conducted marketing in Korea over a relatively short term, entering the market in May as stablecoin interest grew post–U.S. presidential election.

Less than three weeks after entering Korea, Huma Finance held its TGE. Despite the short promotional window, many domestic users participated and received airdrops, leaving a positive impression.

Initially, PayFi Network was used to enable stablecoin deposits. Alloted deposit capacities filled up quickly, but as they were reopened twice during the Korean campaign, the community buzzed about it. Airdrop distribution via Kaito provided another participation avenue beyond simply depositing funds.

These activities coincided with heightened interest in Kaito within Korea, prompting Korean accounts to upload content about Huma Finance. The short yet effective campaign is a case study in rapid community engagement ahead of TGE.

2-2. Trading Volume Update

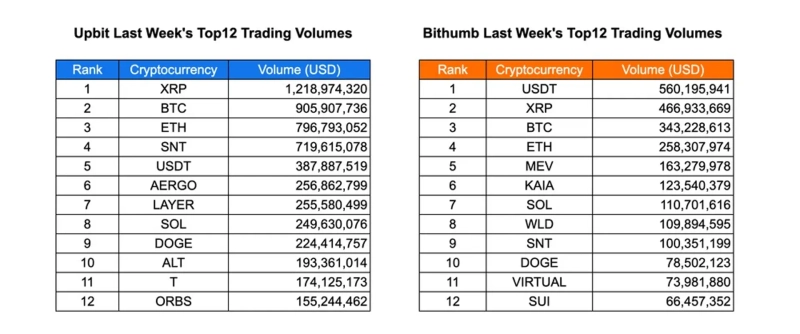

Upbit again posted active volumes this week. XRP ranked first with $1.21 billion, followed by BTC at $905 million and ETH at $796 million. SNT surged to $719 million, taking fourth, likely driven by short-term trading in legacy altcoins. AERGO, LAYER, and ALT each surpassed $190 million in volume, highlighting retail interest in themes beyond megacap tokens.

Bithumb saw USDT top the volumes at $560 million, likely due to off-ramping (fiat conversions) and strategic positioning. XRP and BTC followed closely. MEV, KAIA, and WLD remained Bithumb-specialty tokens—likely influenced by community focus and campaign-style trading. SNT ($100 million) and DOGE were traded on both Upbit and Bithumb, confirming broad retail demand.

Overall, the market's buy-side sentiment remains steady, with clear capital rotation from major coins into niche tokens. XRP's dominance is undiminished, and Upbit's diverse lineup cements its edge in altcoin liquidity.

2-3. Top 10 Gainers This Week

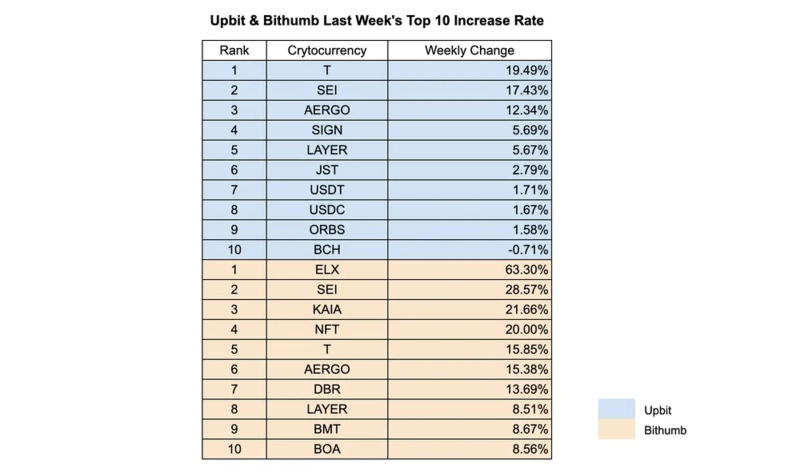

The biggest gainers on Upbit this week were T (+19.49%), SEI (+17.43%), and AERGO (+12.34%), all of which enjoyed high volume and strong local narratives to fuel price momentum. LAYER (+5.67%) and SIGN (+5.69%) also made the list, reinforcing persistent interest in modular infrastructure and interoperability themes. USDT and USDC rose slightly, likely tied to risk-off demand and related KRW pair premiums.

On Bithumb, ELX soared 63.3%, taking the top spot. SEI and KAIA also posted double-digit gains, mirroring some momentum seen on Upbit. T and AERGO were ranked near the top on both exchanges, confirming broad market attention. Tokens like NFT and DBR also featured, suggesting wider narratives beyond L1 through topics like DePIN and NFTs.

In summary, Upbit showed stable upward trends focused on infrastructure themes, while Bithumb saw pronounced speculative spikes. The cross-listing of SEI, T, and AERGO underscores the convergence of key themes, as well as each exchange’s distinct community dynamics.

3. Domestic Community Highlights

3-1. Upbit Pop-up Store Surge

From June 17th–23rd, Upbit made headlines by running an offline pop-up store for a week. Completing missions such as MBTI tests, typing games, quizzes, and stopwatch challenges earned visitors mock BTC coins, which could be collected (up to 5) and exchanged for Upbit merchandise.

The highlight was the exclusive 'Upbit × Samsung Galaxy S25 Edge' limited-edition prize, for which attendees queued for over an hour on-site.

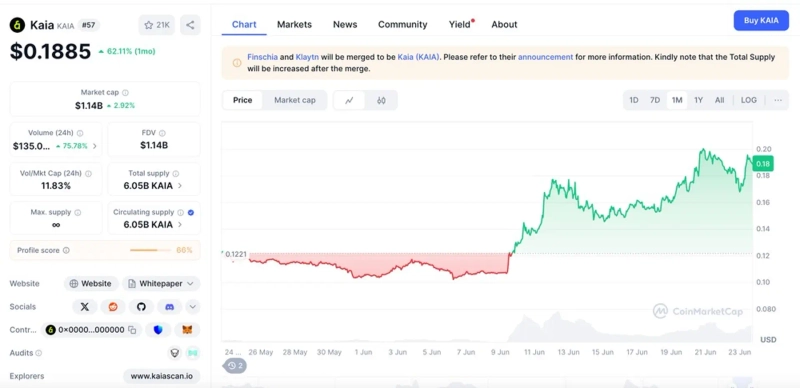

3-2. KAIA Price Soars

Korea's recent political transition reignited discussion around KRW-based stablecoins, driving attention towards the KAIA token. KAIA also leveraged an offline meetup to spell out its marketing, liquidity expansion, DeFi integration, and Japan-market strategies. The three-hour-plus event aimed to deliver substantive content beyond just price talk.

3-3. Mira Character Unveiling

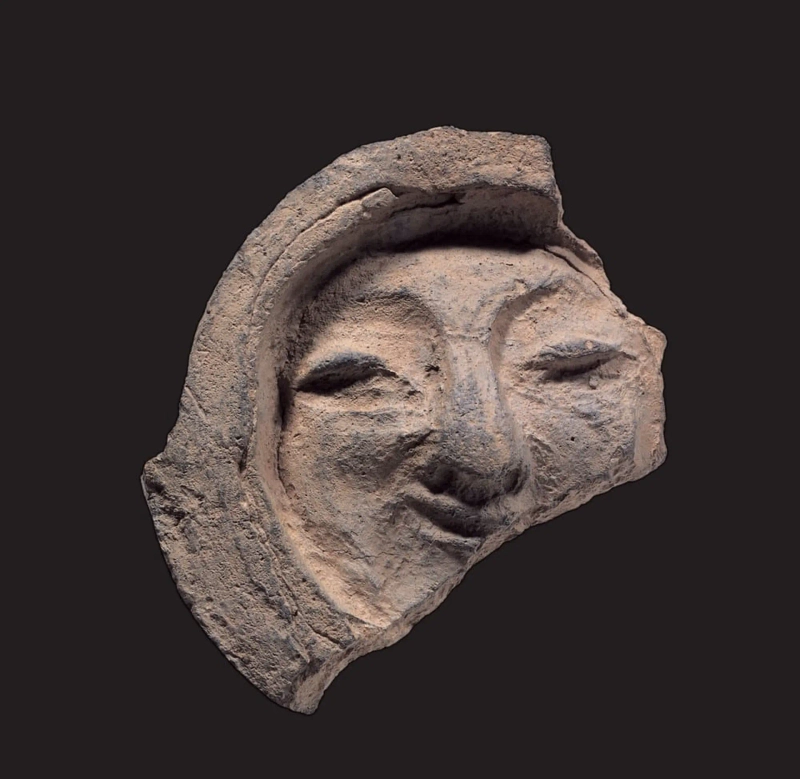

The Mira project debuted its new mascot 'Veri' to the Korean community, sparking unexpected reactions. Some users observed that the character resembled traditional Silla dynasty roof tile face patterns, contributing to a familiar regional feel and positive responses. Despite no official connection, the cultural symbolism piqued interest.

*All information is provided for informational purposes only and does not constitute an investment decision or any form of investment recommendation or advice. The contents herein bear no responsibility for investment, legal, tax, or other consequences.

INF Crypto Lab (INFCL) is a consulting firm specializing in blockchain and Web3, offering one-stop services for corporate Web3 strategy, tokenomics design, and global business expansion. INFCL provides strategic planning and hands-on execution for major domestic and international securities firms, game and platform companies, and global Web3 businesses. Drawing on deep experience and references, INFCL helps drive sustainable growth in the digital asset ecosystem.

Responsibility for this report lies entirely with the information provider and is independent from the editorial direction of any media outlet.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)