U.S. FHFA Director "Orders Preparation to Recognize Virtual Assets as Mortgage Loan Collateral"

Summary

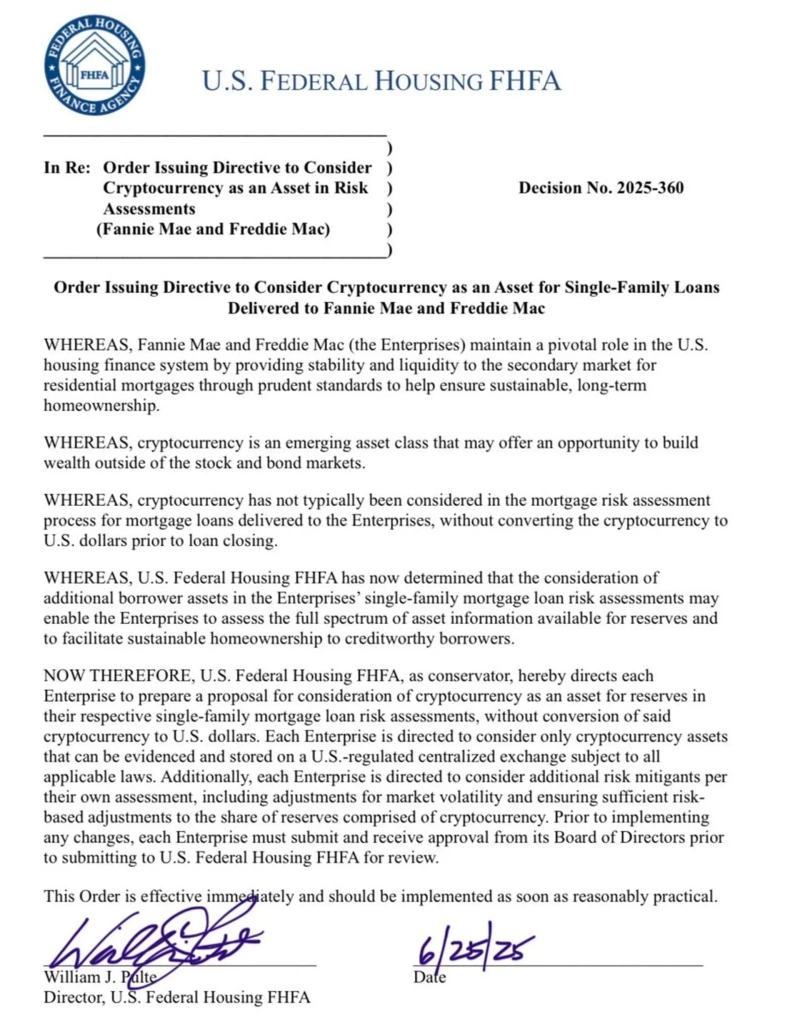

- William J. Pulte, Director of the U.S. Federal Housing Finance Agency, announced that he has instructed relevant institutions to prepare to recognize virtual assets as mortgage loan collateral.

- This is expected to be applied to major U.S. government-sponsored real estate-backed lending institutions such as Fannie Mae and Freddie Mac.

- This measure is interpreted as a signal that the trend of institutional adoption of virtual assets is expanding to the housing finance market.

William J. Pulte, Director of the U.S. Federal Housing Finance Agency (FHFA), has ordered real estate-backed lending institutions to prepare their businesses so that virtual assets (cryptocurrencies) can be recognized as mortgage loan collateral.

On the 26th (local time), Pulte stated on his X, "In accordance with President Donald Trump's vision to make the United States the capital of virtual assets, today I ordered Fannie Mae and Freddie Mac to make preparations to recognize virtual assets as mortgage loan collateral."

Fannie Mae and Freddie Mac are the two major government-sponsored real estate-backed lending institutions in the United States, regulated by the FHFA. This move is interpreted as a sign that the trend of institutional adoption of virtual assets is expanding to the housing finance market.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.