KRW Stablecoins Must Always Be Issued Mainly on Ethereum (ASA Opinion #2)

Summary

- The article emphasizes that while KRW stablecoins can be issued on various networks, it is essential that the initial issuance focuses on Ethereum.

- Ethereum has overwhelming liquidity, proven network stability, high security, and decentralization—making it the optimal network chosen by major stablecoin issuers.

- Networks such as Kaia and Avalanche can be used strategically, but issuers are advised to prioritize Ethereum to avoid liquidity fragmentation and ensure global market access.

For global readers, it may seem obvious that stablecoins should be issued on Ethereum. However, the market situation in Korea is quite different. Discussions about stablecoins have been accelerating in Korea, and it is common for institutions, media, and communities to assume that stablecoins should be issued on a 'single specific network.' This has often led to widespread misconceptions. For example, in Korea, networks such as Kaia and Avalanche are frequently mentioned.

It is desirable for KRW stablecoins to be distributed across various networks like Kaia, Avalanche, and Solana, and issuers are free to issue KRW stablecoins on those networks. However, to run a successful stablecoin business, one principle should remain firm: when issuing KRW stablecoins, Ethereum must always be the primary issuance-supporting network.

1. Discussion on Networks for Issuing KRW Stablecoins

1.1 KRW Stablecoins Are Still a Blank Slate

Now, everyone in the world is aware that discussions around issuing KRW stablecoins in Korea have become more active. However, even as the government delivers top-down messages, there are still no detailed regulatory guidelines specifically for KRW stablecoins.

As a result, practitioners at public agencies, financial institutions, banks, and corporations are almost entirely lacking a blueprint for who should issue KRW stablecoins, how, where, and how they should be used/managed. This has led to many discussions in Korea about issuance pipeline, issuer, reserve assets, risk management, issuance networks, and use cases. In this article, I will focus on the "issuance network" of KRW stablecoins.

1.2 Which Networks Are Mentioned for KRW Stablecoins?

Recently, the Korean financial and blockchain industries have seen heated debates about which networks should be used to issue KRW stablecoins. While many different networks are brought up—including Ethereum—Kaia and Avalanche are particularly prominent in Korean communities. Let’s examine why these are so frequently discussed.

1.2.1 Kaia

Kaia is by far the most frequently mentioned network in Korea. Recently, Kaia’s Chairman, Sangmin Seo, communicated, "Just as Kaia has onboarded native USDT, we will do our best to enable the issuance of KRW stablecoins," expressing a strong commitment to KRW stablecoins.

Kaia is a newly rebranded network resulting from the merger of the former Klaytn and Finschia networks. Klaytn originated from Kakao’s blockchain subsidiary Ground X, while Finschia originated from a former LINE affiliate. In addition to this history, Populus researcher Ponyo (Jaewon Kim) presented the following reasons why Kaia could be a suitable issuance network for KRW stablecoins:

- Swift regulatory response and operational efficiency: Kaia is a domestic L1 where the Kakao-affiliated team (Ground X) was involved from the design stage. This enables rapid execution of regulatory measures such as network changes, wallet limits, transaction suspensions, and on-chain reserve disclosures. This "ability to respond immediately" is a clear competitive edge from a supervisory authority's perspective.

- Policy leverage of using a domestic blockchain: Running the KRW stablecoin on a domestic chain aligns with policy and political narratives emphasizing financial sovereignty. It reduces controversy around dependency on foreign L1s and is likely to be viewed favorably by key policy groups such as the National Assembly and the Financial Services Commission.

- USDT onboarding: In May 2025, Tether (USDT) issued 100 million USDT natively on Kaia, and major exchanges like Bitfinex and MEXC also supported deposits and withdrawals. This suggests that Kaia has the basic infrastructure and operational capacity to process major stablecoins.

- User base expansion via messenger: After the merger, LINE NEXT onboarded Kaia mini dApps to the LINE mini-app portal. If the Kaia wallet is integrated into KakaoTalk in the future, KRW stablecoins can be immediately utilized on a single on-chain network connecting KakaoTalk (about 50 million users in Korea) and LINE (about 200 million users in Japan and Southeast Asia). This substantial initial user base is a differentiator that foreign L1s cannot easily match.

From a personal perspective, since the current Kaia foundation is established in Abu Dhabi and operated from Singapore, and there is currently no direct connection to Kakao or LINE, it’s questionable whether "swift regulatory response and operational efficiency" as well as "use of a domestic blockchain" will have practical effect. However, considering Kaia's DNA and the significant number of employees originating from Kakao and LINE, these advantages are hard to dismiss.

Furthermore, Ground X, the operator of Klaytn and a Kakao subsidiary, previously participated in the Bank of Korea’s CBDC pilot project, and currently Kaia has validators such as LINE NEXT, Kakao, Kakao Pay, Kakao Entertainment, and LINE Genesis—all relevant Kakao or LINE affiliates. This strengthens Kaia’s standing as a potential issuance network for KRW stablecoins.

1.2.2 Avalanche

Although not widely mentioned in retail communities yet, Avalanche has started to be discussed in Korean blockchain and financial industry circles. The reasons for considering Avalanche as an issuance option for KRW stablecoins are as follows:

Experience in institutional collaboration: Avalanche has a track record of blockchain technology collaborations with various public and financial institutions worldwide, such as Singapore’s MAS and Japan’s SMBC.

Institutional-specific products: Avalanche provides solutions such as Evergreen that make it easy for enterprises or financial institutions to build their own blockchains, offering various features like enforced KYC/KYB, geo-blocking, flexible validator controls, and more—enabling customizations between public and private networks.

2. KRW Stablecoins Must Always Be Issued Primarily on Ethereum

2.1 Key Considerations

A key advantage of stablecoins over traditional currency is that they can offer more features and be used across more countries. To fully realize these strengths, it is crucial for stablecoins to be utilized across multiple networks.

However, "where should KRW stablecoins be distributed?" and "which network should be chosen for the initial distribution?" are different questions. Future issuers, whether banks, fintechs, or corporations, must consider "which networks should natively support their KRW stablecoins."

From this perspective, I want to emphasize that if KRW stablecoins are to be issued, they must always be issued natively on Ethereum, while issuers’ freedom to additionally issue/distribute on networks such as Kaia, Avalanche, or Solana should remain.

2.2 All Leading Stablecoins Issue on Ethereum

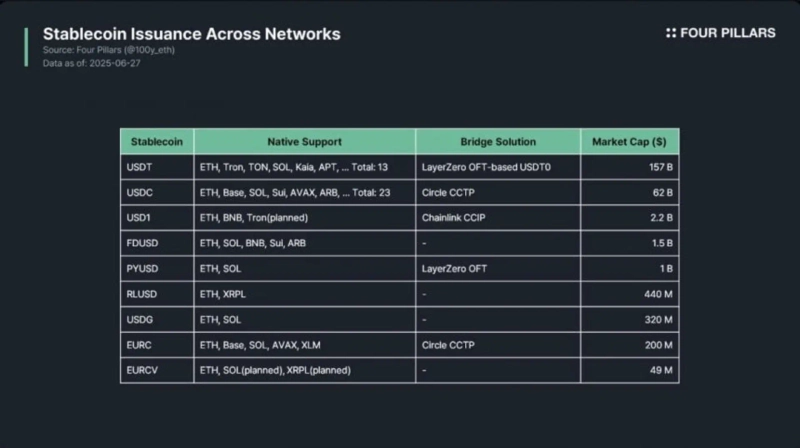

2.2.1 Tether USDT

Native issuance support: Ethereum, Tron, TON, Solana, Aptos, Avalanche, Kava, Celo, Kaia, Vaulta (formerly EOS), Liquid, Polkadot, Tezos

Bridge solution: LayerZero-based USDT0

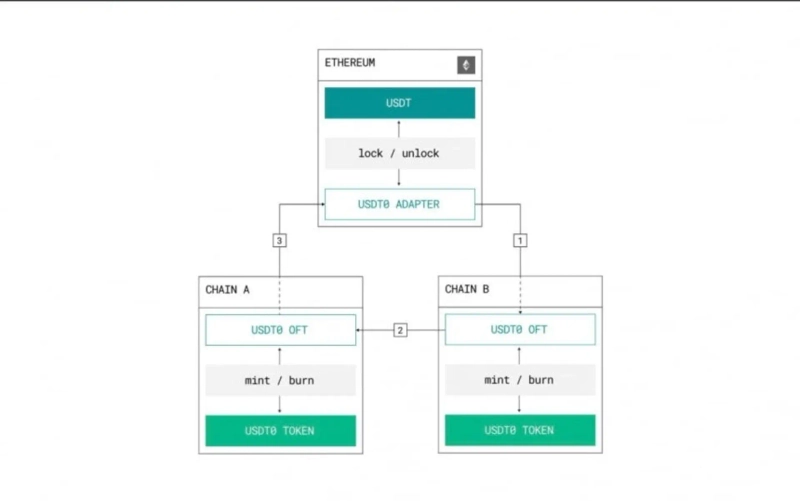

USDT, the stablecoin with the largest market capitalization, is currently natively issued on 13 networks. Interestingly, via USDT0 (LayerZero-based), USDT can be used on major networks like Arbitrum, VeraChain, Unichain, Optimism, Sei, and Ink—even though native USDT is not supported there—without liquidity fragmentation.

USDT0 is a token following LayerZero’s OFT standard, operating as follows:

USDT lock: When sending USDT from Ethereum to another chain, the USDT on Ethereum mainnet is locked in a smart contract.

USDT0 minting on destination chain: An equivalent amount of USDT0 is minted on the destination chain, representing the USDT held in the Ethereum mainnet contract.

Cross-chain bridging: USDT0 can be freely bridged across networks—USDT0 is burned on the source chain and minted on the destination chain.

Redemption: USDT0 can be redeemed for actual USDT via the smart contract lock on Ethereum.

If systems like USDT0 didn’t exist, non-native networks would see multiple types of bridged tokens issued by different third-party solutions, causing severe liquidity fragmentation.

For example, if USDT is natively supported on chain A but not on chain B, and the market has X, Y, and Z as bridge operators, then chain B could have three fragmented USDT liquidity pools—X-wrapped USDT, Y-wrapped USDT, and Z-wrapped USDT. This creates a poor user experience, so solutions like LayerZero OFT-based USDT0 are essential.

Bridging is verified by LayerZero DVN, with USDT0 and LayerZero acting as validators.

2.2.2 Circle USDC

Native issuance support: Ethereum, Base, Solana, Arbitrum, Aptos, Algorand, Avalanche, Celo, COTEX, Hedera, Linea, NEAR, Noble, Optimism, Polkadot, Polygon PoS, Sonic, Stellar, Sui, Unichain, WorldChain, XRPL, zkSync

Bridge solution: Circle’s own CCTP

USDC, the second-largest stablecoin, currently supports native issuance on 23 networks. Circle’s bridge solution, CCTP, allows seamless bridging. CCTP works as follows (assuming transfer from chain A to B):

Burn: USDC held by the user is burned on chain A.

Verification (attestation): Circle’s attestation service observes the burn event and sends a signed verification to chain B.

Mint: Chain B, upon receiving Circle’s signed verification, mints the equivalent amount of USDC for the user.

Since CCTP also follows a burn-and-mint mechanism like OFT, it prevents liquidity fragmentation. Verification is conducted internally by Circle.

2.2.3 PayPal PYUSD

Native issuance support: Ethereum, Solana

Bridge solution: LayerZero OFT

PYUSD, issued by PayPal and Paxos and integrated into the PayPal app, is supported natively only on Ethereum and Solana. Bridging between these is performed via LayerZero OFT, with Paxos, Google Cloud, and LayerZero participating as DVN validators.

2.2.4 Others

FDUSD: Issued by Hong Kong-based FD121, natively supported on Ethereum, Sui, Solana, BNB, and Arbitrum. No cross-chain solution is provided, but liquid centralized exchanges like Binance may indirectly play a bridging role.

RLUSD: Issued by a Ripple Labs subsidiary, natively on Ethereum and XRPL, with no specific cross-chain solution.

USDG: Issued by a Singapore-based Paxos affiliate, natively supported on Ethereum and Solana, without a cross-chain solution.

EURC: Circle’s euro stablecoin, natively supported on Ethereum, Base, Avalanche, Solana, Stellar, with cross-chain support through Circle’s CCTP.

EURCV: Issued by SG-Forge (a subsidiary of Societe Generale), initially on Ethereum, with plans to add Solana and XRPL support in the future.

USD1: Issued by World Liberty Financial (involving a Trump family member), initially supporting Ethereum and BNB, with future plans for Tron. Chainlink CCIP is used as a cross-chain solution.

3. Why Ethereum?

Disclaimer: As mentioned at the beginning, given that Kaia and Avalanche are the most commonly discussed blockchains in Korea for KRW stablecoins, these will be referenced for comparison. Importantly, the argument is not that KRW stablecoins should not be issued/distributed on Kaia, Avalanche, etc.; rather, issuing companies must select Ethereum as the primary issuance network, and can freely issue/distribute on Kaia, Avalanche, and others thereafter.

Most major stablecoins are first issued on Ethereum. Is this a coincidence? I argue it is not, and that Ethereum should always serve as the primary network for KRW stablecoin issuance. Here’s why Ethereum is the optimal choice:

3.1 Overwhelming Liquidity

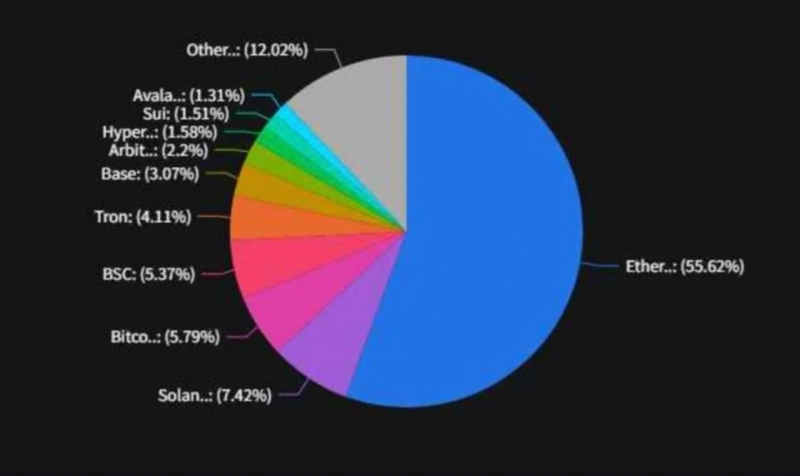

Of all blockchain networks, Ethereum has by far the highest liquidity. TVL in Ethereum’s DeFi protocols is about $61B, and stablecoin TVL alone is around $126B. Compared to Solana (the second-largest ecosystem), that’s 8x the DeFi TVL and 13x the stablecoin TVL.

For reference, Kaia’s DeFi TVL is about $35M and stablecoin TVL about $106M—meaning Ethereum is roughly 1,740 times and 1,180 times larger, respectively. Avalanche’s DeFi TVL is ~$1.45B and stablecoin TVL ~$1.5B, making Ethereum about 42x and 84x larger. Stablecoin value is in utilization, not just issuance, and Ethereum’s unmatched liquidity underpins a far broader application and infrastructure ecosystem. This underscores why KRW stablecoins should begin on Ethereum.

3.2 Battle-Tested System

Since launch, the Ethereum network has never suffered a complete chain halt. While there have been client issues (e.g., Geth DoS attacks, Nethermind bugs), Ethereum’s validators use varied clients, so the entire chain has never been affected.

Conversely, Kaia suffered prolonged block production halts in 2020 and 2021, and Avalanche has seen several multi-hour halts in 2023, 2024, and 2025. Not just Kaia and Avalanche, but every other non-Ethereum network (Solana, Aptos, Polygon PoS, Sui, Tron, etc.) has experienced chain halts. Stablecoins fundamentally deal with money, so the reliability of the chain is a crucial factor.

3.3 Network Effect

Ethereum offers not only deep liquidity for cryptocurrencies, but also for stablecoins; all major stablecoins are issued here. Additionally, key institutions like BlackRock, VanEck, and Franklin Templeton have onboarded tokenized funds to Ethereum. This massive network effect incentivizes not only stablecoin issuers, but also RWA token projects and others to issue here, driving a virtuous cycle that reinforces Ethereum’s dominance.

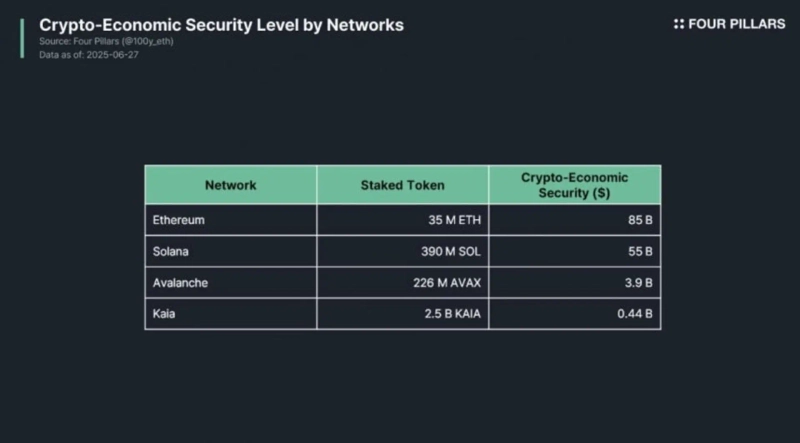

3.4 High Security Scale

Ethereum is the world’s most economically secure smart contract network. As of June 27, 2025, crypto-economic security on Ethereum is about $85B, with Solana, Avalanche, and Kaia at $55B, $3.9B, and $0.44B respectively. With the largest economic security, Ethereum is the optimum choice to safely underpin major stablecoin liquidity.

3.5 Superior Decentralization

Ethereum is the most decentralized smart contract network in terms of token distribution, foundation management, validator count/distribution, governance, and stakeholder dynamics. This not only provides strong justification for issuing stablecoins, but also brings meaningful practical benefits by avoiding the centralization risks found on other platforms.

4. Proposal for Issuance Process

4.1 Framework for Stablecoin Issuance Support Networks

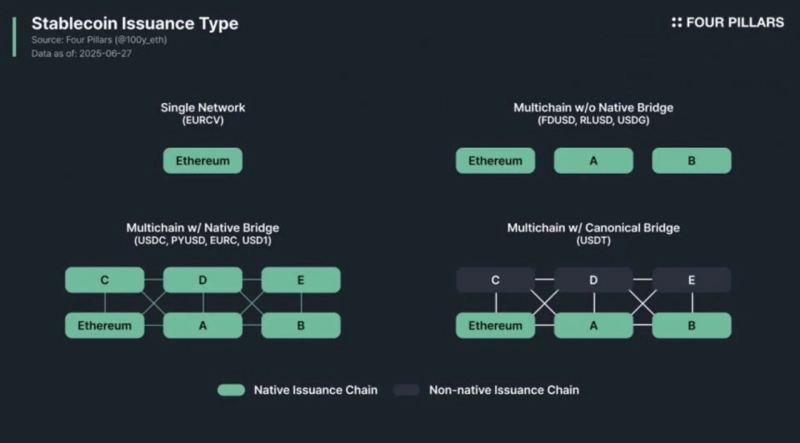

Looking at overseas stablecoin cases, issuance networks can be categorized into four types:

Single Network: Stablecoin is issued only on one network. Easy to manage, but ecosystem growth is limited (example: EURCV).

Multichain without Native Bridge: Native issuance on multiple networks, enabling broader ecosystem growth, but still suffers from third-party bridge-induced liquidity fragmentation (examples: FDUSD, RLUSD, USDG).

Multichain with Native Bridge: Native issuance on multiple networks and supports native bridges (CCTP, CCIP, OFT, etc.), making ecosystem growth easier and avoiding fragmentation for officially supported networks. However, fragmentation still occurs on unsupported networks relying on third-party bridges (examples: USDC, PYUSD, EURC, USD1).

Multichain with Canonical Bridge: Native issuance on multiple networks plus an official mint-burn bridge for efficient cross-chain use without fragmentation. Most effective for ecosystem growth, but existence of both native and bridged versions could confuse users (in practice, only one type is used per network, so no real issue). Example: USDT.

4.2 Proposals for Issuing KRW Stablecoins

Based on these discussions, here are proposals for how to issue KRW stablecoins:

4.2.1 Always Issue on Ethereum

Ethereum is the only network with all necessary characteristics for stablecoin issuance—liquidity, reliability, security, decentralization, and an active ecosystem. There is no reason for issuers to avoid Ethereum when issuing a KRW stablecoin. Even if the initial native issuance supports only a few networks, it must always include Ethereum.

4.2.2 Select Additional Native Issuance Networks Strategically

While many stablecoins claim multichain support, the vast majority of liquidity is concentrated on a few networks. Of Tether’s $156.8B, $80B is on Tron, $73B on Ethereum. For USDC, $41B of $59B is on Ethereum, $6.8B on Solana. This suggests that extensive native issuance is not inherently beneficial.

Due to the particularities of the KRW, global onchain adoption is likely much lower than for USD stablecoins. Thus, supporting too many native networks may fragment liquidity. Issuers should strategically select only a few additional native chains that align with their business strategy. In this context, Kaia may offer some strategic advantages for issuing KRW stablecoins; it is not directly linked to Kakao/Naver/LINE currently, but has historical and indirect ties, and a high proportion of Korean employees and users. However, low liquidity and economic security on Kaia could limit expansion. For Kakao Pay or Kakao Bank-affiliated issuers, Kaia could nevertheless be considered.

Avalanche’s case is slightly different and can be divided into two:

Avalanche C-Chain: As a public network, it has decent liquidity and security, but given alternatives like Solana or Base with more liquidity, security, and active ecosystems, Avalanche C-Chain is relatively less prioritized.

Avalanche Subnets: If KRW stablecoins are issued on custom institutional subnets, validators are chosen by the issuer, with KYC/KYB by default, making it a hybrid between public and private chains. This may make it unlikely to coexist with public networks like Ethereum, Solana, Base, or Kaia. While advantageous for regulatory compliance, it harms ecosystem expansion prospects.

If an issuer expects significant overseas capital inflow, networks like Solana or Base—after Ethereum—would be the best secondary choices due to their strong global user bases and liquidity.

4.2.3 Integrate Cross-Chain Solutions

A successful KRW stablecoin issuer will natively support Ethereum and a handful of public networks. Without cross-chain bridges, users and platforms will face substantial liquidity management headaches, requiring either laborious redemption/reissue processes or reliance on risky, fragmentation-prone third-party bridges.

Therefore, issuers should incorporate mint-burn cross-chain bridges as seen in network types 3 or 4 in the framework above. While large issuers like Circle can maintain their own CCTP, for KRW stablecoin issuers, adopting solutions like LayerZero OFT or Chainlink CCIP is far more efficient for frictionless liquidity management.

5. Conclusion: The Particularities of KRW Stablecoins

5.1 The KRW Stablecoin Dilemma

We have explored why Ethereum must be the go-to issuance network for any successful KRW stablecoin. While those long involved in the stablecoin ecosystem may consider issuance on Ethereum a given, recent intensification of domestic debate warrants this explanation.

However, one major reason it is hard to choose a public base network like Ethereum in Korea is the distinctive nature of both the country and its currency. Korea is highly dependent on foreign exports, mandating strict monitoring of cross-border capital flows and exchange rates, driven by its experience with FX reserve depletion during the IMF crisis—leading to particularly strict FX laws.

Due to FX laws, large overseas transfers, borrowing, or conversions by individuals or corporations must be reported and monitored. If KRW stablecoins allow seamless cross-border movement, the Bank of Korea, National Tax Service, Customs, and the Financial Supervisory Service may view them as a serious issue.

Some argue that, given Korea’s unique circumstances, KRW stablecoins should be launched not on public networks like Ethereum or Solana, but private networks or compliance-focused solutions like Avalanche subnets. This indeed makes sense in that specific context.

However, it is important to reconsider the original intent of adopting stablecoins. Korea is a financial powerhouse; through the existing banking and payments network, users can already access all forms of economic activity. Blockchain and stablecoins enable global access and reduced intermediaries, and could disrupt—or improve—the securities market and payments industry.

If KRW stablecoins are issued solely on private networks, they would not offer a significant improvement over existing systems, and Korea risks being left out of the rapidly advancing global stablecoin market.

Further specific policy/regulatory barriers due to the peculiarities of KRW stablecoins will be covered in the next article.

5.2 Where Should KRW Stablecoins Be Distributed?

Recent crypto regulations proposed in Korea allow banks, non-bank institutions, and corporations to issue stablecoins. Ultimately, the choice of which network to support for their KRW stablecoin is entirely up to the issuer. Some may choose only Kaia, others only Avalanche, and some may choose Ethereum and a few others.

However, I want to stress: choosing which network to support is like deciding which supermarket to distribute your product in. With the safest platform, unmatched capital and user base, and the de facto marketplace for all stablecoin issuers—shouldn’t you naturally consider the Ethereum “supermarket” as a distribution channel?

*The Asia Stablecoin Alliance was initiated by Kang Hee-chang and Bok Jin-sol of Populus, along with Alex Lim (Jonggyu Lim) of LayerZero Korea. The Alliance aims to facilitate stablecoin adoption across Asia, foster clear regulatory environments, and promote robust technical infrastructure through research and exchange.

The opinions expressed by outside contributors do not necessarily reflect the editorial stance of our publication.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)