Editor's PiCK

Hot Debuts Newton & Sahara Shake Up Korean Crypto Exchanges: Korean Crypto Weekly [INFCL Research]

Summary

- It was reported that newly listed coins such as Newton and Sahara AI attracted investors' attention with successful marketing and localization strategies.

- Trading volumes in mid-cap tokens surged on both Upbit and Bithumb, highlighting Korean investors’ strong interest not only in major coins but also in emerging assets.

- Risk appetite among individual investors is being reflected in both the crypto and stock markets, as seen in the race to 3,000 between KOSPI and Ethereum and the surge in purchases of Circle (CRCL) stock.

1. Market Overview

Last week, the Korean cryptocurrency market saw renewed activity driven by new listings and changing narratives among retail investors. Newton and Sahara AI drew attention with successful local marketing campaigns. Newton heightened its presence by operating a Korea-exclusive leaderboard on Kaito, while Sahara AI continued to attract interest through constant meetups and an oversubscribed token sale.

In terms of trading volume trends, major coins like XRP, BTC, and ETH maintained strong liquidity on Upbit and Bithumb, while mid-cap tokens such as MOVE, SAHARA, and NEWT surged, revealing Korean investors' preference for mid-sized coins. Pengu (PENGU) and Sei (SEI) both posted remarkable gains on both exchanges, reflecting synchronized momentum among retail traders.

Meanwhile, the community buzzed about OpenLedger's large-scale meetup, Korean investors' heavy buying of Circle stock, and memes comparing Ethereum’s and KOSPI’s rallies. This indicates a robust risk appetite spanning crypto, equities, and pop culture.

2. Exchanges

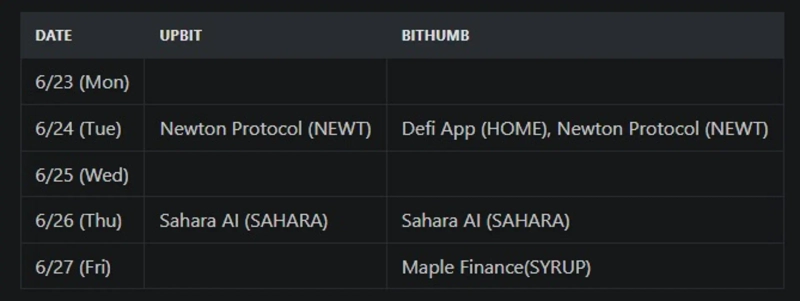

2-1. Newly Listed Tokens

Last week, several new tokens were listed on major Korean exchanges.

Upbit listed Newton Protocol and Sahara AI.

Bithumb listed DeFiApp, Newton Protocol, Sahara AI, and Maple Finance.

Key Marketing Strategies & Insights

Newton Protocol (NEWT)

Newton launched a rapid, phased marketing campaign targeting the Korean market. From early to mid-May, it climbed swiftly in the Kaito Korea pre-TGE rankings, and drove user engagement through Twitter missions, credit point quests, dice and minesweeper games, and side quests.

Notably, they set up a dedicated Kaito allocation pool and leaderboard for Korean users, allowing those who missed out on account registration to be immediately added via comments—a detail-oriented approach that stood out. The official Twitter encouraged even small accounts to post quality content for reward opportunities, and news of the June TGE fueled further excitement.

Some KOLs estimated that with a FDV of $300 million, the Kaito reward pool was $2.25 million, with $150,000 allocated to Korea. If there were 100 winners, the payout would be $24,000 per person; with 1,000 winners, an average of $2,400 was possible. After TGE, many participants reported high returns, cementing the campaign's success.

Sahara AI (SAHARA)

Sahara AI made a strong impression on the Korean community last year with an ice cream event at the KBW main booth and a side event attended by Eunbi Kwon and Dynamic Duo. Afterwards, it built presence further through partnerships with global Web2 AI companies and prestigious universities, staged testnet releases, and continued meetups. Its Korea-only Telegram group, launched in April this year, attracted over 2,000 members in a short time, proving its popularity.

The token sale on BuidlPad recently raised $7.4 billion, with 777% oversubscription, over 103,000 applicants, and final participation from more than 30,000 people across 118 countries—a record-breaking feat. After TGE, the token price more than doubled, earning praise for a successful distribution.

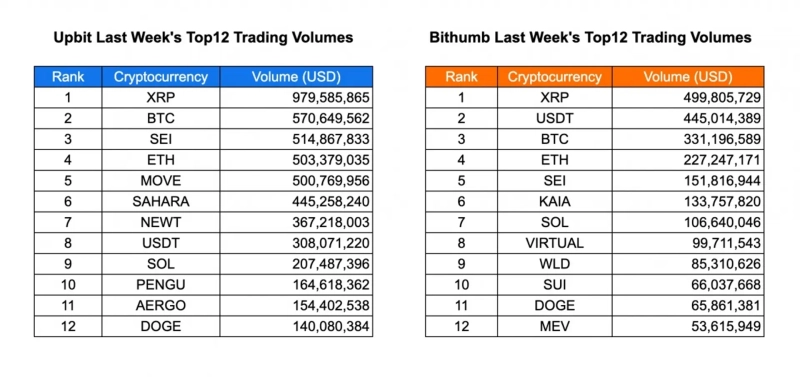

2-2. Trading Volume

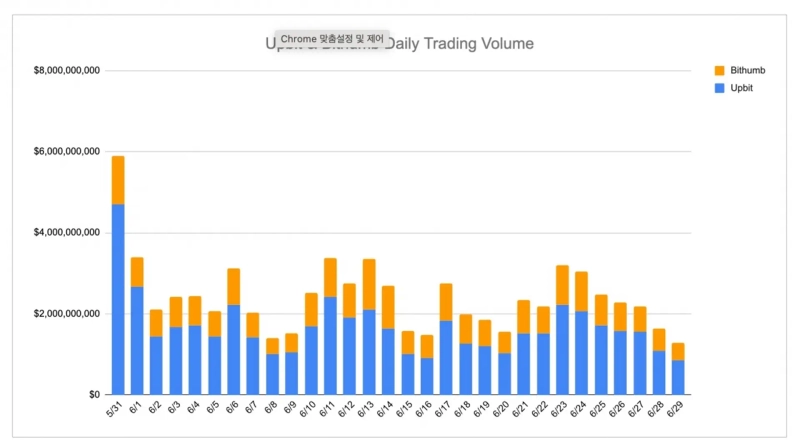

Upbit maintained powerful trading momentum overall. XRP claimed first place in weekly volume at $979.6 million, with BTC at $570.6 million, and SEI surging to $514.9 million. Notably, the newly listed MOVE reached $508 million, overtaking ETH and reflecting intense speculative demand. SAHARA, NEWT, and PENGU also cracked the top 12 by volume, indicating heightened volatility and growing interest in emerging assets. USDT, SOL, and DOGE maintained top ranks, further reinforcing their liquidity advantage. The monthly volume trend shows a gentle rebound in June compared to the May low.

On Bithumb, XRP also led with $499.8 million, followed closely by USDT ($445 million) and BTC ($331.2 million), mirroring Upbit’s trading preferences. However, SEI’s Bithumb trading volume was $151.8 million—much lower than on Upbit—suggesting SEI is more concentrated on the latter. KAIA, VIRTUAL, and WLD held sustained local interest, while MEV and SUI posted steady, albeit smaller, volumes. The overlap of leading tokens across the two exchanges—XRP, BTC, ETH, DOGE, and SOL—demonstrates stable institutional and retail demand for highly liquid assets, while divergence spotlights trends unique to each platform’s retail traders.

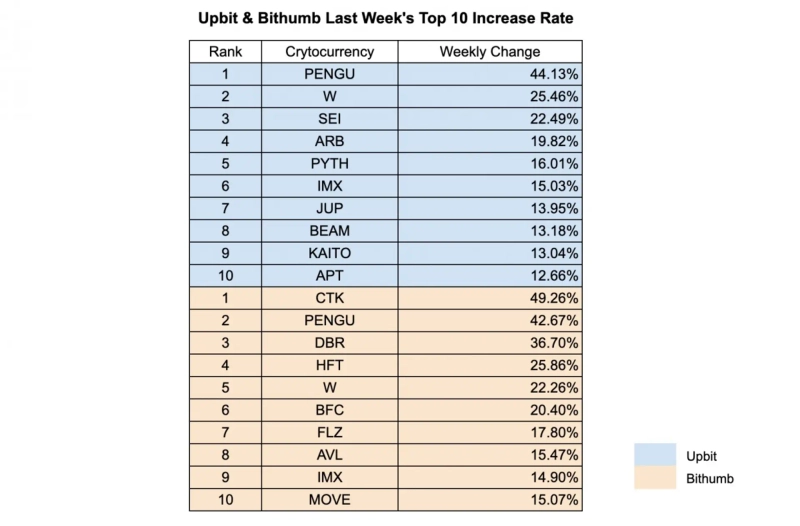

2-3. Top 10 Rising Tokens

PENGU achieved remarkable gains on both Upbit and Bithumb, posting rises of 44.13% and 42.67%, respectively—thanks to vibrant retail sentiment and community growth. SEI also maintained an upward trajectory, up 22.49% on Upbit and 22.26% on Bithumb, reflecting ecosystem momentum. Additional Upbit gainers included W (+25.46%), ARB (+19.82%), and PYTH (+16.01%), highlighting renewed attention to Layer 2 and oracle infrastructure tokens.

On Bithumb, CTK led with a 49.26% rise despite limited influence on Upbit, indicating exchange-specific volume gains. DBR and HFT followed with double-digit growth, and BFC, FLZ, and AVL saw increased participation from Korean investors. IMX appeared on both charts simultaneously (Upbit +15.03%, Bithumb +14.90%), signaling cross-platform interest in gaming narratives, and MOVE’s 15.07% jump on Bithumb mirrored a recent Upbit volume surge.

Overall, this week saw trader focus shift to speculative mid-cap tokens and ecosystem plays, marking a subtle change from prior large-cap-led trends.

3. Korean Community Buzz

3-1. Meetups Remain the Most Popular Meta

Meetups offering exclusive benefits continued to dominate the Korean crypto scene last week, with several projects drawing fervent crowds. OpenLedger’s event boasted over 1,500 registrants and more than 500 attendees—a rare turnout for a non-KBW period. Attendees remarked, “I’ve never seen such crowds outside KBW,” underscoring the event’s excitement. The giant octopus mascot of OpenLedger went viral on social media, particularly images of it being cut up.

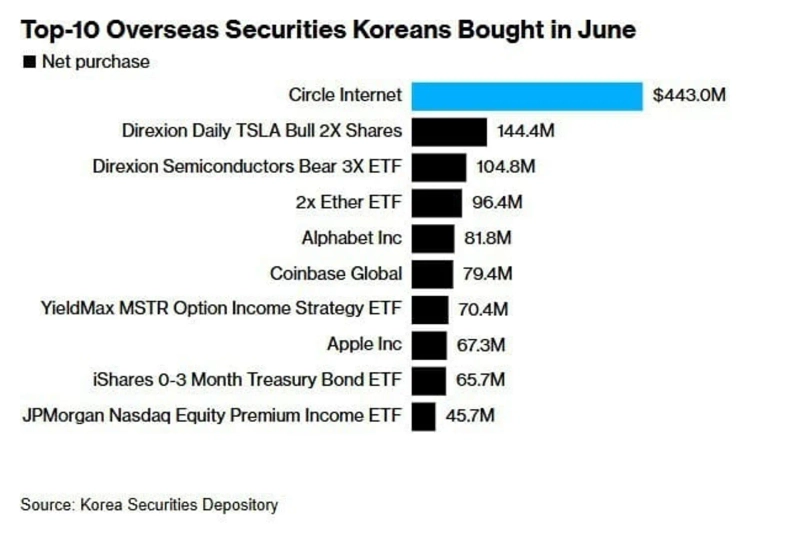

3-2. US Stocks Most Bought by Koreans

Last week, a tweet by ZeroHedge attracted the attention of Korea’s Web3 community.

CRCL’s massive price move is thanks to Korean’s momentum kamikaze. Circle has become the most popular overseas stock among Korean investors this month, reflecting rising individual interest in crypto-linked investments. (BBG)

Recent data shows the top five US stocks most purchased by Koreans in June:

-

Circle (CRCL)

-

Tesla (x2)

-

x2 Ether ETF

-

Alphabet

-

Coinbase

3-3. KOSPI vs. Ethereum: Who Will Hit 3,000 First?

A playful meme comparing the Korean KOSPI index and Ethereum is making the rounds, questioning which will breach the 3,000 mark first. Last week, KOSPI broke above 3,100 for the first time in 3 years and 9 months, taking the lead. The index surged 19.25% over the past month and 28.82% year-to-date—making Korea’s market the top gainer among major global stock markets.

Bloomberg noted that restored political stability under President Jaemyung Lee, alongside optimism for stronger investor protection, has boosted market confidence.

*All information is provided for informational and reference purposes only and does not constitute the basis for investment decisions, recommendations, or advice. The content here does not offer legal, tax, investment, or any other assurances.

INF Crypto Lab (INFCL) is a consulting firm specialized in blockchain and Web3, offering end-to-end services such as Web3 market entry strategies, tokenomics design, and global expansion support for companies. We provide both strategy and execution to major domestic and international securities firms, game companies, platform operators, and global Web3 enterprises. Our accumulated expertise and references drive the sustainable growth of the digital asset ecosystem.

This report is independent of the outlet's editorial direction, and all responsibility rests with the provider of the information.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)