Whoever captures Upbit will win in the Korean Won stablecoin market [ASA Opinion #3]

Summary

- It was reported that Korea’s Naver Pay and Upbit are pushing for a partnership for a KRW-based stablecoin business and are poised to secure an overwhelming market share.

- The stablecoin issued by their consortium could have significant growth potential, driven by widespread use cases in payments and as an order book currency for exchanges.

- However, current 'Virtual Asset User Protection Act' and strict foreign exchange regulations may impose legal limitations on issuance and on-chain expansion.

1. The Key to Early Distribution of Stablecoins: Exchanges

1.1 Emergence of the Naver Pay x Upbit Consortium

On July 1, 2025, there was significant news in Korea’s won-based stablecoin industry: Upbit decided to partner with Naver Pay for a stablecoin business. This meant that the number one cryptocurrency exchange and the top simple payment service provider in Korea would jointly pursue a stablecoin issuance project through a partnership.

Recently in Korea, there have been various developments such as eight commercial banks forming a consortium to issue stablecoins, and fintech firms/payment card companies like Kakao Pay, KakaoBank, and Shinhan Card applying for trademarks related to stablecoin names, signaling wide interest from banks, financial institutions, and companies in the stablecoin business.

Thus, the Korean market is currently expecting a variety of KRW-based stablecoins from multiple issuers. However, I believe that if Naver Pay and Upbit launch a stablecoin together, they are highly likely to dominate the KRW stablecoin market.

1.2 How Did USDT and USDC Grow?

1.2.1 Exchange Support Is the Key

1.2.2 The Growth Trajectory of USDT

USDT did not initially start with the goal of simply creating a stablecoin. Instead, developer J.R. Willett came up with the idea of making new cryptocurrencies on the Bitcoin blockchain. This idea was realized via a project called Mastercoin, which later became the technological foundation for USDT through the Omni Layer. In October 2014, USDT was first issued on the Omni Layer under the name Realcoin, and in January 2014, it was rebranded to Tether.

USDT began full-scale circulation in January 2015 when it was adopted by the Bitfinex cryptocurrency exchange. This was because Bitfinex’s senior executives had established Tether Holdings Limited in BVI in 2014. Between early 2017 and September 2019, USDT’s issuance surged from $10 million to $2.8 billion as Bitfinex experienced complete suspension of USD deposits and withdrawals due to the halting of remittance by local Taiwanese banks and Wells Fargo in April 2017, which forced exchange users to adopt USDT and enabled rapid growth.

Subsequently, not only Bitfinex but also other major global exchanges like Binance, Huobi, and OKX started supporting Tether, which served as a major catalyst for Tether’s growth and helped establish it as the standard currency of the crypto market.

1.2.3 The Growth Trajectory of USDC

USDC was announced in May 2018 by Centre, a consortium established by Circle and Coinbase, and officially launched in September the same year. As with USDT, exchange support for trading pairs, especially by Coinbase and Kraken, played a critical role in USDC’s initial growth. USDC further benefited when it was adopted as a major stablecoin on the Solana network, powering its on-chain expansion.

2. The Synergy Between Naver Pay and Upbit

Given that all leading stablecoins, which have come to dominate the market for dollar-denominated stablecoins, grew significantly through cryptocurrency exchanges in their early stages, it appears essential for KRW stablecoins to similarly collaborate with exchanges to increase market share. Therefore, the consortium between Naver Pay, Korea’s number one simple payment service, and Upbit, the top crypto exchange, jumping into the KRW stablecoin business is enormous news within Korea.

2.1 Korea’s Top Simple Payment Service: Naver Pay

In Korea, the average daily transaction value for simple payment services reaches about ₩1 trillion, with simple payment accounting for about ₩480 billion, and the so-called “big three”—Naver Pay, Kakao Pay, and Toss Pay—securing over 90% of the market. Among these, Naver Pay’s sales are around ₩1.6 trillion, roughly double that of its competitors Kakao Pay and Toss Pay.

2.2 Korea’s Top Cryptocurrency Exchange: Upbit

Korea is a nation of crypto exchanges. According to a 2024 second-half virtual asset business operator survey by the FIU under the Financial Services Commission, some notable statistics were revealed:

The average daily trading volume was ₩14.3 trillion, outpacing the same period’s KOSPI trading volume (₩10.8 trillion).

KRW deposits reached ₩10.7 trillion.

Major Korean crypto exchanges include Upbit, Bithumb, Korbit, Coinone, and GOPAX, with Upbit commanding about 60~70% market share, making it the clear leader.

2.3 Potential Use Cases and Ripple Effects

If Upbit and Naver Pay issue a KRW stablecoin together, where might it be used? For convenience, let’s refer to this prospective stablecoin as “nKRW.”

2.3.1 Anticipated Applications

The first use case is as an order book currency for Upbit. Just as exchanges in gray areas such as Binance and Bybit cannot support fiat but list crypto-denominated stablecoins, fully regulated exchanges like Coinbase support both USD fiat and USDC stablecoins as order book currencies. Notably, on Coinbase, the USD and USDC order books are merged, allowing both USD and USDC holders to trade in a consolidated liquidity pool.

Similarly, if nKRW is implemented on Upbit, nKRW holders could enjoy the same liquidity as today’s KRW market. Previously, transferring KRW deposits to Upbit required bank intermediaries, which was cumbersome. With Naver Pay’s participation, users could easily recharge nKRW and transfer it to Upbit. Additionally, unlike KRW, nKRW is not affected by bank clearing times—a particular strength for exchange operations.

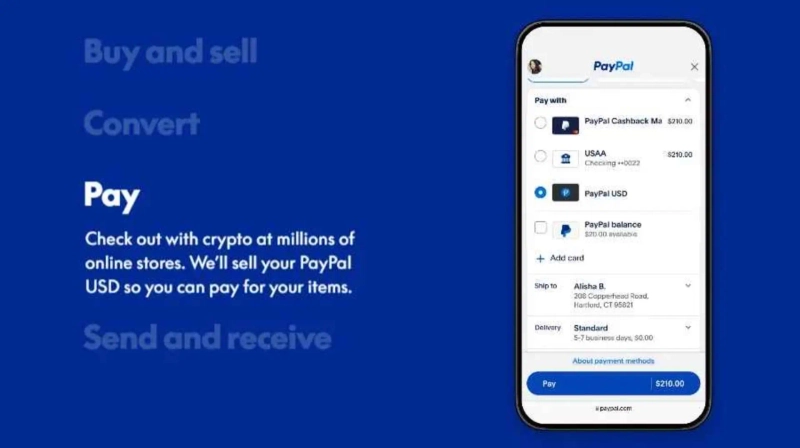

The second case is using nKRW as a payment currency for Naver Pay. PayPal’s PYUSD is a prominent example where a fintech utilizes a stablecoin for payments. PayPal users can recharge PYUSD via bank accounts or cards, hold it within the app, and make payments with it. Similarly, if nKRW is introduced, Naver Pay could support it as a fourth payment option in addition to accounts, cards, and Naver Pay Money.

Naver Pay is used extensively in Korea—not only on Naver’s own shopping platform but also on major external online retailers and offline stores. Thus, if nKRW launches, it could instantly gain a broad spectrum of use cases.

Additionally, Naver Pay currently offers cards linked to Naver Pay Money. Building on this, it could issue a card that allows payments from nKRW balances. Using stablecoins for payments reduces intermediary fees, since there is no need to settle via card networks, and can radically improve clearing times compared to the existing system.

2.3.2 Ripple Effects

3. Conclusion

3.1 Who Will Be the Issuer?

If various banks and companies enter the KRW stablecoin issuance market, it may still be difficult for anyone to surpass the Naver Pay–Upbit consortium. Upbit could drive early distribution and adoption of the stablecoin based on its enormous liquidity, and once a certain economic scale is achieved, Naver Pay could leverage it across its remittance and payment services for long-term growth.

But wait—who will actually issue the KRW stablecoin? In the early days of USDC, Circle acted as the issuer under the governance of Centre, the consortium co-founded by Circle and Coinbase. However, in August 2023, Centre was dissolved, and all governance and issuance rights were centralized under Circle. With PayPal’s PYUSD, PayPal handles distribution and branding, but the actual issuance is done by Paxos.

It may seem that Naver Pay and Upbit could mirror this by splitting issuance and distribution like Circle and Coinbase, but the reality is different. Under the current “Virtual Asset User Protection Act,” the issuance or trading of virtual assets developed or issued by oneself or related parties is prohibited. In other words, a fintech company both issuing and distributing a stablecoin under current law would be difficult. However, according to Kim Hyo-bong, attorney at Bae, Kim & Lee LLC, if the law is interpreted as applying only to trading within crypto exchanges, there could be possibilities for fintech-issued stablecoins. Ultimately, it all depends on legal interpretation.

Thus, subject to legal interpretation, Naver Pay could act as a direct issuer of KRW stablecoins. If this is not possible, a third-party bank or private issuer may need to join the consortium to handle issuance.

3.2 Can It Expand On-chain?

Given existing deposit pools and distribution channels, a KRW stablecoin issued by Naver Pay and Upbit has strong potential to become one of the world’s top 10 stablecoins. But could this stablecoin naturally expand into on-chain DeFi?

Initially, I would say this is unlikely for two reasons.

The first reason is Korea’s strict foreign exchange regulations. Since the 1997 IMF crisis, Korea has adopted stringent regulations; further legal development of KRW stablecoins will likely grant them fiat-like status, making on-chain transfers challenging. Under current law, transactions (remittance, receipt, or exchange) involving amounts of $10,000 or more trigger automatic reporting and complex paperwork—meaning on-chain withdrawals may be heavily restricted.

The second reason is low global demand for KRW. One of DeFi protocols’ prime objectives is to secure deposits. With high global demand for dollar stablecoins, most on-chain users worldwide use them as a de facto base currency. Conversely, if a DeFi protocol adopted a KRW stablecoin, its user base would likely be limited to a small number of Korean on-chain users. Even so, if the KRW stablecoin itself grows as large as other global stablecoins, this domestic demand alone could make it attractive to global DeFi protocols.

3.3 Birth of a Mega Stablecoin for the Digital G2 Era

The global payment share of KRW is less than 0.2%—not even ranking in the top 20 currencies by transaction volume. However, as calculated above, if the stablecoin issued by Naver Pay and Upbit simply captures about 5% of existing deposits, it could easily surpass the scale of EURC, the top euro-denominated stablecoin.

Let’s watch closely to see if the top fintech player and crypto exchange can succeed, and what new strategies other domestic players might deploy in response.

The Asia Stablecoin Alliance was founded as a research and networking platform to promote stablecoin adoption across Asia and to foster clear regulatory environments and robust technical infrastructure, started by Kang Hee-chang and Bok Jin-sol of Populous and Alex Lim (Lim Jong-kyu), Korea representative for LayerZero.

Guest articles reflect the views of the contributors and may not represent the editorial policy of this outlet.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)