Summary

- It was reported that Ethereum, Kaito, Monad, USDC, and Doodles are receiving strong attention in the virtual asset market.

- Ethereum saw strengthened investor sentiment as BlackRock's ETHA spot ETF surpassed $10 billion in assets under management.

- Kaito and Union are conducting a large-scale incentive program, and Monad is planning to launch its native token MON on September 29.

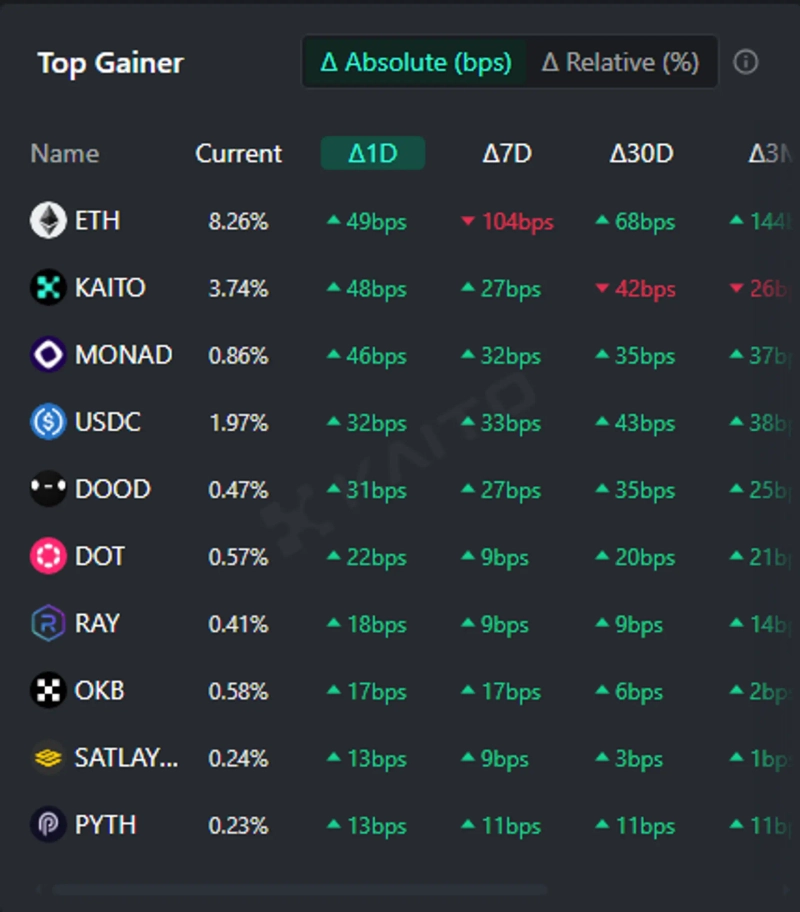

According to the Top Gainer, an AI-based Web3 search platform Kaito's Token Mindshare (a metric that quantifies the influence of specific tokens within the virtual asset market), as of the 25th, the five most popular keywords in the virtual asset market are Ethereum (ETH), Kaito (KAITO), Monad (MON), USDC, and Doodles (DOOD).

Ethereum, the leading altcoin, took first place. In recent weeks, as investor sentiment for Ethereum strengthened, BlackRock’s Ethereum spot exchange-traded fund (ETF), ETHA, surpassed $10 billion in assets under management, attracting investor interest. ETHA reached $10 billion in assets just 251 days after its launch, marking the third fastest pace in history.

Kaito ranked second. The cross-chain interoperability protocol Union announced the launch of a major reward program, 'Mad Yaps', in partnership with Kaito ahead of its mainnet release, drawing investor attention. The program will be conducted in collaboration with the AI-based analytics platform Kaito (KAITO), and 1% of the total Union token supply will be distributed to early contributors. 'Mad Yaps' is an on-chain incentive program that rewards community members who share and spread content about Union’s vision and technology on X (formerly Twitter).

Monad took third place. Monad announced that it will release its native token MON on September 29, which is attracting investor interest.

USDC, the stablecoin, ranked fourth.

Finally, Doodles came in fifth place.

In addition, investors were also found to be interested in Polkadot (DOT), Raydium (RAY), OKB, SetLayer (SATLAYER), and Pyth Network (PYTH).

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.