Summary

- It has been analyzed that the virtual asset market is cooling off from its recent short-term overheating.

- The size and duration of the current short-term overheating in Bitcoin and similar assets are smaller than in the past, indicating a period of rest for the market.

- The current adjustment may be shallow and brief, and a bullish trend in the second half of the year may be anticipated.

An analysis has emerged that the virtual asset (cryptocurrency) market is cooling off its recent short-term overheating.

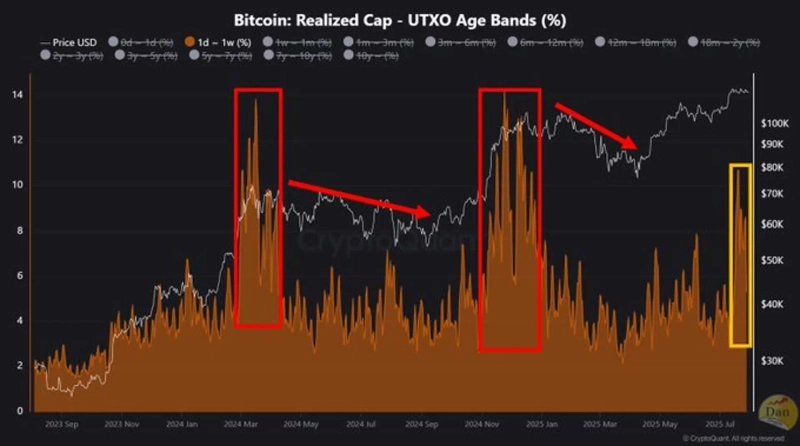

On the 30th, Crypto Dan, an analyst at the on-chain analytics platform CryptoQuant, stated, "Looking at the size (%) of funds that have traded Bitcoin within the past 1 to 7 days, there are signs of short-term overheating, indicating the market is entering a period of rest."

He added, "The degree of overheating and its duration before corrections in March to October 2024 and January to April 2025 were greater than now, and the periods lasted longer. However, this time, both the extent and duration of the overheating are smaller than in the previous two cases. Since the price increase was also relatively modest, the upcoming correction period may be shallower and shorter than before, and a bullish trend in the second half of the year can be expected."

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)