Summary

- It was reported that most companies that strategically hold Ethereum (ETH) are recording profits.

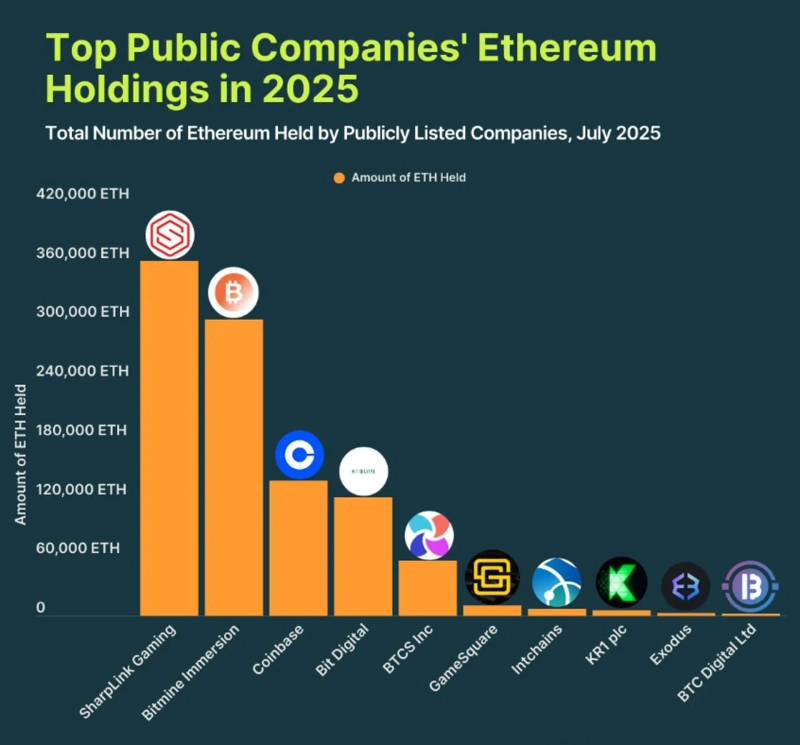

- Top companies such as SharpLink Gaming and BitMine Immersion Technologies have seen their current position values rise above their average buy-in prices.

- CoinGecko stated that, recently, Ethereum prices rebounded from $1,383 in April to $3,700 in July, resulting in profits for leading public holders.

It has emerged that most companies strategically holding Ethereum (ETH) are now recording profits.

On the 30th (local time), the virtual asset data platform CoinGecko published its 'Status of Ethereum Strategic Reserve Companies' report.

According to the report, the company with the largest Ethereum reserves is SharpLink Gaming, which invested a total of $1.03 billion at an average price of $2,864. The current position value now stands at $1.33 billion. The second-largest holder is BitMine Immersion Technologies, with an average price of $3,251 and a current value of $977.3 million.

CoinGecko explained, "Interestingly, most of the top public companies holding Ethereum are currently profitable. This is because Ethereum prices rebounded from $1,383 in April to around $3,700 as of July."

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)