Editor's PiCK

Last week, $223 million flowed out of digital asset investment products… First outflows after 15 weeks

Summary

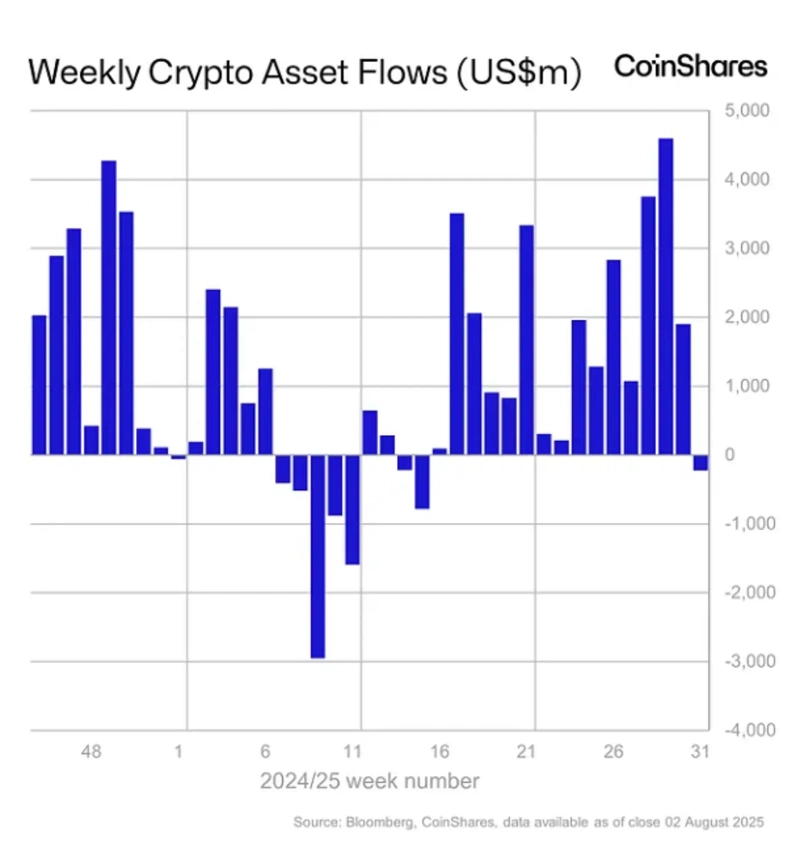

- Last week, digital asset investment products saw outflows of $223 million, shifting the fund trend to outflows for the first time in 15 weeks.

- In particular, while Bitcoin (BTC) related products experienced outflows of $404 million, annual inflows remain strong at $20 billion.

- Major altcoin products such as Ethereum, XRP, Solana (SOL), and Sei (SEI) have shown solid inflows for 15 consecutive weeks and continue to report stable capital inflows.

It was found that last week, digital asset investment products saw an outflow of funds amounting to $223 million.

On the 4th (local time), CoinShares, a digital asset management firm, analyzed in its 'Weekly Digital Asset Fund Flows' report, "$223 million was withdrawn from digital asset investment products last week. The worsening macroeconomic environment and strong signals from the Fed influenced the market." This switch to fund outflows last week marks the first outflow trend in digital asset investment product flows in 15 weeks.

The product that saw the largest outflow was those related to Bitcoin (BTC), which recorded a massive outflow of $404 million. However, the total inflow this year still stands at $20 billion, maintaining a bullish trend.

Ethereum recorded continuous inflows for 15 consecutive weeks ($133 million), while major altcoin-related products such as XRP, Solana (SOL), and Sei (SEI) also recorded significant inflows.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)