Editor's PiCK

'Unstoppable' Ethereum Rally..."Potential to Break $5,000 Within the Year"

Summary

- The price of Ethereum (ETH) surged by nearly $2,000 in just the past month, breaking above $4,300.

- Institutional accumulation of Ethereum, led by U.S. entities, and pro-cryptocurrency policies from the Trump administration have been cited as the main drivers of the rally.

- Market research indicates a strong possibility that Ethereum could break through $5,000 within the year.

The price of Ethereum (ETH) is soaring unstoppably. The market expects Ethereum to surpass $4,400 this month, with some predicting it could break through $5,000 within the year.

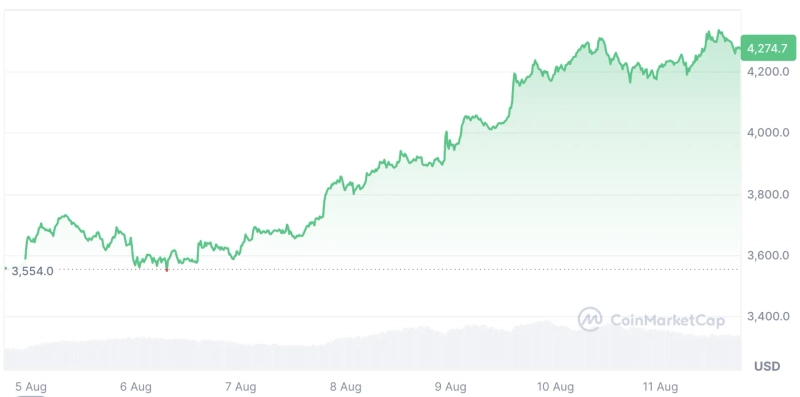

According to CoinMarketCap, a cryptocurrency market tracker, on the 10th, the price of Ethereum broke above $4,300 for the first time in almost four years since December 2021, and as of the 12th, is trading in the $4,310 range. This is an approximately 20% surge compared to a week ago.

Ethereum's price began to rise in earnest starting last month. As of the 11th of last month, Ethereum was trading just below $2,900. In just a month, its price has skyrocketed by nearly $2,000.

U.S.-Centric Institutional Accumulation Accelerates

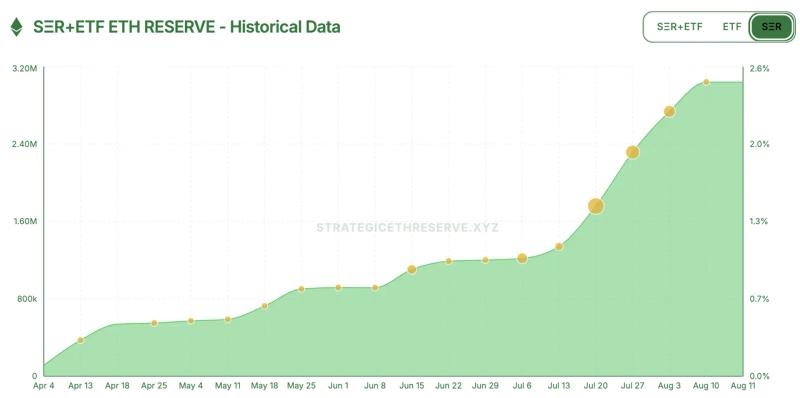

The rally in Ethereum is due to multiple factors. Chief among them is the surge in institutional accumulation of Ethereum, especially by companies centered in the U.S. Notably, Bitmine, a U.S.-based cryptocurrency mining company, has recently intensified its Ethereum reserves, pursuing an 'Ethereum strategy.' According to Strategic ETH Reserve, as of this day, Bitmine's Ethereum holdings are valued at $3.5 billion (about ₩4.9 trillion), making it the world's top public company by Ethereum holdings.

Nasdaq-listed Sharplink Gaming also announced an Ethereum finance strategy this past May and has since been purchasing large volumes of Ethereum. Sharplink is chaired by Joseph Lubin, co-founder of Ethereum. Last weekend alone, Sharplink reportedly accumulated $200 million (approx. ₩280 billion) worth of Ethereum.

According to cryptocurrency analysis firm Matrixport, "Ethereum’s break above the $4,000 level was fueled by strong institutional buying and massive short (sell position) liquidations," adding, "The Ethereum held by listed companies aggressively accumulating positions is ten times higher than the same period last year."

The pro-cryptocurrency policy drive of the expected second Trump administration has also served as a strong catalyst. President Trump signed an executive order on the 8th allowing crypto investments for the U.S. retirement plan '401K.' The 401K is America’s representative pension plan, with assets under management totaling $9 trillion (about ₩12,500 trillion). CoinDesk reported that "this measure should positively impact cryptocurrency prices while integrating digital assets more broadly into the financial system."

The U.S. Securities and Exchange Commission (SEC) recently clarified that 'liquid staking,' which allows flexible crypto asset management, does not violate securities laws. Staking, a key service in the Ethereum network, had previously been at the center of the debate over whether certain cryptocurrencies could be considered securities. With the regulatory risk over staking now resolved, the value of the Ethereum ecosystem is seen to have risen substantially.

"Double Top Resistance Broken"

The market sees significant room for further upside. On Polymarket, the world's largest prediction market, as of this day, the chance of Ethereum exceeding $4,400 this month stands at 87%—a 66 percentage point surge compared to a week ago (21%). Its chances of surpassing $4,600 within the month were calculated at 61%. Matrixport stated, "The (Ethereum) short-term target is $4,362."

There are even analyses suggesting Ethereum could break $5,000 in the second half of this year. That would significantly surpass its all-time high of $4,891 set in November 2021. Jack Yi, founder of crypto investment firm LD Capital, remarked, "Ethereum has broken through the $4,000 'double top' resistance," adding, "The next target is $5,000, a new all-time high." The double top is a bearish pattern where prices fall after forming two peaks. On Polymarket, the probability of Ethereum hitting $5,000 within the year reached 70% as of today.

However, there are mixed views on the so-called 'altcoin season.' Traditionally, altcoin season begins in earnest when Ethereum’s price is strong. Crypto exchange Bybit, in a report on the 10th, noted, "Despite the bullishness in Ethereum’s price, the overall gains among altcoins remain limited," arguing that institutional investors’ preference for large-cap assets and long-term holding strategies is the main reason. Crypto analyst Benjamin Cowen also commented, "This is not an altcoin season; it is an 'Ethereum season.'"

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)