Editor's PiCK

SharpLink Riding Ethereum ... Expectations Rising Ahead of Q2 Earnings Announcement

Summary

- SharpLink Gaming has drawn investor attention by securing around 600,000 units of Ethereum, valued at $2.84 billion.

- Since adopting its Ethereum financial strategy, the share price has surged 590% in three months, and expectations for the Q2 earnings announcement are high.

- Standard Chartered analyzed that stocks of Ethereum-holding firms are attractive investment options, but also noted concerns regarding SharpLink Gaming’s fundamentals.

SharpLink, Q2 Earnings Call on the 15th

First Results Since Financial Strategy Shift

Secured $2.84 Billion Worth of Ethereum

Share Price Continues to Rise on Earnings Expectations

US Nasdaq-listed SharpLink Gaming will announce its second quarter results this week. Given that this is the first earnings release since it declared its Ethereum (ETH) accumulation strategy earlier this year, the market is paying close attention.

According to industry sources on the 14th, SharpLink Gaming will hold its Q2 earnings call on the 15th (local time). For Korea, this will be held at 9:30 p.m. on the 15th.

This earnings call marks the first time SharpLink Gaming’s results after starting its Ethereum accumulation will be made public. This is why investors are focusing on the Q2 earnings announcement. Previously, in May, SharpLink Gaming became the first Nasdaq-listed company to formally adopt an Ethereum financial strategy.

Onboarding Ethereum Co-founders and Others

SharpLink Gaming originally started as a sports marketing company in 1995. However, in the first half of the year, the company made a business transition by bringing on board prominent figures from the crypto industry. For example, last May, the company appointed Joseph Lubin, Ethereum co-founder, as chairman of SharpLink Gaming’s board.

Last month, Joseph Chalom, former Head of Strategic Partnerships at BlackRock, was appointed as Co-CEO. CEO Chalom led the launch of spot Bitcoin (BTC) and Ethereum (ETH) ETFs at BlackRock.

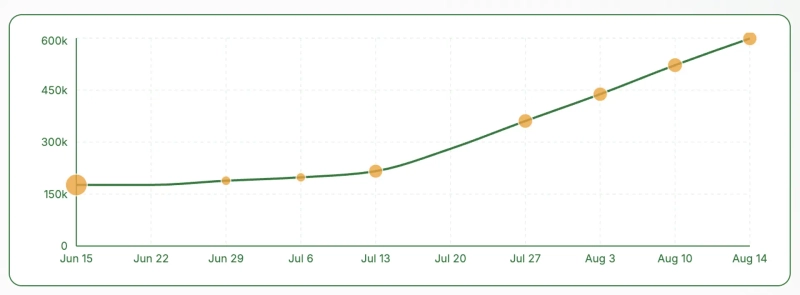

SharpLink Gaming has already secured about 600,000 units of Ethereum. According to Strategic Ethereum Reserve, as of today, SharpLink Gaming holds about 598,800 ETH, valued at $2.84 billion (about ₩4 trillion). This is the result of aggressively purchasing Ethereum over the past 3 months. SharpLink Gaming said, “We are buying Ethereum almost every day.”

What the market is watching is SharpLink Gaming’s return on Ethereum investment. At the end of last May, when SharpLink Gaming declared its intention to accumulate Ethereum, the coin was trading around $2,500. Even in June and July, when the company started buying Ethereum in earnest, the price stayed around $2,000 and $3,000 respectively. As of today, Ethereum is trading in the $4,700s on CoinMarketCap, up about 2% from the previous day.

Share Price Soars 590% Over 3 Months

Driven by rising expectations for the results, the stock has shown a sharp upward trend. SharpLink’s stock closed at $23.5 on the 13th, up about 6.2% from a week ago. Compared to 3 months ago (when it was around $3.4) just before the Ethereum financial strategy introduction, the price has jumped nearly 590%.

Some speculate that this earnings release may encourage more companies to adopt Ethereum financial strategies. In a recent report, global investment bank Standard Chartered (SC) commented, “The stocks of Ethereum-holding firms are more attractive investment options than Ethereum ETFs,” adding, “SharpLink Gaming’s Q2 earnings announcement could strengthen the standing of companies accumulating Ethereum.”

On the other hand, there are doubts about SharpLink Gaming’s fundamentals. Last year, the company’s revenue was $3.66 million (about ₩5 billion), down around 26% from $4.95 million a year earlier. During the same period, its cash holdings shrank by over 42%, from $2.49 million to $1.44 million.

Dave Wiesberger, former CEO of algorithmic trading platform CoinRoutes, said, “(Ethereum accumulation) is no different than buying emerging-market bonds when deemed cheap,” and added, “Ultimately, it’s just about leveraging public imagination to attach a premium to the company’s share price.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)