Editor's PiCK

Ruling party accelerates 'stablecoin drive'..."Future financial dominance at stake"

Summary

- The Democratic Party of Korea and financial authorities announced that they are speeding up the institutionalization of won stablecoins.

- It is reported that the core of the second phase virtual asset legislation government bill to be unveiled in October will be stablecoins.

- There is ongoing discussion in the financial sector between the stability of issuance centered on banks and open competition by non-banking sectors.

National Assembly 'Won Stablecoin' Seminar

Min Byung-deok: "Urgent need for institutionalized strategies"

"Launch of 'Digital Won Era' with adoption"

Financial authorities plan to propose government bill in October

The Democratic Party of Korea is accelerating the institutionalization of the won stablecoin. Financial authorities are also planning to propose a government bill for the second phase of virtual asset legislation around October.

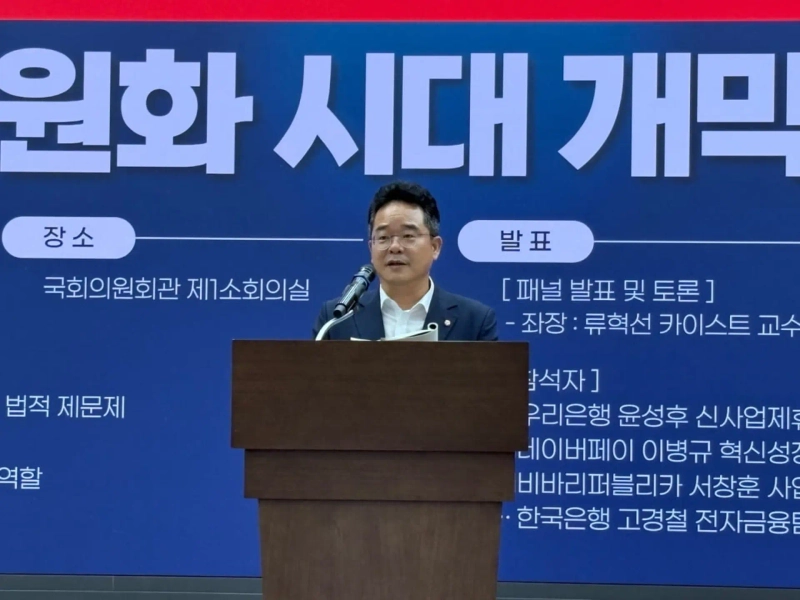

Assembly member Min Byung-deok attended the 'Won Stablecoin: Opening the Era of Digital Won' seminar at the National Assembly Members’ Office Building in Seoul on the 18th and stated, "Strategies for the won stablecoin through institutionalization are urgently needed." He added, "The institutionalization and policy foundation for the won stablecoin have become a core task that will determine the Republic of Korea’s future financial dominance." He emphasized, "We need wisdom so that the won can secure a leading role in the digital economy powered by blockchain technology, rather than being pushed to the periphery."

Min cited the need to introduce the won stablecoin as a measure to counter dollar stablecoins. He said, "U.S. dollar hegemony is now expanding into the digital realm, shrinking the economic territory of non-key currency countries," and warned, "It’s a serious sign that the stability of Korea’s won market could also be shaken." He continued, "Financially advanced countries are quickly devising stablecoin policies to defend their own currencies against the dominance of dollar-based stablecoins," and stressed, "(Korea too) should establish digital currency sovereignty, pursue financial innovation, and develop ways for the digital won to expand its role as a key global currency."

He also pointed to the growth potential of the won stablecoin. Min said, "The fusion of the won stablecoin and Korea’s world-class platform competitiveness will truly open the 'digital won era.'" He noted, "Korea's strengths like K-Content, when combined with digital assets, can create new economic value and increase the won's global influence." He added, "The opening of the digital won era will bring fresh momentum to our economy and provide a great opportunity to enrich people's lives."

Government to Propose 'Second Phase Legislation' Bill in October

The government is also stepping up efforts to institutionalize stablecoins. Assembly member Park Min-kyu said at the seminar, "The Financial Services Commission plans to submit the government bill for the second-phase virtual asset legislation around October," adding, "With this large new wave of digital assets, it’s crucial for lawmakers, regulators, and the industry to reach a future-oriented consensus." In relation, Kim Sung-jin, Director at the Financial Services Commission, explained, "We will aim to prepare the government bill by October if possible."

The core of the government’s proposal for the second phase of virtual asset legislation is expected to be stablecoins. Earlier this month, the Financial Services Commission also commissioned a study to analyze overseas stablecoin legislative cases. A representative stated, "Through the second-phase virtual asset legislation, stablecoins are expected to be incorporated into the regulatory system and used as payment and settlement methods, as well as for cross-border fund transfers."

As the ruling party accelerates the introduction of the won stablecoin, concerns from monetary authorities are growing. The Bank of Korea has repeatedly stated that the won stablecoin could weaken monetary policy. Ko Kyung-chul, head of the Electronic Finance Team at the Bank of Korea, attended the seminar and said, "There needs to be consideration of what impact the won stablecoin will have on the conduct of monetary policy," and noted, "Issuing a won stablecoin may raise issues such as circumventing existing capital regulations and conflicts with the principle of separation between banking and commerce."

BOK: "Should be issued through banks"

The BOK maintains that the won stablecoin should be issued through banks. Ko said, "Stablecoins should be issued in a consortium led by banks," explaining that "credibility is necessary for stablecoins to become established as reliable payment and settlement tools." He added, "(The banking sector) should first build credibility and ensure stability by utilizing fintech companies’ technology and business models," and noted, "However, if non-financial companies enter the financial industry via stablecoins, it is necessary to consider what confusion may arise with existing businesses."

There was also the opinion that the stablecoin industry should be open to the non-banking sector. Lee Byung-kyu, a director of Naver Pay’s Innovation Growth Support Office, said at the seminar, "In designing the stablecoin system, it is especially important to form an open, competitive environment where diverse tech companies can participate, rather than a closed structure centered on specific industries or financial institutions."

Min also pointed out, "What’s more important now is innovation." He stated, "Issuing stablecoins focused on the banking sector is a choice that prioritizes stability over innovation," and argued, "Taking a direction similar to the United States, which allows non-banking entities to issue stablecoins, is more globally consistent."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)