[Analysis] "Bitcoin: $113,600 is a resistance level… reaching it could trigger selling"

Summary

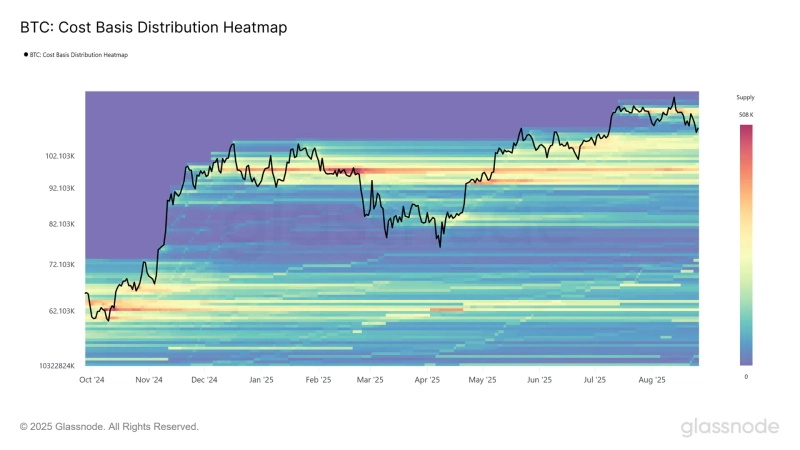

- Glassnode analyzed that Bitcoin reaching $113,600 could increase short-term investors' selling pressure.

- Spot demand is neutral and perpetual futures demand is bearish, and the key support level was presented as $107,000–$108,000.

- If the support breaks, an additional drop to the $93,000–$95,000 range is possible, and the market is said to be at an inflection point between recovery and decline.

An analysis said that if Bitcoin (BTC) price reaches $113,600, short-term investors' selling pressure could increase.

On-chain analytics firm Glassnode said in its weekly report on the 27th (local time), "Bitcoin short-term holders are still under pressure," and "on a price rebound, selling pressure makes $113,600 likely to be a strong resistance level." Glassnode said, "Spot demand is neutral but perpetual futures demand is leaning bearish," and "funding rates suggest an unstable neutral."

It presented key support in the $107,000 to $108,000 range. Glassnode said, "The market is testing the key zone," and analyzed that "if it fails to "hold" the support, it could fall to the $93,000 to $95,000 range." It added, "This correction is moderate compared to past cycles but investor sentiment has weakened," and "the market is at an inflection point between recovery and further decline."

Meanwhile, Bitcoin's price was showing gains that day. As of 4:22 PM that day, Bitcoin was trading on CoinMarketCap at $113,259.01, up 2.11% from the previous day.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)