Editor's PiCK

'Money Tree Sister' also Got Hooked… US Listed Companies, Altcoin Hoarding Frenzy

Summary

- Recent reports say U.S.-listed companies are stockpiling altcoins, driving sharp stock price increases.

- Companies including ARK Invest have adopted treasury strategies for Ethereum, Solana, and XRP, which has driven price gains.

- Some warn that excessive optimism about these cryptocurrency treasury strategies is risky.

ARK Invest, large-scale purchase of 'Bit Mining'

Stock soars 1000% in 3 months

Listed companies stockpile altcoins one after another

"Excessive optimism is risky," critics say

Recently, the altcoin hoarding by U.S.-listed companies has attracted attention. Since altcoin prices typically react sensitively to institutional demand, the market is keeping a close eye on related developments.

According to the industry on the 29th, ARK Invest, the U.S. asset manager led by Cathie Wood — known as a representative tech investor — recently added US$15.6 million (about 22 billion won) worth of Bit Mining shares. ARK Invest began investing in Bit Mining last month and is reported to have bought a total of US$300 million (about 420 billion won) over roughly two months.

The reason ARK Invest has been buying Bit Mining shares is clear. Bit Mining has recently emerged as a company representing an Ethereum treasury strategy. Bit Mining originally started as a Bitcoin (BTC) miner, but after declaring an Ethereum reserve in June this year, it transformed into an "Ethereum-version Strategy". According to the Strategic Ethereum Reserve, the amount of Ethereum Bit Mining has secured stands at US$7.98 billion (about 11.1 trillion won) as of this date, making its holdings the largest in the world by volume.

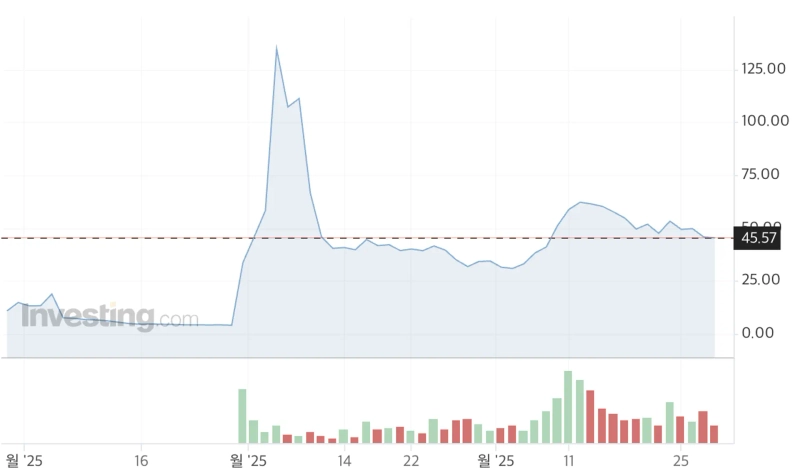

The stock also surged. Bit Mining closed at US$45.57 on the previous day (the 28th). Bit Mining shares were trading in the $4 range as recently as June. In just the last three months, the stock has risen more than tenfold. Cointelegraph reported, "ARK Invest is continuing large-scale investments in innovative technologies such as blockchain and artificial intelligence (AI)," adding, "the recent (Bit Mining) purchases reflect a bullish outlook on Ethereum-related companies."

Sharplink Gaming, the U.S. marketing firm that fired the starting gun on Ethereum reserves, has also seen its stock gain momentum. After bringing Joseph Lubin, co-founder of Ethereum, on board as chairman in May, Sharplink Gaming aggressively accumulated Ethereum. Sharplink Gaming's stock rose more than sixfold over three months after it began its Ethereum treasury strategy in earnest. As of this date, Sharplink Gaming's Ethereum holdings amount to US$3.55 billion (about 5 trillion won), making it second in the world after Bit Mining.

More listed companies are turning their attention to other altcoins. E-commerce company Upexi and online real estate firm DeFi Development, which began stockpiling Solana in the first half of this year, are representative examples. Both are Nasdaq-listed companies whose stock prices rose sharply after adopting Solana treasury strategies. Also, just this month, two Nasdaq-listed firms — VivoPower International and Trident Digital Tech — adopted XRP treasury strategies.

The family of U.S. President Donald Trump is also accelerating altcoin hoarding. Trump Media & Technology Group (TMTG) has recently begun work to establish a company to hold Cronos (CRO). Cronos is the native token of the U.S. cryptocurrency exchange Crypto.com. The Trump family's crypto project World Liberty Financial (WLFI) purchased Ethereum in large quantities from its early launch last year.

The issue is fundamentals. Some argue that most companies that have adopted Bitcoin and altcoin treasury strategies do not have strong core businesses. Critics say that while the underlying business has low sustainability, these companies are buying cryptocurrencies aggressively via measures such as paid capital increases to lift their stock prices. Patrick Jenkins, deputy editor of the Financial Times (FT), wrote in a recent column that "a Bitcoin treasury strategy is either ingenious financial engineering or a Ponzi scheme," adding, "excessive optimism about companies (that hold cryptocurrency treasuries) is risky."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)