Editor's PiCK

Gold on a record rally... Will Bitcoin rise too?

Summary

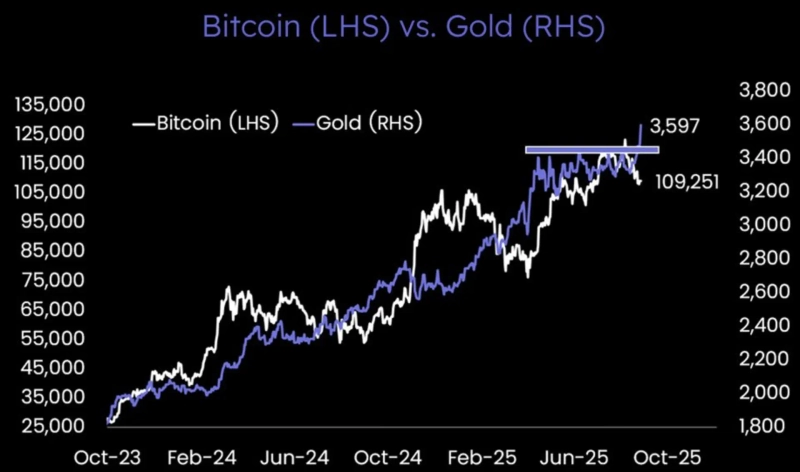

- Gold prices surpassed $3,600 per ounce for the first time ever, continuing the rise of a representative safe-haven asset.

- After past sharp rises in gold prices, Bitcoin prices have begun to rise after a certain period, repeating cases that draw market attention to the correlation between the two assets.

- Institutional inflows, such as $333 million in net inflows into U.S. Bitcoin spot ETFs, have increased, signaling a positive outlook for Bitcoin investments.

Gold price breaks $3,600 for the first time

Correlation with Bitcoin draws attention

Seen as an inflation hedge

'US ETF' institutional funds also saw net inflows

Global stock market instability and related fallout have stirred gold prices, a representative safe-haven asset. As gold prices rise, there are forecasts that Bitcoin (BTC), often cited as an alternative investment alongside gold, may also increase in price.

On the 2nd (local time), according to COMEX, the metals futures exchange under the CME Group (CME), gold futures prices briefly surpassed $3,600 per ounce during trading. This is the first time gold has exceeded $3,600 per ounce. Following April 1, it broke its record again in just one day.

The market uncertainty known as the 'Trump risk' has been cited as the main factor driving up gold prices. As President Donald Trump recently increased pressure on the Fed by dismissing Fed governor Lisa Cook and others, unease in the U.S. stock market grew. Christine Lagarde, President of the European Central Bank (ECB), said she is "very concerned about the potential impact on the stability of the U.S. economy" regarding President Trump's attempts to "shake the Fed."

Market attention is focused on whether gold and Bitcoin prices are 'coupling' (synchronizing). Bitcoin, called 'digital gold,' has shown a high correlation with gold. A representative example is that after gold first exceeded $3,500 in April, Bitcoin prices rose substantially one to two months later. When gold first broke $2,000 per ounce in 2020, Bitcoin prices also followed an upward trend. Crypto outlet Cointelegraph analyzed, "When gold prices rise, investment funds seeking greater returns often move into risk assets like Bitcoin."

Analysts also say that fiscal instability emerging mainly in the U.S. and the European Union (EU) could act as a tailwind. Whenever confidence in fiat currencies weakens, funds that had flowed into safe-haven assets are likely to be redistributed to Bitcoin, which has emerged as an inflation hedge.

Ray Dalio, founder of the world's largest hedge fund Bridgewater Associates, said on X, "The serious debt situation of reserve currency countries threatens the appeal of the dollar as a reserve currency and a store of wealth," adding, "If dollar supply increases or demand falls, cryptocurrencies (such as Bitcoin) could become an attractive 'Alternative Currency'."

Analyses that Bitcoin is undervalued relative to gold arise in the same context. Global investment bank JPMorgan recently said in a report, "Current Bitcoin price volatility is about twice that of gold, at historically low levels," and analyzed, "Taking volatility into account, Bitcoin's market capitalization should be about 13% higher than it is now." Crypto analytics firm Matrixport also said, "Opportunities for investing in gold are linked to Bitcoin," adding, "Bitcoin is still in a corrective phase, but the long-term outlook remains firmly bullish."

Institutional inflows also support this outlook. According to Soso Value, U.S. Bitcoin spot ETFs saw net inflows of $333 million (about 460 billion won) that day. This marked a return to net inflows after one trading day. Matrixport explained, "Even in a situation with limited liquidity, gold prices surged," adding, "Investors are diversifying into both gold and Bitcoin simultaneously."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)