Editor's PiCK

Ethereum range-bound for a week… ETF outflows accelerate

Summary

- Ethereum has recently been trapped in the $4,200–4,300 range, and the ETF market has seen the largest-ever net outflows.

- Ethereum network profitability deterioration and a slowdown in purchases by reserve-holding firms like Bitmain have left additional upside momentum lacking.

- However, a decrease in Ethereum holdings on major exchanges suggests investor accumulation, some say.

Hovering in the $4,200–4,300 range

ETFs post record net outflows

Buying by reserve-holding firms also slows

"Additional upside momentum absent"

Ethereum (ETH) prices, which had surged last month, have been stuck in a range this month. Outflows of institutional money, including spot exchange-traded funds (ETFs), have been notable. Market opinions are divided on the short-term outlook.

According to crypto market tracker CoinMarketCap, Ethereum's price has been hovering in the $4,200–4,300 range for about a week from the 1st through the date in question. The price briefly surpassed $4,400 on the 5th, when the U.S. August jobs report was released, but soon gave back all gains. As of the day in question, Ethereum was trading around $4,290, down about 0.2% from the previous day.

Outflows have continued from spot ETFs, which reflect institutional investor flows. According to SosoValue, U.S. Ethereum spot ETFs recorded net outflows for five consecutive trading days as of the prior trading day (the 5th). Last week alone, $790 million (about 1.1 trillion won) vanished from Ethereum spot ETFs — the largest weekly net outflow on record. Crypto analytics firm 10x Research said, "Last week Ethereum trading volume was $34.3 billion, about a 25% decrease from the weekly average."

Network profitability also deteriorates

Buying by firms that have adopted Ethereum treasury strategies has also slowed. Bitmain, which holds the most Ethereum among listed companies worldwide, announced an Ethereum reserve in June and bought about $7.7 billion (about 10.7 trillion won) worth of Ethereum over roughly two months from July to August. According to Strategic Ethereum Reserve, Bitmain's Ethereum holdings stood at about $8.02 billion (about 11.1 trillion won) as of the day in question, an increase of only about 4% compared with the end of last month.

Analysts say fatigue from the recent rally combined with the "September Effect" has weakened upward momentum. The September Effect refers to the tendency for asset markets to notably decline in September. Kim Minseung of the Korbit Research Center said, "Due to the seasonal characteristics of September, it appears investors are maintaining a wait-and-see stance," adding, "The absence of additional upside momentum for Ethereum this month is also a cause of the sideways movement."

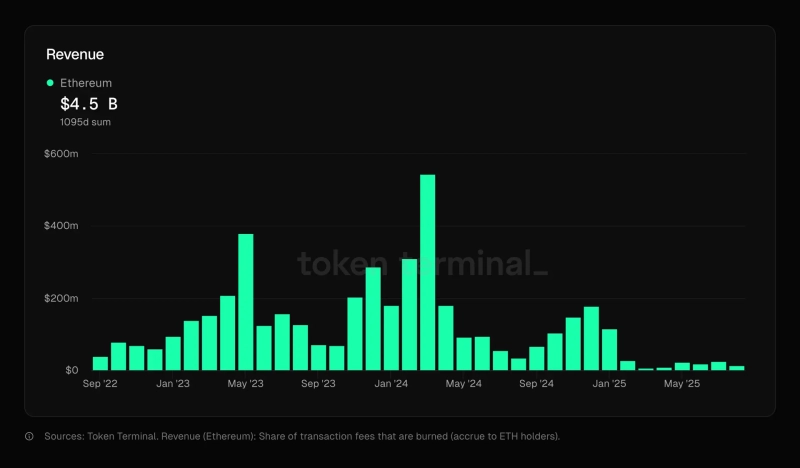

Deteriorating Ethereum network profitability is also cited as a factor encouraging investor outflows. According to on-chain analytics firm Token Terminal, Ethereum network revenue last month totaled $14.1 million, a sharp drop of about 45% from the prior month ($25.6 million). Typically, a decline in a blockchain network's profitability leads to reduced staking rewards, which can weaken investor sentiment. Crypto analytics firm Messari even warned that "Ethereum's fundamentals are deteriorating."

"On-chain indicators suggest bullishness"

Despite hopes for a U.S. rate cut, the outlook for the month is not bright. On betting site Polymarket, the probability that Ethereum's price will fall below $4,200 by the end of the month stood at 89% as of that day, up 9 percentage points from a week earlier (80%). Kim said, "News that the U.S. Nasdaq plans to tighten regulation on listed companies adopting crypto asset treasury strategies (DAT) may have acted as a negative for investor sentiment."

However, some on-chain indicators point to bullish momentum. A CryptoOnChain contributor to CryptoQuant wrote on the 8th, "From the end of June through early this month, total Ethereum holdings on all crypto exchanges decreased by more than 2.6 million," adding, "During that period, exchange holdings and Ethereum price showed an inverse correlation." He went on, "Simultaneous declines in holdings on major exchanges Binance and Coinbase indicate strong accumulation by investors," saying, "It means the supply of tradable Ethereum is rapidly shrinking."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)