Summary

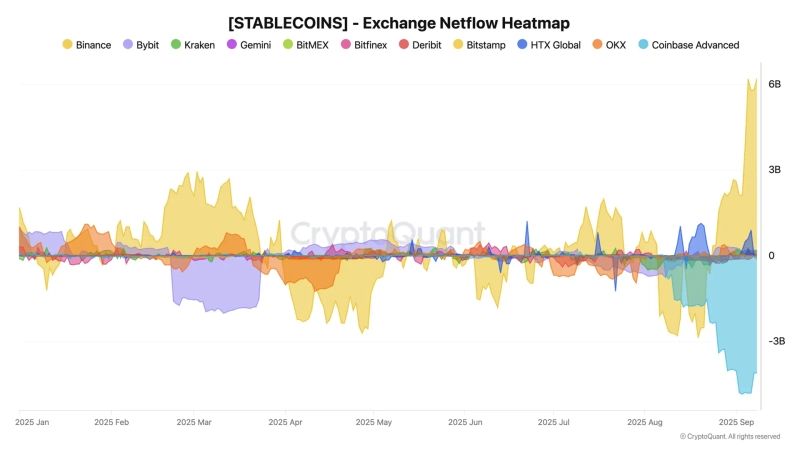

- Ahead of the U.S. Federal Reserve's interest rate decision, a large inflow of stablecoins into Binance was reported.

- On the 8th, the 6.2 billion dollars inflow was the largest this year, and was reported to reflect expectations of a rate cut.

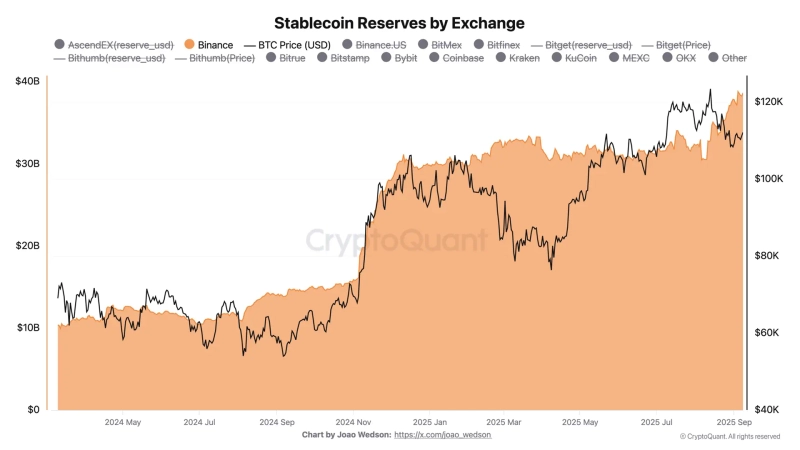

- As a result, Binance's stablecoin holdings also reached a record high of about 39 billion dollars, it was reported.

Ahead of the U.S. Federal Reserve (Fed)'s interest rate decision in September, a large amount of stablecoins has flowed into Binance.

On the 10th (local time), a DarkPost CryptoQuant contributor said in a report, "A record inflow of stablecoins has appeared ahead of the next benchmark rate decision," and "On the 8th (local time) 6.2 billion dollars flowed into Binance, recording the largest daily inflow this year."

This was said to reflect market expectations of a rate cut. A rate cut increases market liquidity and acts as a positive for risk asset markets. The analyst said, "The funds may be inflows of the exchange's own funds, but investor funds also appear to be significantly reflected," adding, "The possibility of a U.S. rate cut has been reflected in the market." He added, "Market liquidity continues to flow into crypto assets."

Meanwhile, buoyed by the record inflows, Binance's stablecoin holdings also hit a record high. Currently, Binance holds about 39 billion dollars in stablecoins.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)