[Analysis] "Bitcoin futures price suggests a bull market…gradual rise expected over two weeks"

Summary

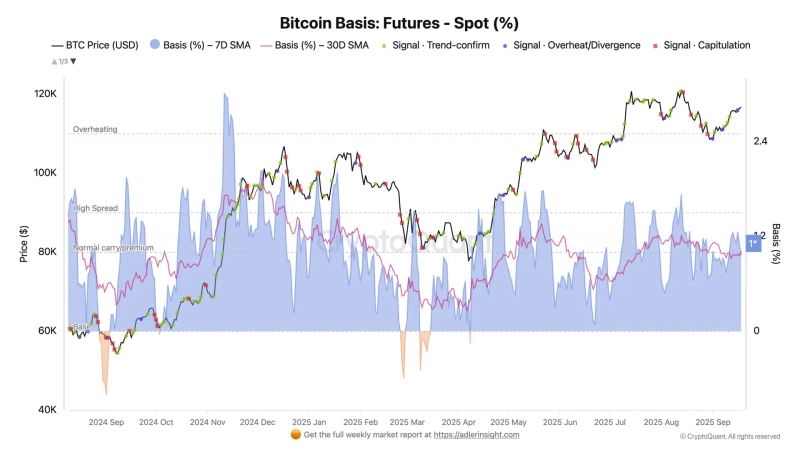

- Bitcoin (BTC) futures price is reported to be trading at a premium to spot and the basis remains positive.

- Axel Adler Jr. said a short-term overheating occurred ahead of the September FOMC, and there is about a 70% chance of a gradual rise or sideways movement over the next two weeks.

- He analyzed that if price, basis, and open interest (OI) show an upward trend in the coming days, it could be a signal that increasing new long positions raise the possibility of a new high being set.

A recent analysis suggested that Bitcoin (BTC) futures price trends indicate a bullish phase.

Axel Adler Jr., a CryptoQuant contributor, said on the 18th (local time) on X, "Bitcoin futures are trading at a premium to spot and the basis has remained steadily positive," adding, "this indicates a bullish regime." He said, "Ahead of the September Federal Open Market Committee (FOMC), a short-term overheating occurred as the basis rose amid light trading volume," and "this movement means the later stage of the (bull market) has been reached."

Axel Adler Jr. forecasted that over the next two weeks there is approximately a 70% chance that (Bitcoin's price) will rise gradually or trade sideways. He analyzed, "If price, basis, and open interest (OI) show an upward trend over the next few days, it would mean new long positions are increasing," adding, "this could be a signal that raises the possibility of a new high being set."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)