Editor's PiCK

Global crypto investment products saw a net inflow of $1.9 billion last week

Summary

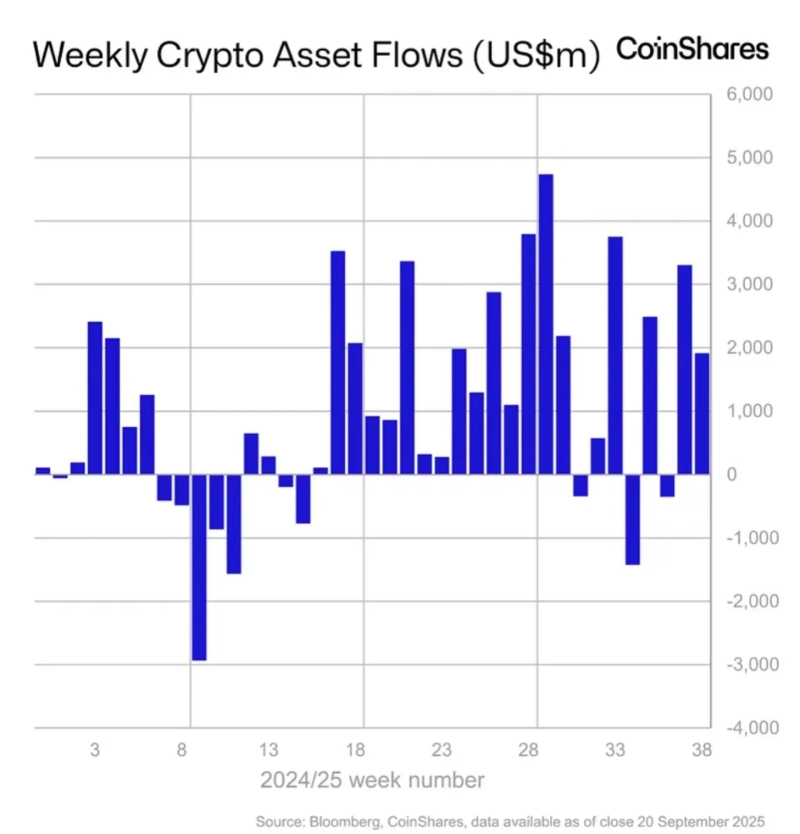

- Last week, global digital asset investment products recorded a net inflow of $1.9 billion, marking two consecutive weeks of net inflows.

- They said that after the Federal Reserve's (Fed) rate cut, investor sentiment strengthened, and assets under management (AUM) for investment products reached a year-to-date high of $40.4 billion.

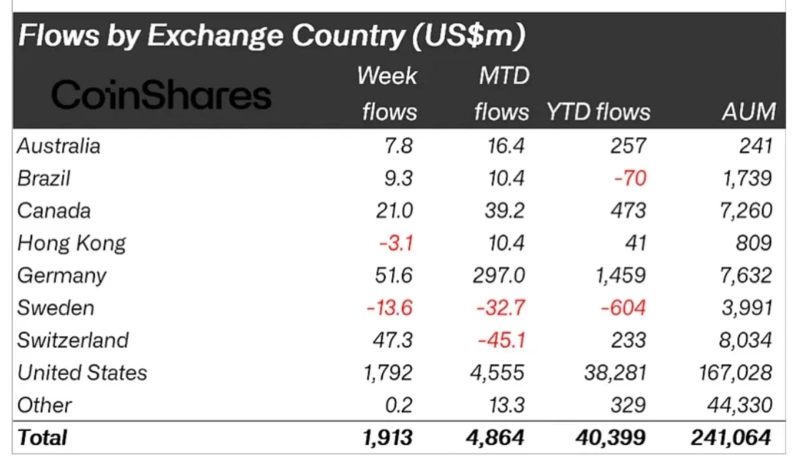

- By country, U.S. inflows were strong, and high capital inflows were recorded in major digital asset products such as Bitcoin, Ethereum, and Solana.

Last week, global digital asset (cryptocurrency) investment products saw inflows of $1.9 billion (2.6444 trillion won).

On the 22nd (local time), CoinShares said in a report, "Last week, digital asset investment products saw a net inflow of $1.9 billion," and added, "This is the second consecutive week of net inflows, and investor sentiment has strengthened following the Federal Reserve's (Fed) rate cut." The funds that flowed in during the two days after the rate cut amounted to $746 million. It went on, "Total assets under management (AUM) for investment products reached a year-to-date high of $40.4 billion," and "it is highly likely to surpass last year's record high."

By asset, Bitcoin (BTC) products ranked first with $977 million of inflows. In contrast, short (sell) Bitcoin products saw $3.5 million flow out, bringing assets under management ($83 million) to their lowest level in years. Ethereum (ETH) saw $772 million flow in. Cumulative inflows since the start of the year reached an all-time high ($12.6 billion).

Major altcoins showed a good trend. Solana (SOL)-based investment products had net inflows of $127.3 million last week. XRP also showed a good trend, with $69.4 million coming in.

By country, inflows from the United States were strong. U.S.-based crypto products alone had net inflows of about $1.792 billion, and Germany and Switzerland saw $51.6 million and $47.3 million respectively. Meanwhile, Sweden and Hong Kong experienced outflows of $13.6 million and $3.1 million respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)