Summary

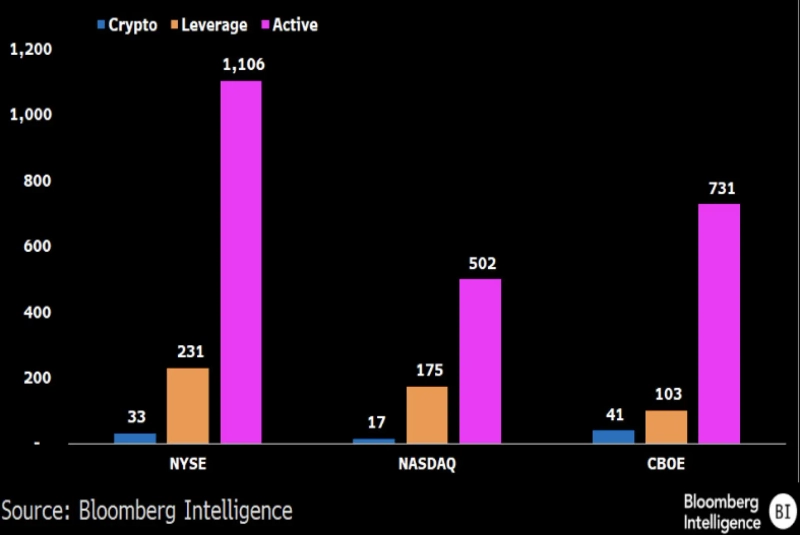

- The Chicago Board Options Exchange (CBOE) said it supports the largest number of crypto ETFs, ranking first with 41.

- The New York Stock Exchange (NYSE) has 31, and Nasdaq has 17 ETFs.

- It said that, following approval by the U.S. Securities and Exchange Commission (SEC), many crypto ETFs are expected to be launched.

The Chicago Board Options Exchange (CBOE) was found to support the largest number of listed crypto assets (cryptocurrencies) exchange-traded funds (ETFs).

On the 22nd (local time), Eric Balchunas, a Bloomberg ETF analyst, said on X (formerly Twitter), "The Chicago Board Options Exchange supports 41 crypto ETFs and is ranked first," and "Second is the New York Stock Exchange (NYSE) with 31 ETFs."

Nasdaq ranked third, supporting trading of 17 products. Balchunas said, "Nasdaq is relatively behind other exchanges," but added, "It still has a presence because it holds IBIT, BlackRock's Bitcoin (BTC) ETF, which was considered last year's best debut."

He also forecast that competition to list crypto ETFs will become fiercer. He said, "Under the general listing requirements recently approved by the U.S. Securities and Exchange Commission (SEC), many crypto ETFs will be launched," adding, "Accordingly, listing competition will intensify."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)